Which of the Following Statements is Not True About Mortgages? Debunking Common Myths

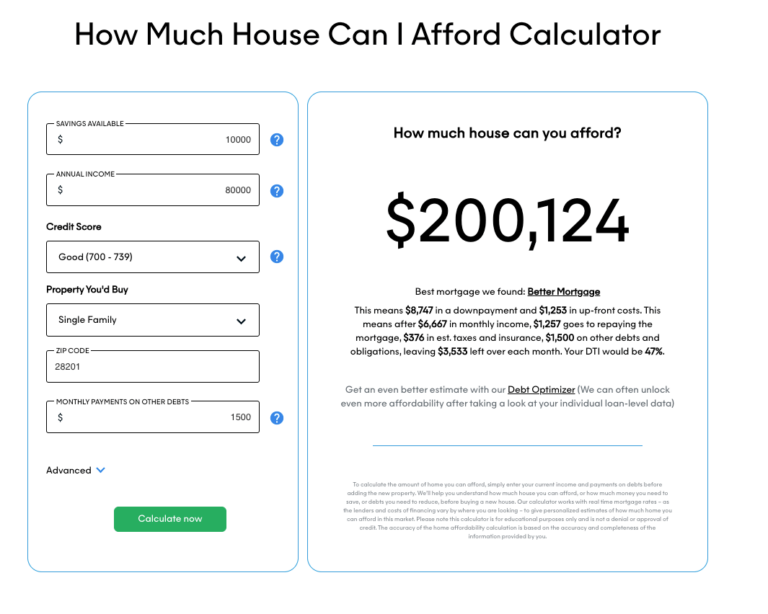

Which of the following statements is not true about mortgages: Mortgages do not require any down payment. The truth is that some mortgage programs do not require a down payment, but it is not accurate to say that mortgages, in general, do not require any down payment. A mortgage is a financial agreement between a…