Cross Default Explained: The Risk You Can’t Afford to Ignore

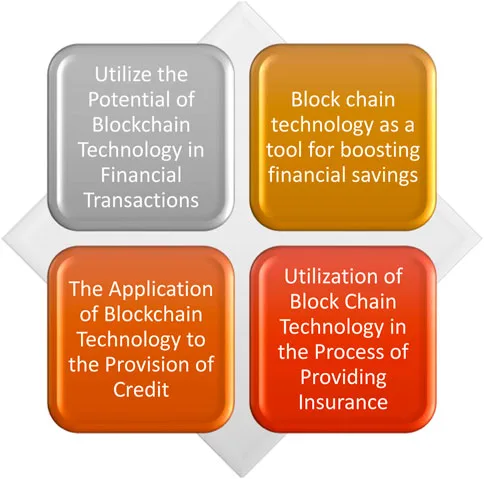

Cross default refers to a situation in which defaulting on one obligation triggers a default on other related obligations. This commonly occurs when a borrower defaults on multiple loans or credit agreements. Credit: blog.hubspot.com What Is Cross Default In the financial world, where contracts and agreements are the backbone of business interactions, cross default is…