How Does a Reverse Mortgage Work in Florida: Unveiling the Process and Benefits

A reverse mortgage in Florida allows homeowners, aged 62 or older, to convert a portion of their home equity into tax-free cash without selling the property. Once the loan is approved, the homeowner receives monthly payments, a lump sum, or a line of credit, depending on the chosen payment option.

The loan balance increases over time with interest, which is added to the principal amount. The reverse mortgage becomes due when the homeowner dies, sells the home, or no longer uses it as the primary residence. At that point, the loan is repaid with the proceeds from the sale of the home, and any remaining equity goes to the borrower or the borrower’s heirs.

While a reverse mortgage can provide financial flexibility for seniors, it is important to understand the terms and eligibility requirements before applying.

Reverse Mortgage Explained

A reverse mortgage in Florida allows homeowners to tap into their home equity, receiving payments without having to sell or move. It offers financial flexibility for seniors, who can use the funds for living expenses or other needs.

What Is A Reverse Mortgage?

A reverse mortgage is a type of loan that allows homeowners, particularly those who are 62 years old or older, to convert a portion of their home equity into usable cash without the need to sell their property or make monthly mortgage payments. It provides financial flexibility and security for seniors who wish to access their home equity while still living in their home.

How Does A Reverse Mortgage Work?

A reverse mortgage works by allowing homeowners to borrow against the equity in their homes. Unlike traditional mortgages, where borrowers make monthly payments towards their loan balance, with a reverse mortgage, the lender pays the homeowner. This payment can be made in a lump sum, fixed monthly payments, a line of credit, or a combination of these options.

As time goes on, the amount owed to the lender increases, and the homeowner’s equity decreases. The loan is typically repaid when the homeowner sells the house, moves out, or passes away. The remaining equity, if any, belongs to the borrower or their heirs.

Requirements And Eligibility

To qualify for a reverse mortgage in Florida, homeowners must meet certain requirements:

- Be at least 62 years old

- Have sufficient equity in their home

- Occupy the property as their primary residence

- Complete a HUD-approved counseling session

In addition to these requirements, there are also financial assessments that evaluate the borrower’s ability to meet the ongoing financial obligations associated with the reverse mortgage, such as property taxes and insurance.

| Benefits | Explanation |

|---|---|

| Supplement retirement income | A reverse mortgage provides seniors with a steady stream of income, allowing them to enhance their retirement lifestyle. |

| Flexibility and control | Borrowers have the option to receive their funds in different ways, offering flexibility in managing their finances. |

| No monthly mortgage payments | Unlike traditional loans, reverse mortgages do not require monthly mortgage payments, providing relief from financial stress. |

| Homeownership is retained | With a reverse mortgage, homeowners can continue to live in their homes as long as they meet loan obligations. |

A reverse mortgage can be a helpful financial tool for Florida homeowners who want to access their home equity while still enjoying the benefits of homeownership. However, it is important to carefully consider all aspects of a reverse mortgage before making a decision. Consulting with a qualified reverse mortgage specialist can provide the guidance needed to make an informed choice.

Benefits Of Reverse Mortgage

Experience the benefits of a reverse mortgage and unlock the equity in your Florida home. Discover how this financial solution works, allowing you to receive payments based on your home’s value without giving up ownership. Maximize your financial stability and enjoy your retirement with a reverse mortgage.

Reverse mortgage is an innovative financial tool that allows homeowners in Florida to tap into their home equity while still living in the property. It offers several benefits, providing financial flexibility and peace of mind for retirees and seniors. Let’s take a closer look at some of the key benefits of a reverse mortgage in Florida.

Access To Home Equity

With a reverse mortgage, homeowners in Florida gain access to their home equity without having to sell or move out of their property. This is especially beneficial for retirees who have built up significant equity over the years. By converting their home equity into cash, they can use the funds to supplement their retirement income, pay off debts, or cover unforeseen expenses.

Additionally, homeowners have the option to receive the funds from a reverse mortgage as a lump sum, line of credit, or monthly payments. This flexibility allows them to tailor the disbursement of funds based on their specific needs and financial goals.

No Monthly Mortgage Payments

One of the major advantages of a reverse mortgage in Florida is that there are no monthly mortgage payments required. Unlike a traditional mortgage where borrowers need to make regular payments, a reverse mortgage allows homeowners to defer their loan repayment until they no longer live in the property.

This absence of monthly mortgage payments can be a significant relief for retirees on fixed incomes. Rather than having to worry about meeting mortgage obligations, they can focus on enjoying their retirement years and utilizing their money for other essential expenses.

