How Do You Know If You Have Gap Insurance?: Essential Tips

You know if you have gap insurance by checking if it is listed in your auto insurance policy. Gap insurance is an optional coverage that pays the difference between the amount owed on a leased or financed car and its actual cash value in the event of a total loss.

Gap insurance can provide much-needed financial protection in certain situations. Whether you are leasing or financing a vehicle, it is essential to understand if you have this coverage in place. Gap insurance is an optional add-on that covers the gap between the amount you owe on your vehicle and its actual cash value.

In the unfortunate event of a total loss, such as theft or an accident, your regular insurance may only reimburse you for the vehicle’s fair market value, which can be significantly lower than what you owe. This leaves you responsible for the remaining balance. However, by having gap insurance, you can avoid being burdened with extra expenses and ensure financial peace of mind. But how can you determine if you have gap insurance?

Credit: www.carpro.com

What Is Gap Insurance?

What is Gap Insurance?

Gap insurance, also known as Guaranteed Asset Protection insurance, is a type of coverage that protects car owners from financial loss in the event of a total loss or theft of their vehicle. It covers the difference, or “gap,” between the amount owed on the car loan or lease and the actual cash value of the vehicle.

| Benefits of Gap Insurance |

|---|

| 1. Protects against depreciation |

| 2. Pays off the remaining balance |

| 3. Provides peace of mind |

| 4. Covers additional expenses |

Gap insurance is crucial for car owners, especially those who have financed or leased their vehicles. Here’s why:

- Protection against depreciation: Vehicles depreciate rapidly, and in the unfortunate event of a total loss, your car insurance may not cover the remaining balance on your loan or lease. Gap insurance ensures that you are not left with a hefty financial burden.

- Pays off the remaining balance: If your car is stolen or severely damaged, the insurance company will only reimburse you for the actual cash value of the car. Without gap insurance, you could be responsible for the difference between the insurance payout and the outstanding loan amount.

- Provides peace of mind: Knowing that you have gap insurance can provide peace of mind, enabling you to enjoy your car without constantly worrying about potential financial losses.

- Covers additional expenses: Gap insurance can also cover additional expenses such as deductible payments, loan or lease termination fees, and unpaid finance charges, depending on the terms and conditions of the policy.

In conclusion, gap insurance is an essential coverage for car owners, protecting them from potential financial hardships in the event of a total loss or theft of their vehicle. By understanding the definition, coverage, and importance of gap insurance, you can make an informed decision about whether this type of insurance is right for you.

Do You Have Gap Insurance?

If you’ve recently purchased or leased a new car, you may have heard about gap insurance. But do you have it? Gap insurance, also known as guaranteed asset protection insurance, is a type of insurance that covers the difference between what you owe on your car loan or lease and the actual value of your car if it’s totaled or stolen. It can provide valuable financial protection if your car is severely damaged or stolen, especially if you owe more on your loan or lease than your car is worth.

Reviewing Your Auto Insurance Policy

The first step in determining whether you have gap insurance is to review your auto insurance policy. Look for any mention of gap insurance or guaranteed asset protection coverage. Gap insurance is typically an optional add-on that you can choose to include in your policy. Check if you selected this coverage when you initially purchased your auto insurance policy. If you can’t find any information about gap insurance in your policy, it’s likely that you don’t have it.

Contacting Your Insurance Provider

If you’re still uncertain whether you have gap insurance after reviewing your policy, the next course of action is to contact your insurance provider directly. Get in touch with their customer service department or your insurance agent to inquire about your coverage. Ask specifically about gap insurance or guaranteed asset protection coverage and provide them with your policy details. They will be able to confirm whether or not you have this coverage and provide you with any additional information you may need.

Checking Your Loan Or Lease Agreement

In addition to reviewing your auto insurance policy, you can also check your loan or lease agreement to see if gap insurance is included. If you financed your car through a lender or are currently leasing it, there’s a chance that gap insurance may be required as part of the loan or lease agreement. Review the terms and conditions of your agreement or contact your lender/leasing company directly to determine if gap insurance is included and what it covers.

Signs You May Have Gap Insurance

Gap insurance is a type of auto insurance coverage that can provide important financial protection in certain situations. If you are unsure whether or not you have gap insurance, there are several signs to look out for. Keep reading to learn about the common indications that may suggest you have this coverage.

