How Does a Reverse Mortgage Work in California? Unlocking the Hidden Financial Potential

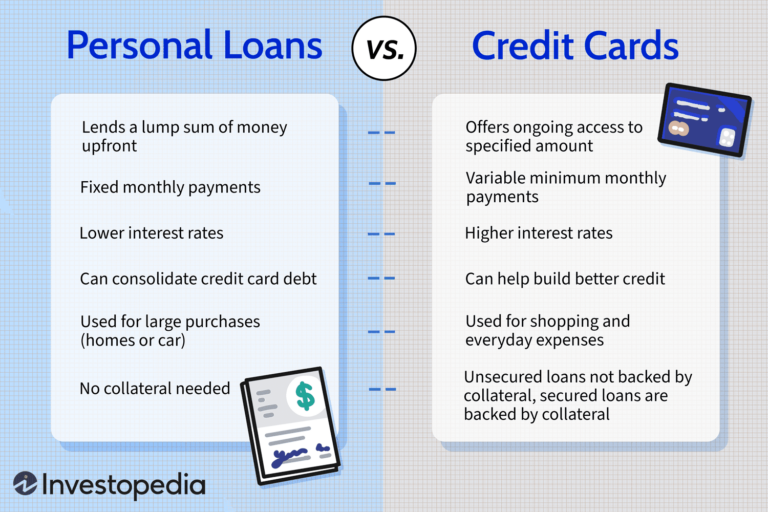

A reverse mortgage in California allows homeowners to convert a portion of their home’s equity into cash without having to sell the property or make monthly mortgage payments. It’s a type of loan that is only available to older adults aged 62 and above, offering financial flexibility during retirement years. Homeowners can receive the loan…