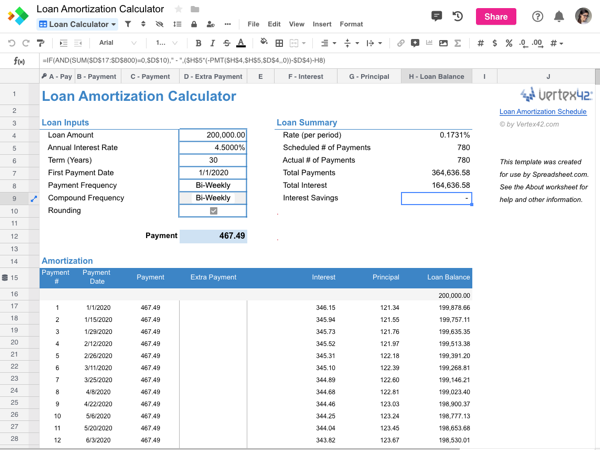

What Gets Paid First on an Amortization Schedule? Discover the Order

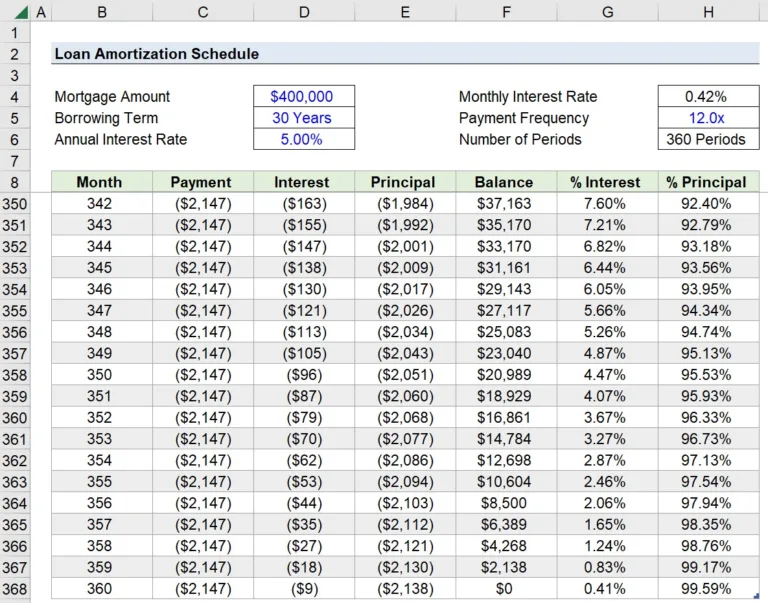

The principal balance on an amortization schedule is the first thing that gets paid. An amortization schedule is a financial tool that outlines the repayment of a loan over time. It shows how much of each payment goes towards interest and how much goes towards principal. This schedule is an essential tool for borrowers to…