How Long Does It Take the Average Person to Pay off Student Loans? Discover the Truth!

On average, it takes about 10 to 20 years for the average person to fully pay off their student loans. Student loan debt can be a significant burden for many individuals, leading to financial stress and limitations on their future plans.

The length of time it takes to repay these loans can vary depending on several factors, such as the amount borrowed, interest rates, and the individual’s financial situation. It is crucial to have a well-thought-out repayment plan to tackle this debt efficiently and minimize the overall repayment period.

We will explore the average duration it takes to pay off student loans and provide tips for faster repayment. Whether you are a recent graduate or have been carrying student loan debt for years, this information will help you navigate the journey to becoming debt-free.

Credit: www.facebook.com

The Student Loan Burden

The burden of student loan debt has become an increasingly prevalent issue in today’s society. With the rising costs of higher education and the financial impact of student loan debt, many individuals grapple with the question of how long it takes to pay off their loans. In this blog post, we will explore the various factors contributing to the student loan burden and shed light on the average time it takes for individuals to become debt-free.

Rising Costs Of Higher Education

One of the key factors contributing to the student loan burden is the rising costs of higher education. Over the past few decades, the cost of attending college or university has skyrocketed, far outpacing inflation rates and the growth of median household incomes. This has placed an immense financial strain on students and their families, who often resort to borrowing money to fulfill their educational dreams.

The Impact Of Student Loan Debt

The impact of student loan debt extends far beyond the immediate financial burden. Many individuals who graduate with student loans face limited career choices and delayed milestones such as buying a house or starting a family. The weight of monthly loan repayments hinders their ability to save, invest, and contribute to the economy in meaningful ways. Consequently, the average time it takes to pay off student loans has lengthened, further exacerbating the student loan burden.

Average Time To Pay Off Student Loans

Are you curious about the average time it takes for individuals to pay off their student loans? This blog post dives into this topic, providing insights on the factors influencing repayment and sharing statistics on loan repayment duration. Understanding these factors can help you make informed decisions to manage your student loan debt effectively.

Factors Affecting Repayment

Several factors can impact the duration it takes to pay off student loans. These factors include:

- Type of Loan: Different types of student loans have different terms and interest rates, impacting repayment length.

- Loan Amount: The total amount you owe affects how long it will take you to repay your student loans.

- Income Level: Your current income plays a significant role in determining the speed at which you can pay off your loans.

- Repayment Plan: The repayment plan you choose can influence the duration. Some plans may extend the repayment period.

- Financial Responsibility: Your financial habits and discipline in managing your finances will also affect how quickly you can pay off your loans.

Statistics On Loan Repayment Duration

Understanding the average time it takes to pay off student loans can provide valuable insights into trends and expectations. Here are some statistics based on recent studies:

| Loan Type | Average Repayment Duration |

|---|---|

| Federal Loans | 10 to 20 years |

| Private Loans | 5 to 15 years |

Keep in mind that these numbers are averages, and your individual circumstances may vary. The duration for some individuals may be shorter, while others may take longer to pay off their student loans.

With a deeper understanding of the factors influencing repayment and statistics on loan repayment duration, you can now take steps towards efficiently managing and paying off your student loans. By considering your own financial circumstances and utilizing strategies to reduce debt, you can pave the way to a brighter financial future.

Challenges Faced During Repayment

When it comes to paying off student loans, the average person faces various challenges during the repayment process. These challenges can have a significant impact on both their financial well-being and psychological state, making it important to acknowledge and address them effectively.

Financial Difficulties

1. Monthly Cash Flow: Juggling between student loan payments and daily expenses can strain financial resources, leading to a tight monthly cash flow.

2. Interest Accumulation: The accruing interest on student loans can significantly increase the total amount owed, prolonging the repayment period.

3. Limited Savings: Difficulty in building emergency funds or saving for major life milestones due to the ongoing financial commitment of student loan repayment.

