Refinance Mortgage for Self-Employed: Smart Savings!

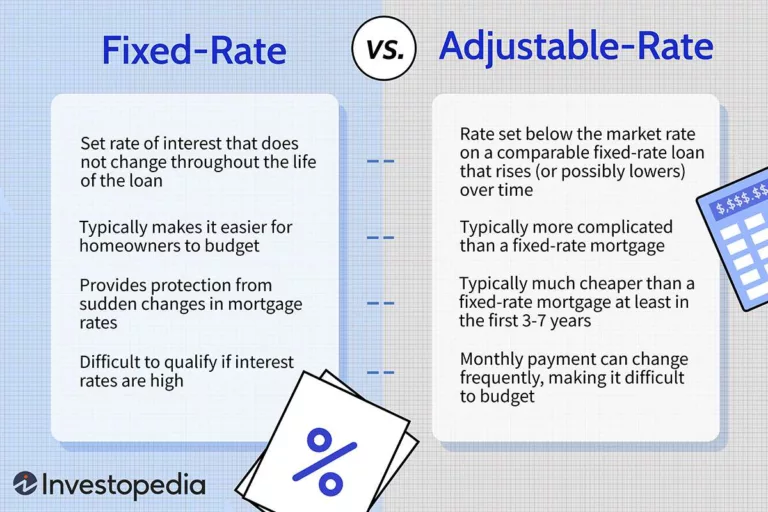

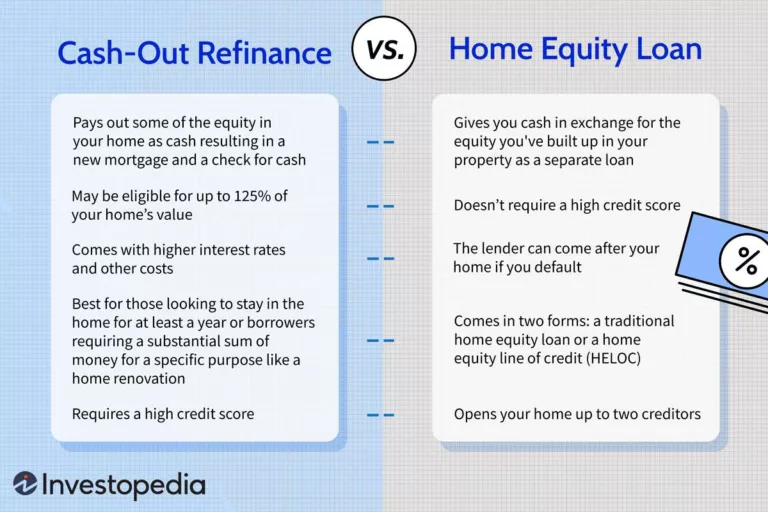

Are you self-employed and looking to refinance your mortgage? This guide shows you how in simple steps. Credit: www.facebook.com What Does It Mean to Refinance Your Mortgage? Refinancing a mortgage means you get a new loan. This new loan pays off your old home loan. People do it to get better loan terms. Credit: www.forbes.com…