Purchase Or Lease A New Vehicle

If you recently purchased or leased a brand new vehicle, there is a high chance that you have gap insurance. This coverage is commonly offered when you finance or lease a new car, as it helps bridge the gap between what you owe on the loan or lease and the actual cash value of the vehicle in the event of a total loss.

Finance A Vehicle With Little Or No Down Payment

When you finance a vehicle with little or no down payment, you may have gap insurance. This is because a smaller down payment means you immediately owe more on the loan than the car is worth. Gap insurance can provide protection in case your vehicle is totaled before you have a chance to build equity in it.

Long-term Auto Loan

If you have a long-term auto loan, such as one with a repayment period of 72 months or more, it is likely that you have gap insurance. Cars depreciate quickly, and a longer loan term can make it more challenging to keep up with the depreciation rate. Gap insurance can help cover the difference between what you owe on the loan and the actual cash value of the vehicle.

Rolling Over Negative Equity

If you rolled over negative equity from a previous vehicle into your current loan, there is a good chance you have gap insurance. Negative equity occurs when you owe more on a car loan than the vehicle is worth. Gap insurance can provide valuable protection in case your new vehicle is totaled and there is still outstanding debt from the previous loan rolled into it.

Add-on In Your Auto Insurance Policy

You may have gap insurance if it is listed as an add-on in your auto insurance policy. Sometimes, gap insurance is included as an optional coverage that you can select and add to your existing auto insurance policy. If you recall selecting this add-on, it is likely that you have gap insurance.

These are some of the common signs that may indicate you have gap insurance. Remember, if you still have doubts, it is always best to review your policy documents or reach out to your insurance provider for confirmation. Gap insurance can provide valuable peace of mind knowing that you are financially protected in certain auto-related situations.

Credit: www.facebook.com

What To Do If You Don’t Have Gap Insurance

Gap insurance, also known as guaranteed asset protection insurance, is a type of coverage that protects car owners from financial losses in the event of a total loss or theft of their vehicle. It covers the “gap” between the amount owed on the car loan or lease and the actual cash value of the vehicle at the time of the loss. However, not everyone is aware of the importance of gap insurance until it’s too late.

Consider Purchasing Gap Insurance

If you don’t currently have gap insurance, it’s important to consider purchasing it as soon as possible. While many car buyers may assume their existing auto insurance policy provides enough coverage, this may not always be the case. Gap insurance can provide crucial financial protection, especially if you financed your vehicle with a loan or leased it.

By purchasing gap insurance, you can bridge the gap between what you owe on your vehicle and its actual cash value in the event of a total loss. This can save you from being left with a significant financial burden and allow you to move forward without the added stress of unpaid debts.

Reviewing Your Auto Loan Or Lease

If you don’t have gap insurance, it’s important to review the terms of your auto loan or lease agreement. Understanding the specifics of your financing contract can help you determine your level of risk and whether gap insurance is necessary for your situation.

Check the details of your loan or lease agreement to see if there are any specific clauses or provisions related to gap insurance. Some lenders or lessors may require you to have gap insurance, while others may offer it as an optional add-on. By reviewing your contract, you can gain a better understanding of your financial responsibilities in the event of a total loss.

Exploring Alternatives For Coverage

If you don’t have gap insurance or if it’s not a viable option for you, it’s important to explore alternative ways to protect yourself financially. While these alternatives may not provide the same level of coverage as gap insurance, they can still offer some form of financial safeguard.

One alternative to consider is purchasing a new car replacement coverage, which can provide additional protection if your vehicle is totaled. This type of coverage can help cover the depreciation of your vehicle and provide funds for a replacement car.

Additionally, you can also explore the option of increasing the collision and comprehensive coverage limits on your existing auto insurance policy. While this may not bridge the entire gap, higher coverage limits can help reduce the financial impact of a total loss or theft.

Ultimately, the best course of action will depend on your individual circumstances and risk tolerance. Consulting with an insurance professional can help you evaluate your options and make an informed decision about the most suitable coverage for your needs.

Understanding Gap Insurance Claims

Understanding Gap Insurance Claims is an important aspect of protecting yourself financially in the event of an accident or theft. Gap insurance is designed to cover the difference between the actual cash value of your vehicle and the amount remaining on your loan or lease. In this section, we will explore how to report an accident or theft, file a claim, and the settlement process.