Unordered List from Financial Difficulties:

- Monthly Cash Flow

- Interest Accumulation

- Limited Savings

Psychological Stress

1. Mental Burden: Dealing with long-term debt can create stress and anxiety, impacting mental well-being and overall quality of life.

2. Delayed Life Milestones: Feeling trapped by the financial burdens of student loans can lead to delays in major life decisions such as buying a home, starting a family, or pursuing further education.

3. Fear of Default: The constant fear of falling behind on payments and possible consequences can contribute to psychological strain.

Unordered List from Psychological Stress:

- Mental Burden

- Delayed Life Milestones

- Fear of Default

Strategies For Accelerated Repayment

Discovering effective strategies for accelerated repayment of student loans is key to shortening the time it takes to clear the debt. By implementing tactics such as making extra payments, refinancing at a lower interest rate, or pursuing loan forgiveness programs, individuals can significantly reduce the average repayment period.

When facing the burden of student loan debt, finding strategies for accelerated repayment is crucial. By implementing the right tactics, you can pay off your student loans faster and achieve financial freedom sooner. In this section, we will explore two effective methods that can help you speed up the repayment process: increasing monthly payments and utilizing loan forgiveness programs.

Increasing Monthly Payments

One of the most straightforward ways to pay off your student loans more quickly is by increasing your monthly payments. By allocating a higher sum towards your loan repayment each month, you can reduce both the principal amount and the overall interest owed. Here are some strategies to consider:

- Create a budget: Start by assessing your monthly income and expenses. Identify areas where you can cut back or save money to free up additional funds for loan repayment.

- Allocate windfalls: Whenever you receive unexpected money like tax refunds, bonuses, or gifts, consider putting a portion (or all) of it towards paying off your student loans.

- Make biweekly payments: Instead of a single monthly payment, divide the amount in half and make biweekly payments. This approach can help you make an extra month’s payment over the course of a year, reducing interest charges.

- Target high-interest loans: If you have multiple student loans, prioritize paying off the ones with the highest interest rates. By tackling these first, you’ll save more money over time.

Utilizing Loan Forgiveness Programs

If increasing your monthly payments is not feasible due to financial constraints, you can explore loan forgiveness programs to expedite the repayment process. These programs offer relief by canceling a portion or all of your remaining student loan balance. Here are a few options to consider:

| Program | Eligibility Criteria | Benefit |

|---|---|---|

| Public Service Loan Forgiveness (PSLF) | Work full-time for a qualifying public service organization and make 120 qualifying payments. | Forgives the remaining loan balance after 120 qualifying payments. |

| Teacher Loan Forgiveness | Teach full-time for five consecutive years in a low-income school or educational service agency. | Forgives up to $17,500 of Direct Subsidized and Unsubsidized Loans or Subsidized and Unsubsidized Federal Stafford Loans. |

| Income-Driven Repayment (IDR) Forgiveness | Enroll in an IDR plan and make payments based on your income for a specific period (typically 20-25 years). | Forgives the remaining loan balance after completing the required IDR plan payments. |

By leveraging these loan forgiveness programs, you can significantly reduce your student loan debt, thereby accelerating your path to financial freedom.

Future Trends In Student Loan Repayment

As the burden of student loan debt continues to impact millions of individuals, it is crucial to explore the future trends that may shape the process of paying off these loans. The good news is that there are government initiatives and innovative solutions on the horizon that offer hope and relief to those struggling with student debt.

Government Initiatives

One of the most promising future trends in student loan repayment is the various government initiatives that aim to ease the financial strain on borrowers. These initiatives focus on providing assistance and implementing programs that can significantly reduce the time it takes to pay off student loans.

- Income-Driven Repayment Plans: These plans allow borrowers to make loan payments based on their income and family size, ensuring that the monthly payments are affordable. As a result, individuals can allocate their resources towards other financial goals, such as saving for a home or starting a family.

- Loan Forgiveness Programs: The government offers loan forgiveness programs for individuals who work in public service or specific professions, such as teachers, nurses, or military personnel. By fulfilling certain requirements, borrowers can have a portion or the entirety of their student loans forgiven, alleviating the financial burden considerably.

