Do You Really Own Your Home If You Have a Mortgage?

Yes, you own your home if you have a mortgage. When you obtain a mortgage to purchase a home, you become the legal owner of the property, even though the lender holds a lien on it.

Credit: m.facebook.com

What Is A Mortgage?

A mortgage is a loan used to purchase a home. While you are making mortgage payments, ownership of the property belongs to the lender, but once the mortgage is fully paid off, you become the sole owner of your home.

Definition Of Mortgage

A mortgage is a legal agreement between a borrower and a lender that allows the borrower to obtain funds to buy a property. The property serves as collateral, which means that if the borrower fails to repay the loan, the lender has the right to take ownership of the property. So, essentially, a mortgage is a loan that is specifically used to finance the purchase of a home or other real estate property.How Does A Mortgage Work?

When you take out a mortgage, you are borrowing a large sum of money to purchase a home. The amount of money you can borrow is based on several factors, such as your income, creditworthiness, and the value of the property. The lender will charge you interest on the amount borrowed, and you will make regular payments over a predetermined period, typically 15 to 30 years, until the loan is fully repaid. During the repayment period, you will be paying both the principal (the original amount borrowed) and the interest. The interest is the cost of borrowing the money, and it can be fixed or adjustable, depending on the type of mortgage you choose. It’s important to note that, in the early years of the mortgage, a larger portion of your payments will go towards paying off the interest rather than the principal. However, as time goes on, the balance will shift, and more of your payments will go towards reducing the principal.Understanding Mortgage Terms

To fully grasp how a mortgage works, it’s essential to familiarize yourself with some common terms associated with this type of loan: 1. Principal: The total amount of money you borrow to purchase the property. 2. Interest Rate: The rate at which the lender charges you interest on the loan. 3. Term: The length of time you have to repay the loan. This is usually expressed in years, such as 15 or 30 years. 4. Amortization: The process of gradually paying off the loan over time through regular payments. 5. Down Payment: The upfront payment you make towards the purchase price of the property. It is typically a percentage of the total price, and a larger down payment can result in a lower mortgage amount and better terms. 6. Equity: The difference between the current market value of your property and the remaining balance on your mortgage. As you make mortgage payments and the value of your property increases, your equity in the property grows. By understanding these terms and how they relate to your mortgage, you can make informed decisions and effectively manage your home loan. Owning a home through a mortgage is a significant financial commitment, but it can also be a valuable asset that builds your wealth over time.:max_bytes(150000):strip_icc()/dotdash-111214-buying-home-cash-vs-mortgage-v2-325bbfe3ca7343ca904ecaa9d2cb6c67.jpg)