Flexibility In Using Funds

A reverse mortgage provides borrowers with the freedom to use the funds in any way they see fit. Whether it’s to cover medical bills, make home improvements, invest in rental properties, or travel, the choice is entirely up to the homeowner. This flexibility allows individuals to maintain their lifestyle and meet their unique financial needs.

Furthermore, the funds obtained through a reverse mortgage are typically tax-free. This means that homeowners in Florida can utilize the money without having to worry about the additional burden of taxes.

In conclusion, a reverse mortgage offers homeowners in Florida a range of benefits, including access to their home equity, no monthly mortgage payments, and flexibility in using funds. By understanding how reverse mortgages work and exploring these advantages, seniors can make informed decisions about their financial future and enhance their quality of life.

The Process Of Obtaining A Reverse Mortgage

Obtaining a reverse mortgage in Florida involves a detailed process. This type of mortgage allows homeowners to convert their home equity into loan proceeds without monthly mortgage payments, making it a popular option for retirees in the state. The process typically includes eligibility requirements, counseling sessions, appraisal, and loan closing.

Finding A Reverse Mortgage Lender

Finding a reputable reverse mortgage lender in Florida is the first step in obtaining this type of loan. It’s crucial to work with a lender who specializes in reverse mortgages and understands the unique regulations and requirements in the state. Start your search by researching online or asking for recommendations from trusted friends and family members who have gone through the process.

- Research online for reverse mortgage lenders in Florida

- Ask for recommendations from friends and family

- Choose a lender who specializes in reverse mortgages

Application And Counseling

Once you have chosen a reverse mortgage lender, the next step is to complete the application process. This typically involves gathering important documents such as your identification, financial statements, and information about your current mortgage. Your lender will review your application and may request additional information if needed.

After submitting your application, you will be required to attend counseling sessions with a HUD-approved reverse mortgage counselor. These sessions are designed to ensure you fully understand the terms and implications of the loan. The counselor will explain the costs, risks, and alternatives associated with reverse mortgages, helping you make an informed decision.

- Gather important documents for the application

- Complete the application process with your chosen lender

- Attend counseling sessions with a HUD-approved counselor

- Understand the costs, risks, and alternatives of reverse mortgages

Appraisal And Closing

After completing the application and counseling sessions, the next steps in obtaining a reverse mortgage include the appraisal and closing processes. An appraisal of your home’s value is necessary to determine the loan amount you are eligible for. The lender will arrange for an appraiser to visit your property and assess its worth.

Once the appraisal is complete, and your loan is approved, the closing process begins. During closing, you will review and sign the necessary documents, including the reverse mortgage agreement and the terms and conditions of the loan. The funds may be disbursed in a lump sum, monthly installments, or a line of credit, depending on your preference.

- Arrange for an appraisal to assess your home’s value

- Review and sign important documents during the closing process

- Choose how you want to receive the funds – lump sum, monthly installments, or line of credit

Understanding the process of obtaining a reverse mortgage in Florida is key to making informed decisions. By finding a reputable lender, completing the application and counseling sessions, and going through the appraisal and closing processes, you can access the financial benefits that this type of loan offers.

Credit: www.forbes.com

Considerations And Risks

When considering a reverse mortgage in Florida, it is important to be aware of the potential risks and carefully evaluate whether it is the right option for your financial needs. While reverse mortgages can offer numerous benefits for seniors, there are certain considerations that should be taken into account before proceeding. This section will discuss three key considerations and risks associated with reverse mortgages in Florida: the impact on heirs, maintenance and ownership responsibilities, and loan repayment.

Impact On Heirs

One important consideration when obtaining a reverse mortgage is the potential impact on your heirs. While a reverse mortgage can provide you with much-needed funds during your retirement years, it can also affect the inheritance you may want to leave behind. It is crucial to discuss your plans with your heirs and ensure they understand how a reverse mortgage will affect the equity in your home.

Maintenance And Ownership Responsibilities

Another consideration to keep in mind is the ongoing maintenance and ownership responsibilities that come with a reverse mortgage. As the borrower, you still bear the responsibility for keeping your home in good condition, paying property taxes, and maintaining insurance coverage. Failure to fulfill these obligations could result in defaulting on the loan and potentially losing your home.

Moreover, as the homeowner, you remain responsible for any necessary repairs or renovations that may arise. It is essential to carefully evaluate whether you have the financial means to meet these obligations, as neglecting them could have serious consequences.

Loan Repayment

Lastly, it is crucial to understand the loan repayment terms associated with a reverse mortgage. While you do not have to make monthly mortgage payments, the loan will eventually need to be repaid when certain conditions occur, such as the sale of the home or the borrower’s passing. It is important to plan accordingly and be aware of the potential financial implications that may arise when the loan repayment becomes due.