Reporting An Accident Or Theft

When you find yourself in a situation where your vehicle has been involved in an accident or stolen, it is crucial to take immediate action. Reporting the incident to the relevant authorities and your insurance company is the first step towards initiating a gap insurance claim.

Here is a step-by-step guide on how to report an accident or theft:

- Contact the police: In the case of an accident or theft, it is crucial to contact the police immediately. They will assess the situation, file a police report, and provide you with an official document.

- Inform your insurance company: After reporting the incident to the police, it’s time to contact your insurance company. Provide them with all the necessary details, including the police report, to ensure a smooth claims process.

- Notify your gap insurance provider: In addition to your insurance company, it is essential to notify your gap insurance provider about the accident or theft. They will guide you through the next steps and explain the claim process.

Filing A Claim

Once you have reported the accident or theft, the next step is to file a claim. This process involves providing the necessary documentation to support your claim and demonstrating the gap between the vehicle’s value and the remaining loan or lease balance.

Here are the key steps involved in filing a gap insurance claim:

- Gather the required documentation: Before filing a claim, ensure you have all the necessary documentation, such as the police report, insurance claim paperwork, photos of the damage, and any other relevant information.

- Contact your gap insurance provider: Reach out to your gap insurance provider and inform them about the accident or theft. They will guide you through the specific steps required to file a claim, including the submission of the necessary documents.

- Provide supporting evidence: To demonstrate the gap between your vehicle’s value and the loan/lease balance, you may need to provide additional evidence. This can include appraisals, valuation reports, or repair estimates.

Settlement Process

After filing a claim, the settlement process begins. This stage involves evaluating the damages or loss, determining the amount covered by your gap insurance policy, and reaching a fair settlement.

Here is what you can expect during the settlement process:

- Evaluation of damages: An assessment of the damages or loss will be conducted by the insurance company and your gap insurance provider. This evaluation helps determine the cost of repairs, replacement, or payout.

- Determining coverage: Based on the terms and conditions of your gap insurance policy, the amount covered will be determined. This typically includes the gap amount, deductibles, and any limitations specified in the policy.

- Reaching a settlement: Once the evaluation and coverage determination are complete, your gap insurance provider will work with the insurance company and other involved parties to reach a fair settlement. This may involve negotiation or mediation if necessary.

- Payout or vehicle replacement: Depending on the settlement arrangement, you will either receive a payout to cover the gap amount or have your vehicle repaired or replaced, ensuring you are not left with a financial burden.

Understanding the process of gap insurance claims can help you navigate the necessary steps in case of an accident or theft. By promptly reporting incidents, filing claims with the required documentation, and engaging in the settlement process, you can ensure a smoother experience when utilizing your gap insurance coverage.