- Refinancing Options: Government-backed refinancing programs provide borrowers with the opportunity to consolidate their debt and secure a lower interest rate, potentially saving them thousands of dollars over the life of their loans. This option gives individuals the chance to pay off their student debt more efficiently and with less financial strain.

Innovative Solutions

In addition to government initiatives, innovative solutions are emerging to address the challenge of student loan repayment. These solutions leverage technology and new approaches to facilitate faster and more manageable student debt payoffs.

- Employer Tuition Assistance Programs: Some forward-thinking companies are recognizing the burden of student loans on their employees and are starting to offer tuition assistance programs. Through these initiatives, employers provide financial support to their employees to help pay off their student loans, ultimately reducing the time it takes for borrowers to become debt-free.

- Fintech Platforms: The rise of financial technology has given birth to platforms that specifically cater to student loan borrowers. These platforms provide personalized financial advice, loan management tools, and access to refinancing options. By leveraging technology, borrowers can gain better insights into their repayment journey and optimize their strategies to pay off their loans more effectively.

- Collaborative Efforts: Various organizations and nonprofits are joining forces to address the student debt crisis collectively. These collaborations aim to raise awareness, advocate for more favorable legislation, and provide resources and support to borrowers. By working together, these initiatives have the potential to drive meaningful change and improve the student loan repayment landscape.

The future of student loan repayment shows promise, as government initiatives and innovative solutions strive to alleviate the burden of student debt. With the introduction of income-driven repayment plans, loan forgiveness programs, refinancing options, employer assistance programs, fintech platforms, and collaborative efforts, the average person may find relief and the ability to pay off their student loans in a more manageable timeframe.

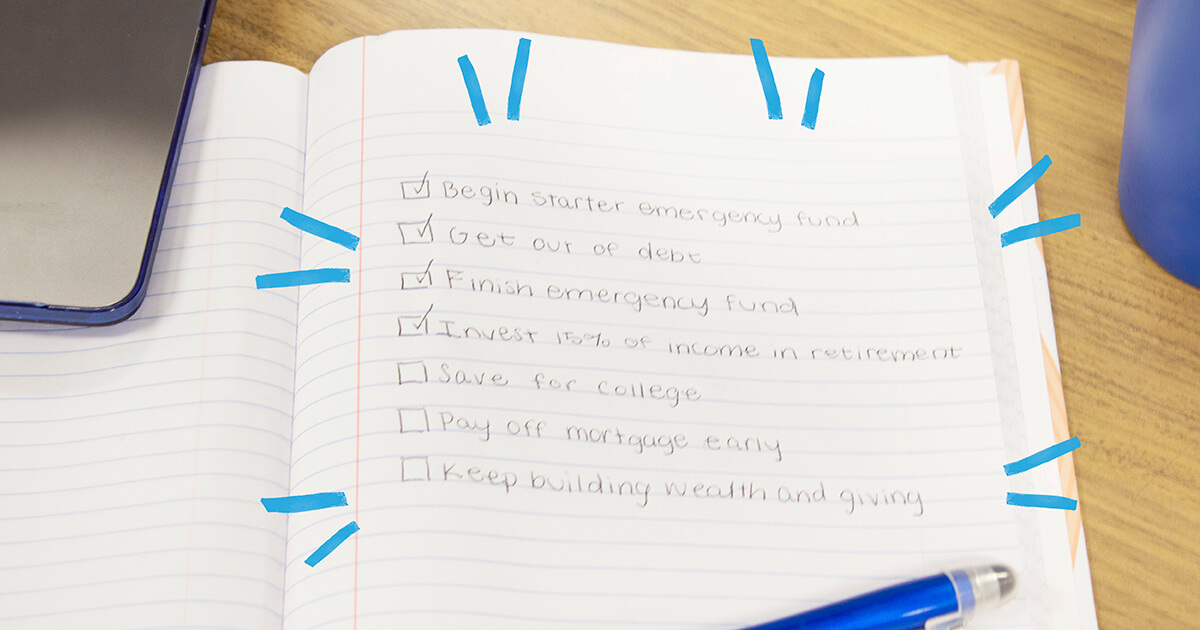

Credit: www.ramseysolutions.com

:max_bytes(150000):strip_icc()/dti-0c7453b83dae4648a4cf19c5a66fad20.jpg)