Additionally, keep in mind that the loan amount will accumulate interest over time, which can significantly impact the final repayment amount. Understanding these terms and discussing them with a reputable reverse mortgage specialist can provide you with clarity and peace of mind.

Considerations and risks are essential aspects to evaluate when exploring the option of a reverse mortgage in Florida. By thoroughly understanding how a reverse mortgage works and considering the impact on heirs, maintenance and ownership responsibilities, and loan repayment obligations, you can make an informed decision that suits your financial goals and circumstances.

Reverse Mortgage Alternatives

Reverse mortgages can be a beneficial option for homeowners in Florida who are looking to tap into their home equity without selling their property. However, they may not be the right choice for everyone. There are several alternatives to reverse mortgages that individuals should consider before making a decision. In this section, we will explore two popular alternatives: home equity loans or lines of credit, and downsizing or selling the home.

Home Equity Loan Or Line Of Credit:

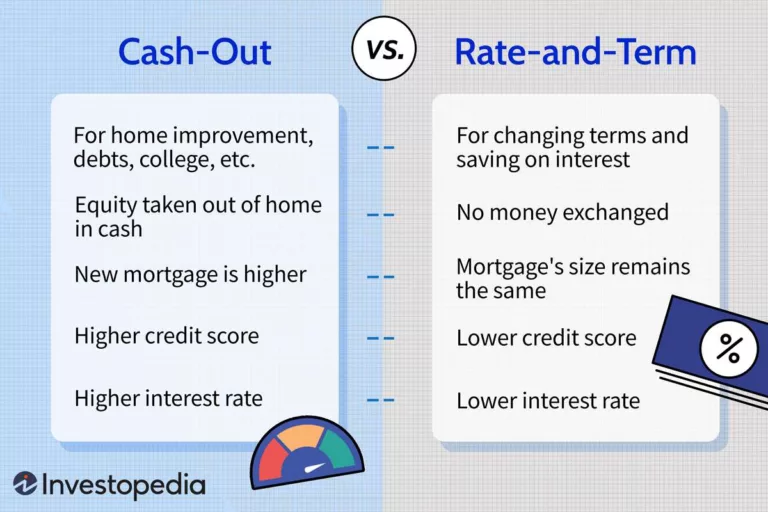

If you want to access your home equity without being subject to potential risks associated with a reverse mortgage, a home equity loan or line of credit might be the right choice for you. Unlike a reverse mortgage, which converts a portion of the home equity into loan proceeds, a home equity loan or line of credit allows you to borrow against the value of your home while keeping ownership.

Benefits of Home Equity Loan or Line of Credit:

- Retain ownership of your home

- Interest rates may be lower compared to reverse mortgages

- Flexible options for repayment

- Greater control over how the funds are used

Downsizing Or Selling The Home:

If you no longer need a large home or are considering a lifestyle change, downsizing or selling your home can be a viable alternative to a reverse mortgage. This option allows you to unlock the equity in your home by selling it and using the proceeds for various purposes, such as buying a smaller property or funding your retirement.

Benefits of Downsizing or Selling the Home:

- Immediate access to your home equity

- Potential for a significant lump sum of cash

- Opportunity to reduce housing-related expenses

- Freedom to choose a more suitable living arrangement

Credit: www.linkedin.com

Credit: southernhl.com

Frequently Asked Questions On How Does A Reverse Mortgage Work In Florida

What Is The Negative Side Of A Reverse Mortgage?

A negative aspect of a reverse mortgage is that it reduces the equity in your home, potentially leaving less value for your heirs. There may also be high closing costs and interest rates associated with reverse mortgages.

Who Owns The House After A Reverse Mortgage?

The homeowner still owns the house after getting a reverse mortgage. The loan is paid back when the homeowner sells the house, moves out, or passes away.

Who Pays The Mortgage On A Reverse Mortgage?

The borrower pays the mortgage on a reverse mortgage.

Does The Bank Stay With My Home If I Do A Reverse Mortgage Loan?

No, the bank does not keep your home if you take out a reverse mortgage loan. You still own your home, and the bank only holds a lien on it.

Conclusion

To sum up, a reverse mortgage in Florida offers an opportunity for homeowners aged 62 and above to access the equity in their homes while still residing in them. With flexible payment options, it can provide financial security during retirement or assist with unexpected expenses.

It’s vital to consult with a trusted lender and thoroughly understand the terms and obligations before proceeding with a reverse mortgage. By making informed decisions, Florida homeowners can make the most of this unique financial option.