Fixed-Rate Vs Adjustable-Rate Mortgage Refinance: Smart Choice

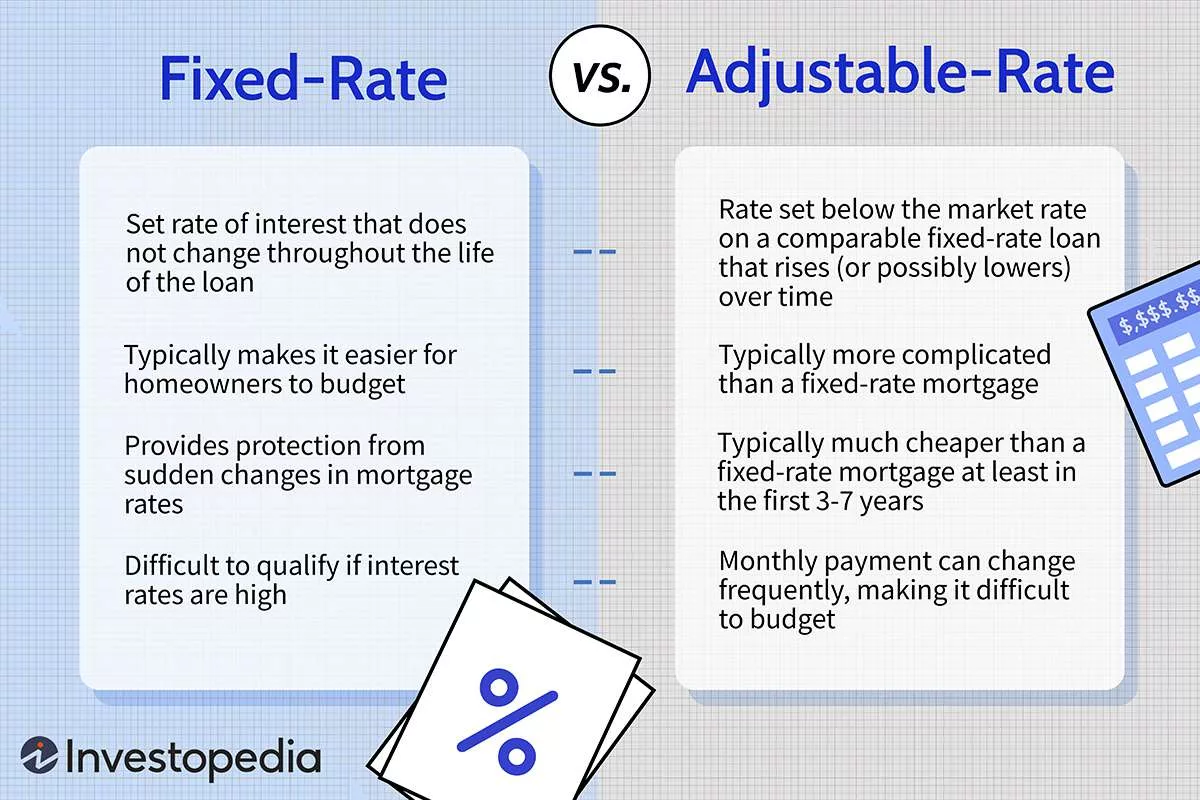

When it comes to refinancing your mortgage, making the right choice is key. It can be hard to decide between a fixed-rate and an adjustable-rate mortgage (ARM) refinance. We will look at both options and help you figure out which one fits your needs best.

What is a Fixed-Rate Mortgage Refinance?

A fixed-rate mortgage has a set interest rate. This rate does not change for the life of the loan. If you refinance to a fixed-rate mortgage, you will have steady monthly payments. This makes it easy to budget and plan for your expenses.

Pros Of Fixed-rate Mortgage Refinance

- Interest rate stays the same.

- Monthly payments are consistent.

- Good for long-term planning.

Cons Of Fixed-rate Mortgage Refinance

- Higher initial rates compared to ARMs.

- Less flexibility if rates fall.

:max_bytes(150000):strip_icc()/arm.asp-Final-45bee660c4a343e0a83eabdbb86a2e74.png)

Credit: www.investopedia.com

What is an Adjustable-Rate Mortgage Refinance?

An adjustable-rate mortgage has a rate that changes. This happens over time after an initial fixed period. The rate adjusts based on market conditions. This means your payments can go up or down.

Pros Of Adjustable-rate Mortgage Refinance

- Lower initial interest rates.

- Can save money if rates go down.

- Good for short-term plans.

Cons Of Adjustable-rate Mortgage Refinance

- Uncertain monthly payments.

- Risk rates and payments can increase.

Comparison Table

| Feature | Fixed-Rate Mortgage | Adjustable-Rate Mortgage |

|---|---|---|

| Interest Rate | Does not change | Can change after fixed period |

| Monthly Payment | Same amount each month | Can vary with rate changes |

| Term Planning | Suitable for long-term | Suitable for short-term |

| Initial Rates | Generally higher | Generally lower |

| Risk | Low risk | Higher risk |

Note: The table helps you see the main differences at a glance. Always talk to a financial advisor for personal advice.

How to Choose Between Fixed-Rate and Adjustable-Rate?

Choosing the right refinance option depends on your situation. Here are some questions to ask:

- How long will you stay in your home? If you plan to stay for many years, a fixed-rate may be better. If you’ll move soon, an ARM could be a smart choice.

- Can you handle changing payments? If steady payments are important, go for a fixed-rate. If not, an ARM’s initial savings might appeal to you.

- What’s your financial outlook? A stable income could make a fixed-rate less stressful. An ability to absorb payment increases might lean you towards an ARM.

Fixed-Rate and Adjustable-Rate: Example Scenarios

Let’s look at some situations where one might be better than the other.

Example 1: Planning For Retirement

John and Jane are planning to retire in 10 years. They want fixed expenses. They choose a fixed-rate mortgage refinance.

Example 2: Moving Soon

Alex plans to move in 5 years for work. A lower initial rate from an ARM refinance suits Alex well.

Example 3: Expecting Higher Income

Sarah is early in her career. She expects her salary to rise. She picks an ARM for now, betting on her growing income.

Credit: www.salliemae.com

Final Thoughts

Your choice between a fixed-rate or adjustable-rate mortgage refinance is important. Think about your future plans, risk tolerance, and financial predictability. It’s always wise to talk to a professional. They can understand your needs and provide guidance.

Remember: What works for someone else may not work for you. Your own unique situation is what truly matters.

Ready to Refinance?

If you’re ready to make a move, start by researching. Get quotes from different lenders. Look at all your options. And always, always make the choice that feels right for you and your family.

Refinancing your mortgage is a big step. But now, you’re a bit more prepared to take that step with confidence!

Frequently Asked Questions For Fixed-rate Vs Adjustable-rate Mortgage Refinance: Smart Choice

What Determines Fixed-rate Mortgage Stability?

Fixed-rate mortgages offer stability through consistent interest rates and predictable monthly payments for the loan’s duration.

Is Refinancing To Adjustable-rate Risky?

Refinancing to an adjustable-rate mortgage can present risks if rates rise significantly, increasing future monthly payments.

Which Refinance Option Saves More Money?

Savings from refinancing depend on current interest rates, loan terms, and how long you plan to stay in your home.

How Do Rate Changes Affect Arm Payments?

Rate changes in an ARM can increase or decrease your monthly payments based on the fluctuating interest market rates.