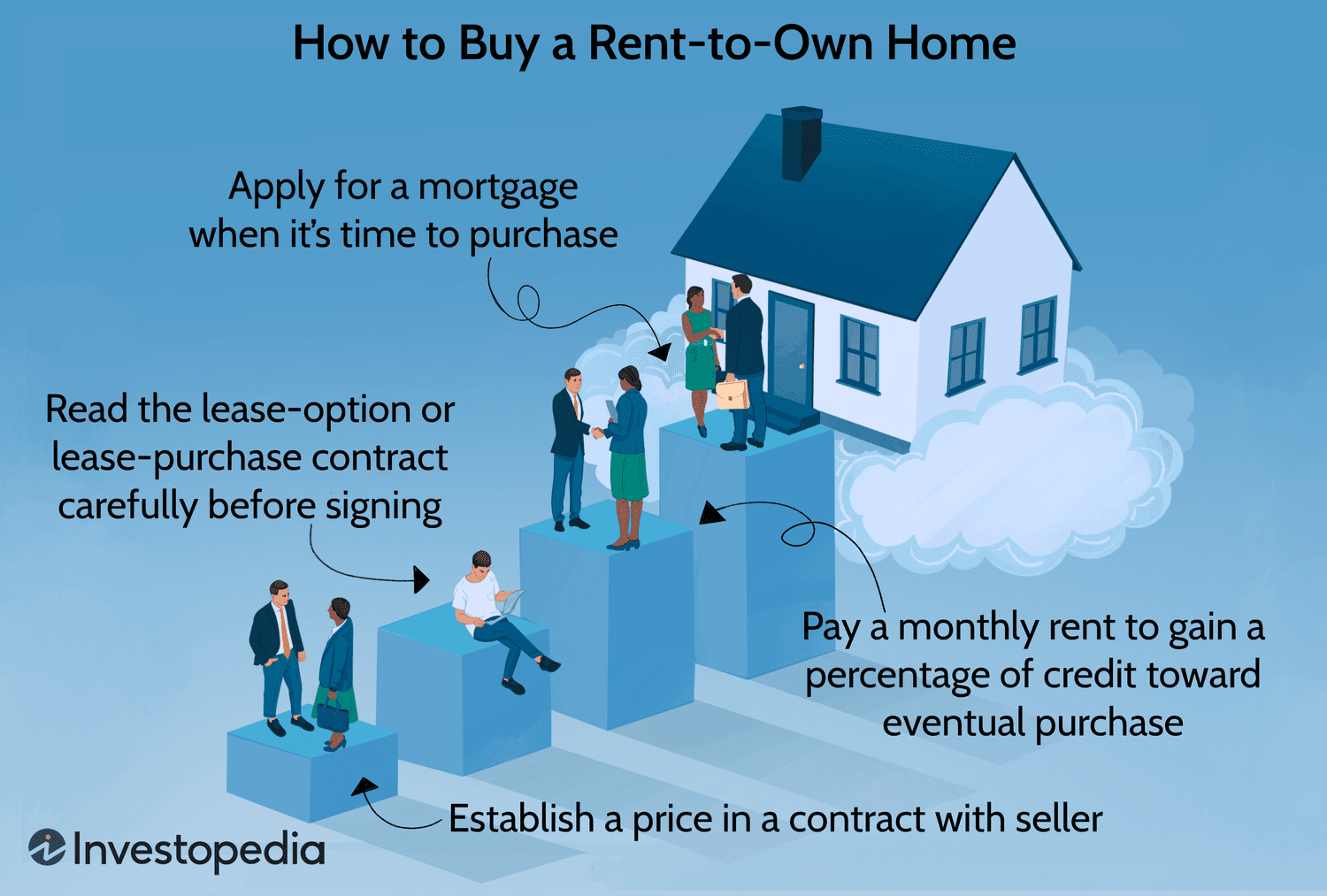

Credit: www.investopedia.com

The Ownership Myth

Discover the truth about homeownership with a mortgage—explore whether you truly own your home or if the myth is too good to be true. Uncover the reality behind this common misconception and gain a fresh perspective on mortgage ownership.

Clearing Up The Misconception

Many people believe they don’t truly own their home if they have a mortgage. This common misconception stems from a misunderstanding of how mortgages and homeownership work. The reality is that, even with a mortgage, you still have ownership rights and can enjoy the benefits of homeownership. Clearing up this misconception is crucial for those considering a mortgage or wanting to have a clearer understanding of their current homeownership status.

Understanding Mortgage Terms

One of the reasons the idea that you don’t own your home with a mortgage persists is the confusion surrounding mortgage terms. However, having a mortgage does not diminish your ownership rights; it is simply a financial arrangement to help you purchase a home. When you take out a mortgage, you borrow money from a lender to buy a property. The lender holds a lien on the property as security until you repay the loan in full.

To gain a better understanding of mortgage terms, let’s dive into the concept of equity. Equity is the difference between the value of your home and the amount of your outstanding mortgage balance. As you make your monthly mortgage payments, you build equity in your property. This equity represents your ownership stake in the home and increases with each payment, bringing you closer to complete homeownership.

It’s important to note that your lender does not have any claim to your home’s equity. They only have a claim to the property itself until the mortgage is fully paid off. This means that while you have a mortgage, you are still the true owner of your home.

Another essential mortgage term to understand is the deed. The deed is a legal document that establishes ownership of the property. Whether you have a mortgage or not, the deed will typically show you as the homeowner. The only difference is that when you have a mortgage, the lender’s lien on the property will also be recorded on the deed.

So, when it comes to homeownership, having a mortgage does not equate to not owning your home. You still have the same ownership rights as those who have paid off their mortgage in full. The only difference is that you have an outstanding loan and financial responsibilities associated with that loan.

The Effects Of A Mortgage

When you take out a mortgage to purchase a home, it’s important to understand the effects it can have on your ownership rights and financial obligations. Although you technically own your home, there are certain limitations and ongoing responsibilities that come with having a mortgage.

Limited Equity

One of the primary effects of having a mortgage is the limited equity you have in your home. Equity represents the difference between the market value of your house and the outstanding balance on your mortgage. In the early years of your mortgage, a significant portion of your monthly payments goes towards interest rather than principal, which means your equity builds up slowly. This limited equity can impact your options to sell, refinance, or borrow against the value of your home.

Ongoing Financial Obligations

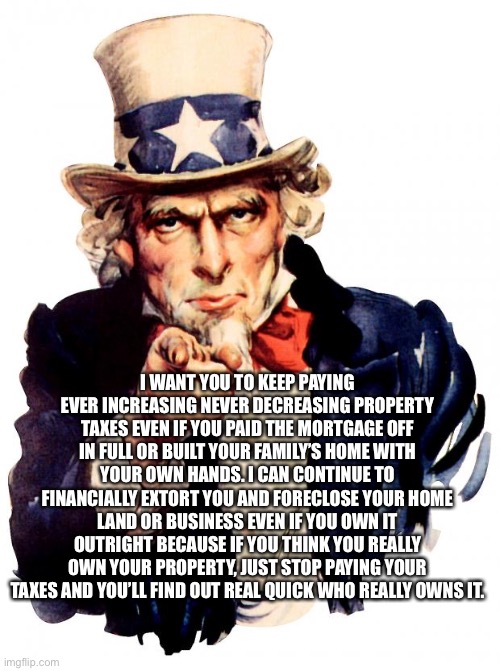

Having a mortgage also means having ongoing financial obligations that extend beyond the initial purchase price of your home. You are responsible for making regular mortgage payments, typically on a monthly basis. These payments consist of principal, interest, homeowner’s insurance, and property taxes. It’s essential to budget for these ongoing expenses, as failure to meet your financial obligations could lead to foreclosure and the loss of your home.

| Ongoing Financial Obligations | Impact |

|---|---|

| Mortgage Payments | Regular monthly payments are required to cover the principal and interest on your loan. |

| Homeowner’s Insurance | Insurance coverage to protect your home against damage or loss. |

| Property Taxes | Annual taxes levied by the local government based on the assessed value of your property. |

Considering these ongoing financial obligations when budgeting for your homeownership journey is crucial to ensure you can comfortably afford your mortgage and maintain a stable financial situation.