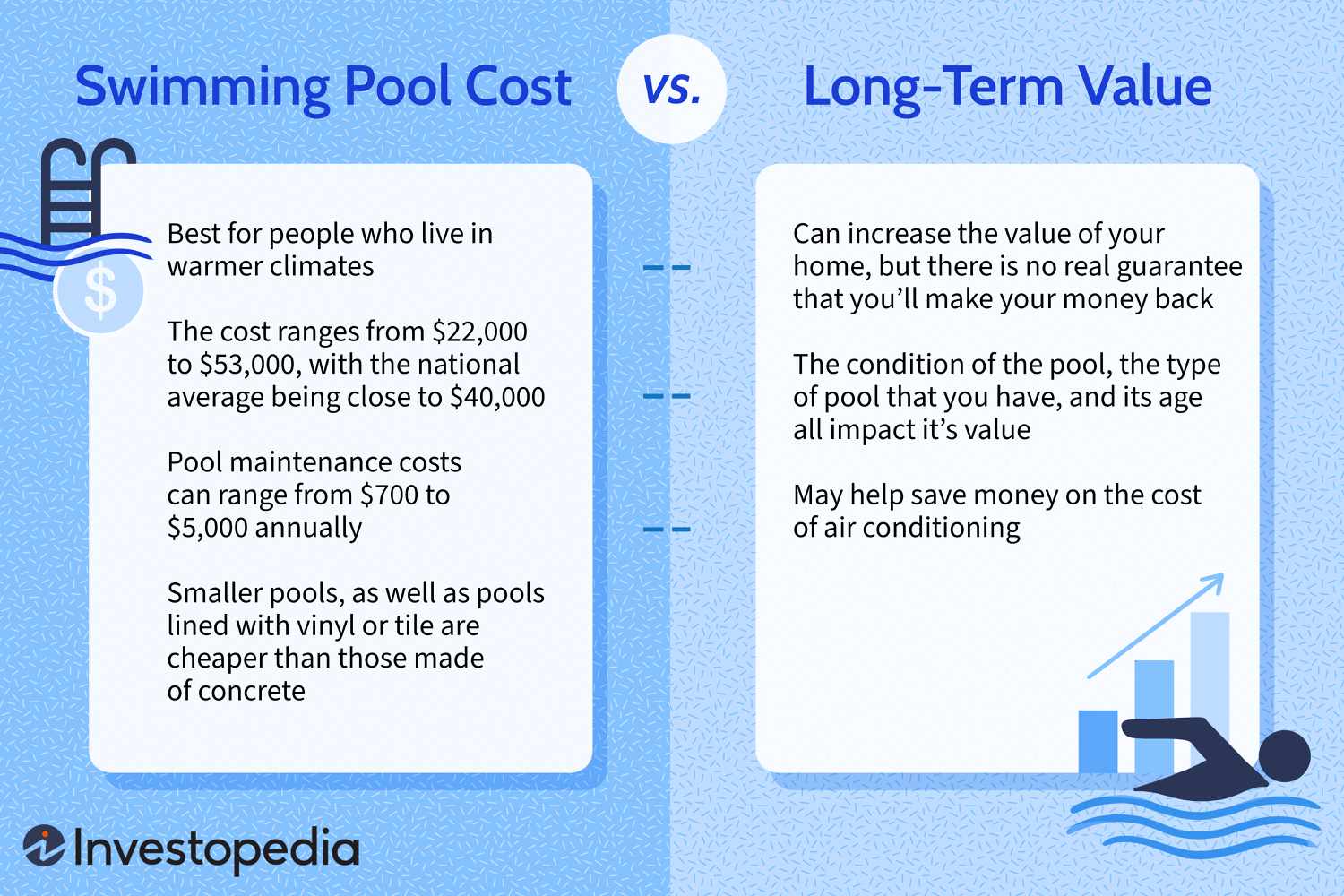

Credit: www.investopedia.com

Frequently Asked Questions Of How Long Does It Take The Average Person To Pay Off Student Loans?

