Can I Buy a House With a 571 Credit Score? Unlocking the Possibilities

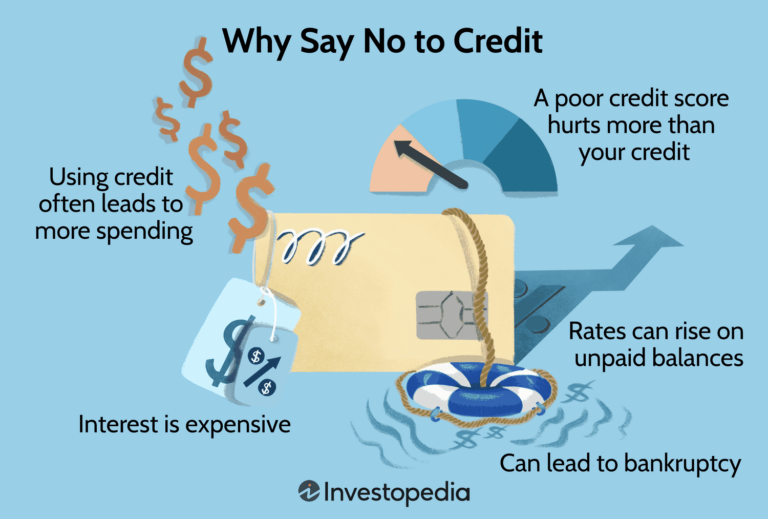

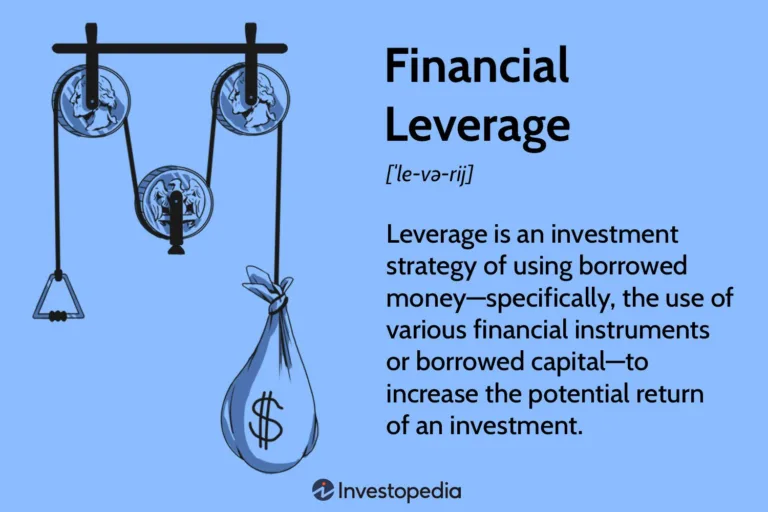

Yes, it may be possible to buy a house with a credit score of 571. However, a lower credit score typically means higher interest rates and stricter lending requirements, making it more challenging to secure a mortgage loan. Your credit score is an important factor that lenders consider when deciding whether to approve your loan…