What Makes a Promissory Note Illegal? : Unmasking the Hidden Dangers

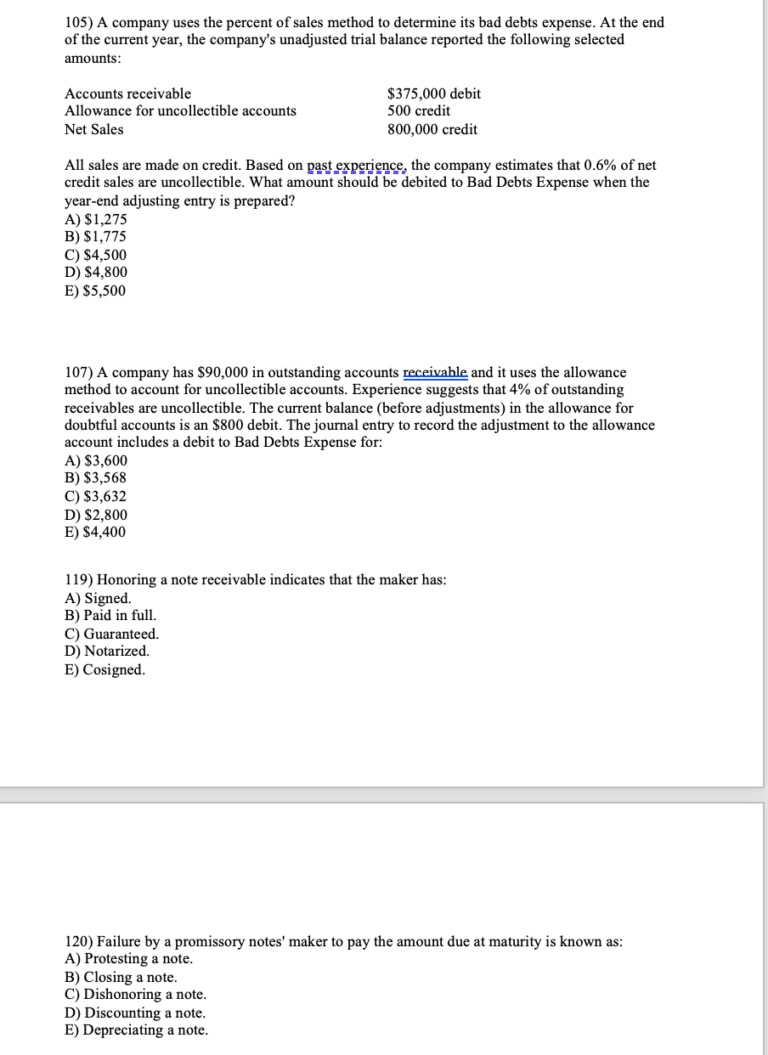

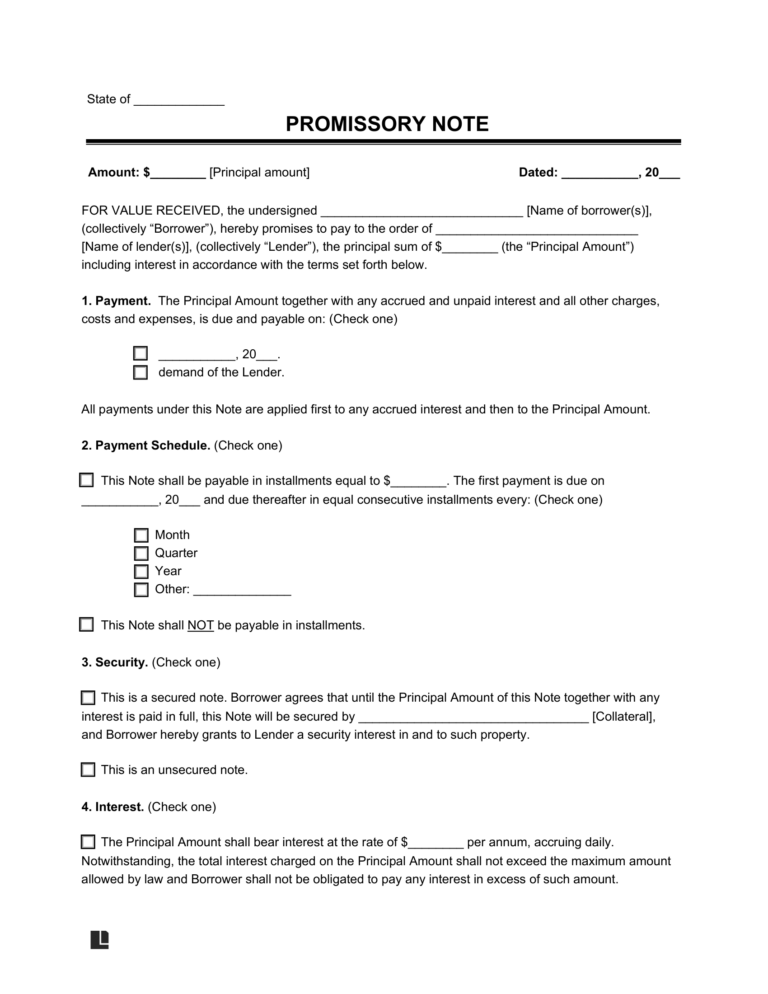

A promissory note may be considered illegal if it lacks necessary elements or violates legal requirements. An illegal promissory note may result from improper drafting, fraudulent intent, or noncompliance with relevant laws or regulations. Credit: us.macmillan.com Recognizing Illegal Promissory Notes Promissory notes serve as legal documents that outline the terms of a loan or financial…