How Long Does It Take The Average Person To Pay Off Student Loans?

On average, it takes the average person around 20 years to pay off their student loans. However, the duration can vary depending on factors such as the loan amount, interest rates, repayment plans, and the borrower’s financial situation. It is important to create a repayment plan and stick to it to pay off your student loans as quickly as possible.

What Are The Factors That Affect The Time To Pay Off Student Loans?

Several factors can influence the time it takes to pay off student loans. These include the loan amount, interest rates, the borrower’s income level, repayment plan chosen, and any additional payments made towards the loan. By considering these factors, individuals can make informed decisions to pay off their student loans more efficiently.

How Can I Pay Off My Student Loans Faster?

To pay off your student loans faster, consider these strategies: 1) Increase your monthly payments if your budget allows. 2) Explore refinancing options to lower your interest rates. 3) Consider making bi-weekly payments instead of monthly payments. 4) Look for ways to increase your income to put more money towards your student loans.

5) Avoid defaulting on your loans by staying organized and keeping up with payments.

Should I Consider Loan Forgiveness Programs To Pay Off My Student Loans?

Loan forgiveness programs can be beneficial for certain individuals. These programs forgive or cancel a portion of the borrower’s student loans under specific circumstances, such as working in public service or teaching. However, each program has its own eligibility criteria and requirements.

Researching and understanding these programs can help determine if they are a viable option for you to pay off your student loans.

Conclusion

Paying off student loans depends on several factors such as the amount borrowed, interest rate, and individual financial circumstances. It can take up to 10 to 20 years for the average person to fully repay their student debt. However, with proper financial planning and budgeting, it is possible to pay off student loans sooner.

Understanding the repayment options and seeking guidance can make a significant difference in managing student loan debt.

{ “@context”: “https://schema.org”, “@type”: “FAQPage”, “mainEntity”: [ { “@type”: “Question”, “name”: “How long does it take the average person to pay off student loans?”, “acceptedAnswer”: { “@type”: “Answer”, “text”: “On average, it takes the average person around 20 years to pay off their student loans. However, the duration can vary depending on factors such as the loan amount, interest rates, repayment plans, and the borrower’s financial situation. It is important to create a repayment plan and stick to it to pay off your student loans as quickly as possible.” } } , { “@type”: “Question”, “name”: “What are the factors that affect the time to pay off student loans?”, “acceptedAnswer”: { “@type”: “Answer”, “text”: “Several factors can influence the time it takes to pay off student loans. These include the loan amount, interest rates, the borrower’s income level, repayment plan chosen, and any additional payments made towards the loan. By considering these factors, individuals can make informed decisions to pay off their student loans more efficiently.” } } , { “@type”: “Question”, “name”: “How can I pay off my student loans faster?”, “acceptedAnswer”: { “@type”: “Answer”, “text”: “To pay off your student loans faster, consider these strategies: 1) Increase your monthly payments if your budget allows. 2) Explore refinancing options to lower your interest rates. 3) Consider making bi-weekly payments instead of monthly payments. 4) Look for ways to increase your income to put more money towards your student loans. 5) Avoid defaulting on your loans by staying organized and keeping up with payments.” } } , { “@type”: “Question”, “name”: “Should I consider loan forgiveness programs to pay off my student loans?”, “acceptedAnswer”: { “@type”: “Answer”, “text”: “Loan forgiveness programs can be beneficial for certain individuals. These programs forgive or cancel a portion of the borrower’s student loans under specific circumstances, such as working in public service or teaching. However, each program has its own eligibility criteria and requirements. Researching and understanding these programs can help determine if they are a viable option for you to pay off your student loans.” } } ] }