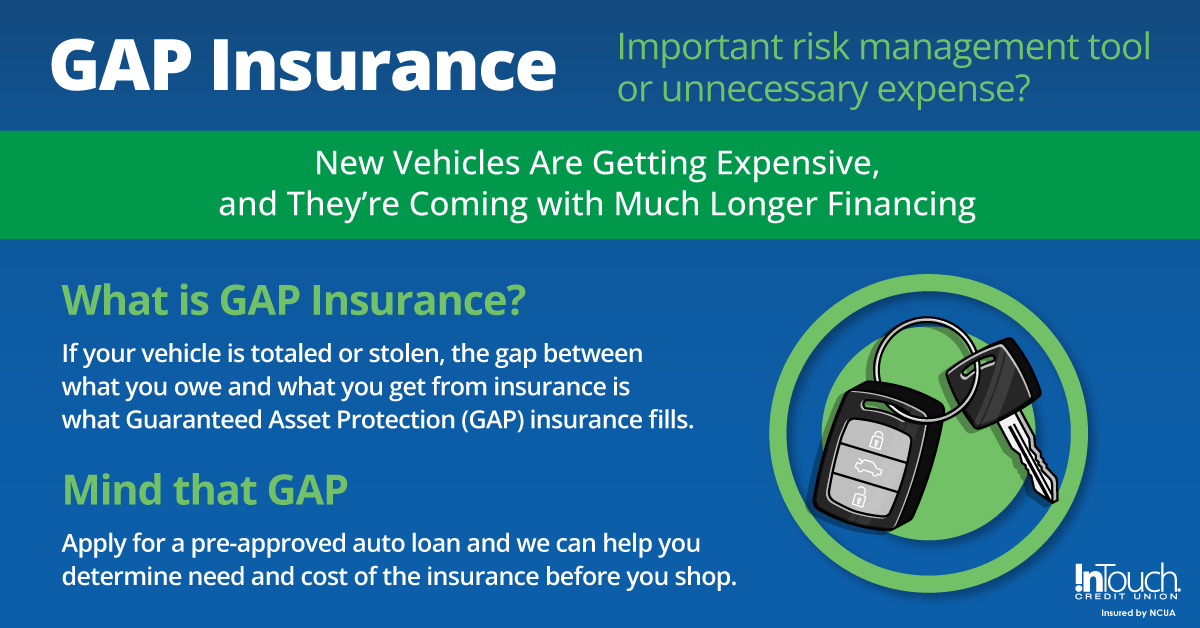

Credit: www.itcu.org

Frequently Asked Questions For How Do You Know If You Have Gap Insurance

What Is Gap Insurance?

Gap insurance is a type of coverage that helps pay off your auto loan if your car is totaled and you owe more than its depreciated value. It bridges the “gap” between what you owe and what your insurance company pays if your car is stolen or damaged beyond repair.

Do I Have Gap Insurance?

To find out if you have gap insurance, you can check your auto insurance policy or contact your insurance provider directly. Gap insurance is usually optional and may have been included as part of your loan or lease agreement. It is important to confirm whether you have it or not to avoid any financial surprises in case of an accident.

How Does Gap Insurance Work?

If your car is totaled or stolen, gap insurance covers the difference between the actual cash value of your car and the amount you still owe on your loan or lease. This can be particularly helpful if you have a significant loan balance or if your car has depreciated quickly.

Gap insurance ensures that you are not left with a financial burden after such events.

Is Gap Insurance Worth It?

Whether gap insurance is worth it depends on your individual circumstances. If you have a large loan balance or if your car has a high depreciation rate, gap insurance can provide valuable protection. It is especially beneficial if you have a low down payment or financed a car with negative equity.

Consider your financial situation and the potential risks before deciding if gap insurance is right for you.

Conclusion

Determining whether you have gap insurance is crucial to protecting your finances if your car is totaled or stolen. Review your car loan or lease agreement, reach out to your insurance provider, and consult with a knowledgeable professional to fully understand your coverage.

By having gap insurance, you can have peace of mind knowing you won’t be left with a substantial financial burden. Stay informed and make the best decision for your individual circumstances.

{ “@context”: “https://schema.org”, “@type”: “FAQPage”, “mainEntity”: [ { “@type”: “Question”, “name”: “What is gap insurance?”, “acceptedAnswer”: { “@type”: “Answer”, “text”: “Gap insurance is a type of coverage that helps pay off your auto loan if your car is totaled and you owe more than its depreciated value. It bridges the \”gap\” between what you owe and what your insurance company pays if your car is stolen or damaged beyond repair.” } } , { “@type”: “Question”, “name”: “Do I have gap insurance?”, “acceptedAnswer”: { “@type”: “Answer”, “text”: “To find out if you have gap insurance, you can check your auto insurance policy or contact your insurance provider directly. Gap insurance is usually optional and may have been included as part of your loan or lease agreement. It is important to confirm whether you have it or not to avoid any financial surprises in case of an accident.” } } , { “@type”: “Question”, “name”: “How does gap insurance work?”, “acceptedAnswer”: { “@type”: “Answer”, “text”: “If your car is totaled or stolen, gap insurance covers the difference between the actual cash value of your car and the amount you still owe on your loan or lease. This can be particularly helpful if you have a significant loan balance or if your car has depreciated quickly. Gap insurance ensures that you are not left with a financial burden after such events.” } } , { “@type”: “Question”, “name”: “Is gap insurance worth it?”, “acceptedAnswer”: { “@type”: “Answer”, “text”: “Whether gap insurance is worth it depends on your individual circumstances. If you have a large loan balance or if your car has a high depreciation rate, gap insurance can provide valuable protection. It is especially beneficial if you have a low down payment or financed a car with negative equity. Consider your financial situation and the potential risks before deciding if gap insurance is right for you.” } } ] }