Cash-Out Refinance Mortgage Calculator: Unlock Savings!

Discover how to use a cash-out refinance mortgage calculator.

Is your home now worth more money? Do you want to get some cash? A cash-out refinance might be for you! Let us explore.

What is Cash-Out Refinance?

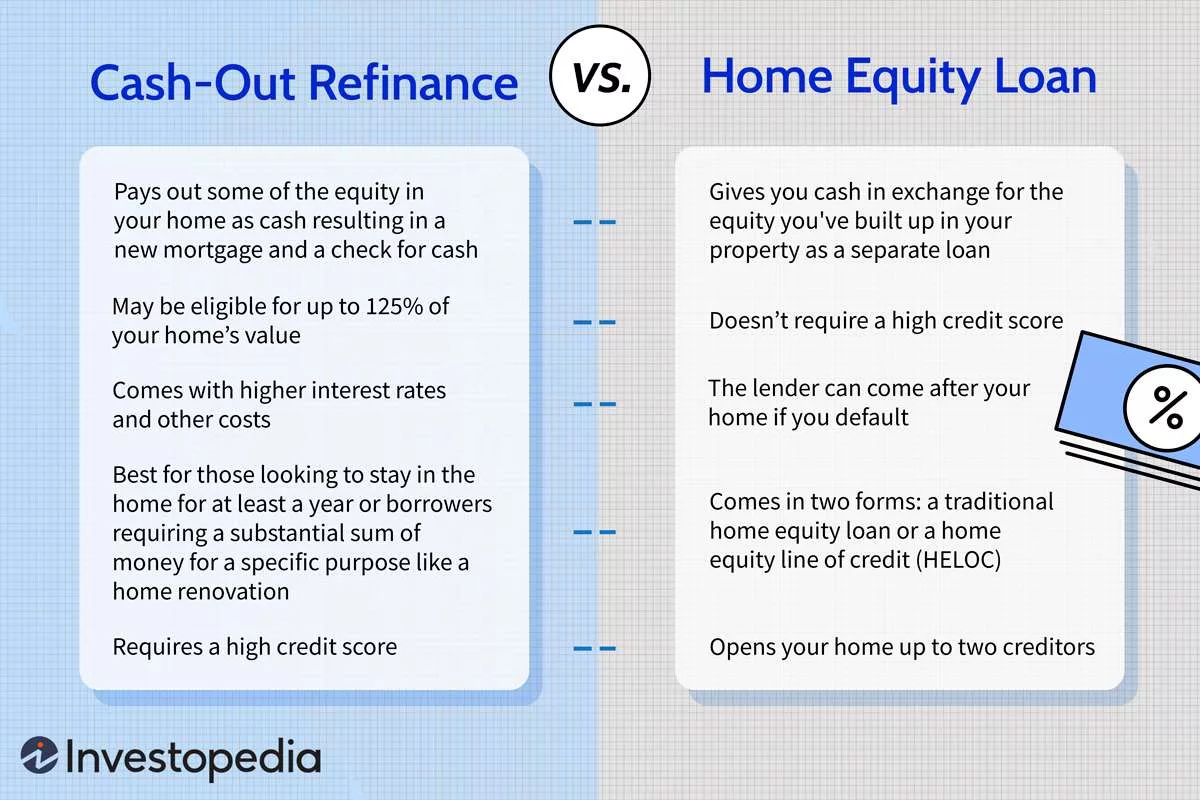

A cash-out refinance lets you borrow more money than you owe on your home. You get the extra cash. This money can be for repairs or other big costs.

How Does a Mortgage Calculator Help?

A mortgage calculator shows you the numbers. It tells you if refinancing makes sense. You will see how much cash you can get and what it costs.

| Input | Output |

|---|---|

| Current Home Value | How Much You Can Borrow |

| Current Mortgage Balance | Your New Monthly Payment |

| Desired Cash Out | Costs and Fees |

| Interest Rate | Total Interest Paid |

Steps to Use a Cash-Out Refinance Calculator

- Find Your Home’s Current Value: Look online or ask a realtor.

- Know Your Mortgage Balance: Check your latest statement.

- Decide on Your Cash-Out Amount: How much money do you want now?

- Input the Interest Rates: Search for the best rates you can get.

- Calculate and Review: See what the calculator says. Think about it carefully.

Credit: www.bankrate.com

Credit: assurancemortgage.com

Why Consider Cash-Out Refinance?

- Home Improvements: Fix your home or make it bigger.

- Big Expenses: Pay for a wedding or college fees.

- Pay Off Debt: Clear high-interest loans or credit cards.

Important Things to Keep in Mind

- Interest Rates: A lower rate saves you money.

- Fees: Refinancing costs money too. Add this to your plan.

- Loan Terms: A longer term means smaller payments, but more interest.

Tips for a Smart Cash-Out Refinance

Shop Around: Don’t take the first offer. Look for better ones.

Boost Your Credit Score: A higher score gets you a better rate.

Consider Future Plans: Will you stay in your home long? Think about this.

Frequently Asked Questions For Cash-out Refinance Mortgage Calculator: Unlock Savings!

What Is A Cash-out Refinance?

A cash-out refinance replaces an existing mortgage with a new loan that exceeds the current loan balance, allowing borrowers to access the equity in their home as cash.

How Does A Cash-out Calculator Work?

A cash-out refinance calculator helps determine the amount of equity you can withdraw from your home, considering your current mortgage balance, home value, and applicable rates.

Benefits Of Cash-out Refinance?

Cash-out refinancing offers borrowers the ability to leverage home equity for large expenses, potentially secure lower interest rates, and consolidate debt under more favorable terms.

Who Qualifies For Cash-out Refinancing?

Homeowners with sufficient equity in their property, a solid credit score, and a stable income are generally eligible for cash-out refinancing options.

“` This blog post provides a kid-friendly guide to understanding the concept of cash-out refinance and how a mortgage calculator can assist homeowners in making decisions related to refinancing. It covers what cash-out refinance is, how a mortgage calculator helps, steps to use such a calculator, reasons to consider cash-out refinancing, important considerations, and tips for a smart cash-out refinance. The HTML format includes SEO-friendly tags, keywords, and descriptions. Tables, lists, and bold text are used to make information digestible and easy to read for younger audiences.