|S 100K in Student Loans a Lot? : Crushing College Debt – Is 100K Too Much?

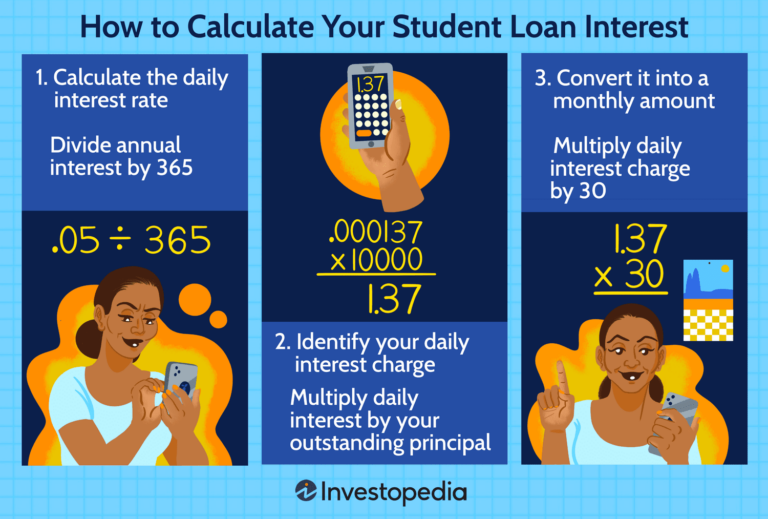

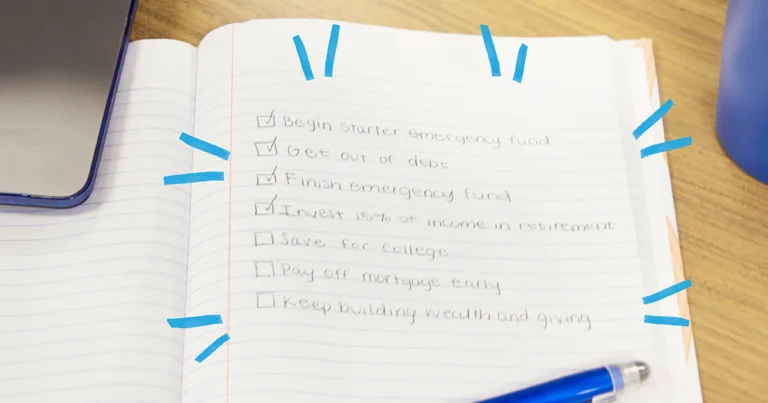

Yes, $100K in student loans is a significant amount. With $100,000 in student loans, borrowers face a substantial financial burden that can have long-term effects on their finances and future opportunities. Pursuing a higher education comes with costs, and for many students, taking out loans is a necessary step. However, the amount of debt incurred…