Credit: imgflip.com

Rights And Responsibilities

When you become a homeowner, whether through purchasing a property outright or obtaining a mortgage, you gain certain rights and responsibilities. Understanding these rights and responsibilities is crucial for maintaining a positive homeownership experience. In this section, we will explore the rights and responsibilities that come with owning a home, focusing on the key points that every homeowner should be aware of.

Rights Of The Homeowner

As a homeowner, you enjoy various rights that grant you control and protection over your property. These rights include:

- Right to Possession: When you have a mortgage, you have the right to live in and possess your home as long as you fulfill your mortgage obligations.

- Right to Equity: As you make mortgage payments, you build equity in your home, which is the difference between the value of the property and the amount you owe on the mortgage. This equity is an asset that can be used for future financial stability or investments.

- Right to Modifications: Subject to lender approval, you have the right to make modifications or improvements to your property to customize it to your preferences and needs.

- Right to Sell: Homeownership provides you with the right to sell your property at any time, allowing you to move or upgrade to a different home.

Responsibilities Of The Homeowner

Alongside these rights, homeownership also entails certain responsibilities that must be fulfilled. These responsibilities include:

- Mortgage Payments: One of the primary responsibilities of a homeowner with a mortgage is to make timely monthly mortgage payments. This ensures that you meet your financial obligation to the lender and avoid potential foreclosure.

- Property Maintenance: It is the homeowner’s responsibility to maintain their property, which includes regular upkeep, repairs, and addressing any issues that may arise.

- Insurance Coverage: Homeowners are required to maintain adequate insurance coverage to protect their property and possessions. This typically includes homeowners insurance, which provides coverage in the event of damages, theft, or liability claims.

- Compliance with Laws and Regulations: Homeowners must comply with all applicable laws and regulations regarding property use, zoning restrictions, building codes, and any other local or state regulations pertaining to homeownership.

- Property Taxes: Homeowners are responsible for paying property taxes, which are assessed by the local government to fund services and infrastructure within the area.

Building Equity

Owning a home with a mortgage means that you are building equity over time. As you make monthly payments, you gradually increase your ownership stake in the property.

Paying Down The Principal

One way you build equity in your home is by paying down the principal on your mortgage. When you make your monthly mortgage payment, a portion goes towards paying off the principal balance owed on your loan. The more you pay towards the principal, the more equity you accumulate. This is because the principal represents the actual value of the home that you own. As you gradually reduce the principal, your ownership stake increases. Over time, with consistent payments, you can significantly grow your equity and have a greater share in your home.Appreciation And Market Value

Another factor that aids in building equity is the appreciation of your home’s market value. Appreciation refers to the increase in the value of your property over time. Real estate markets can fluctuate, and if your home’s value goes up, so does your equity. Market conditions, location, and improvements to your property can all contribute to appreciation. It’s important to stay informed about the market trends in your area to gauge the potential for your home’s value to increase. By keeping up with maintenance and making strategic upgrades, you can enhance your home’s value and further bolster your equity. Below is a table summarizing the key points:| Factors | Effect on Equity |

|---|---|

| Paying Down the Principal | Increases equity by reducing the loan balance |

| Appreciation and Market Value | Increases equity by raising the value of the property |

Frequently Asked Questions On Do You Own Your Home If You Have A Mortgage

Does Paying Mortgage Mean You Own The House?

Paying a mortgage doesn’t automatically mean you own the house. Ownership is transferred when the mortgage is fully paid off. Until then, the lender holds a lien on the property as collateral for the loan.

Does A Mortgage Mean The Bank Owns The House?

No, a mortgage does not mean the bank owns the house. It is a loan used to purchase the property, and the ownership remains with the borrower. The bank has a lien on the house until the mortgage is paid off.

Does My House Belong To Me Or The Bank?

Your house belongs to you, not the bank.

Can You Be On A Mortgage Without Owning The House?

Yes, it is possible to be on a mortgage without owning the house. This is known as co-signing or being a co-borrower on the loan. In this case, you share the responsibility for repaying the mortgage with the primary borrower, even though you don’t own the property.

Conclusion

While you have a mortgage, you do not fully own your home until you have paid off the entire loan. Your mortgage is essentially a loan secured by the property, allowing you to purchase the house. Until the mortgage is fully paid, the lender has a legal claim to the property in case of default.

However, as you make monthly mortgage payments, you will gradually build equity and move closer to owning the home outright. So, while you don’t own your home entirely, homeownership becomes a reality through the process of mortgage repayment.