A Participation Mortgage is an Example of a Financial Boost

A participation mortgage is an example of a shared equity mortgage. This type of mortgage allows multiple lenders to participate in the financing of a property, where each lender holds a portion of the mortgage.

Shared equity mortgages provide an innovative way for homebuyers to secure financing by spreading the risk among multiple lenders. In a participation mortgage, the lenders typically split the mortgage amount and share in the corresponding interest payments. The borrower benefits from the reduced risk as well as the potential access to a larger pool of funds.

This type of mortgage arrangement often appeals to individuals who may not qualify for a traditional mortgage or who want to diversify their risk. Additionally, participation mortgages can be structured in various ways, such as joint ventures or syndicated loans, offering flexibility for both borrowers and lenders.

Credit: investors.atlanticunionbank.com

What Is A Participation Mortgage?

A Participation Mortgage is an example of a cooperative homeowner loan where multiple lenders share ownership and receive a portion of the profits and risks involved. This type of mortgage allows lenders to invest in real estate without directly managing the property.

Definition

A participation mortgage, also known as a shared appreciation mortgage, is a type of home loan where the lender shares in the profits when the property is sold or refinanced. Unlike a traditional mortgage, where the lender only receives interest on the loan, a participation mortgage allows the lender to have an ownership interest in the property. It is a way for the lender to potentially earn a larger return on their investment.

How It Works

When a borrower obtains a participation mortgage, they agree to share a portion of the property’s future appreciation or equity with the lender. The exact terms of the arrangement can vary depending on the agreement between the parties involved.

- Instead of solely paying interest on the loan, the borrower may also agree to share a predetermined percentage of the property’s increased value.

- This can be done through a lump sum payment, monthly payments, or a combination of both.

- It is important to note that the borrower retains full ownership and use of the property throughout the mortgage term.

The lender’s participation typically comes into effect when the property is sold or refinanced. At this point, the lender will receive their share of the property’s appreciation or equity as outlined in the agreement.

A participation mortgage can be beneficial for both the borrower and the lender. For the borrower, it allows them to secure financing while potentially benefiting from the lender’s expertise and resources. For the lender, it presents an opportunity to earn a greater return on their investment compared to traditional mortgages.

Benefits Of A Participation Mortgage

A participation mortgage is an example of a mortgage that offers unique advantages to both borrowers and lenders. By spreading the risk and allowing multiple parties to participate in the financing of a property, participation mortgages provide increased borrowing power, lower down payment requirements, and a shared risk that can benefit all parties involved.

Increased Borrowing Power

One of the key benefits of a participation mortgage is the increased borrowing power it provides to borrowers. By involving multiple lenders, the overall loan amount can be higher, allowing borrowers to access a larger pool of funds for their property purchase. This increased borrowing power opens up opportunities for borrowers to invest in more valuable properties or to pursue larger-scale projects.

Lower Down Payment

Another advantage of a participation mortgage is the ability to make a lower down payment. With traditional mortgages, borrowers are often required to provide a substantial down payment, which can be a barrier to entry for many aspiring homeowners or real estate investors. However, participation mortgages allow for a lower down payment by spreading the financing across multiple lenders. This lower down payment requirement makes property ownership more attainable for a wider range of individuals.

Shared Risk

Shared risk is a fundamental aspect of participation mortgages and can greatly benefit both borrowers and lenders. When multiple parties share the risk of a mortgage, the potential losses are distributed among them, reducing the individual exposure for each participant. In the event of foreclosure or default, the financial burden is shared, minimizing the impact on any single lender. This shared risk encourages lenders to be more open to financing opportunities, resulting in greater access to mortgage options for borrowers.

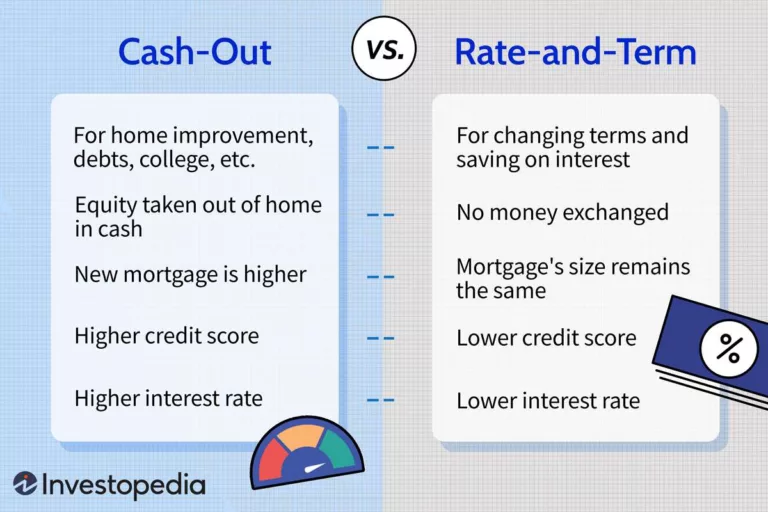

Qualifying For A Participation Mortgage

Qualifying for a participation mortgage is an essential step in acquiring a property through this unique financing option. Participating in this type of mortgage allows the borrower to share both the risks and rewards of the property investment with the lender, making it an attractive choice for certain individuals. To qualify, however, the borrower must meet specific criteria related to creditworthiness, income, and property evaluation.

Creditworthiness

Creditworthiness plays a crucial role in determining whether an individual qualifies for a participation mortgage. Lenders assess an applicant’s credit history and credit score to evaluate their ability to manage debt and make timely payments. Maintaining a good credit score, usually above 640, demonstrates responsible financial behavior, making it easier to secure a participation mortgage.

Income Requirements

Income requirements also factor heavily into qualifying for a participation mortgage. Lenders typically set minimum income thresholds to ensure that borrowers have sufficient earnings to handle mortgage payments. The specific income requirements may vary depending on the lender, the size of the mortgage, and other factors. It’s important to provide accurate and verifiable income information for a successful application.

Property Evaluation

The lender’s evaluation of the property itself is another crucial aspect of qualifying for a participation mortgage. They want to ensure that the property’s value aligns with the loan amount being requested. A professional appraisal may be required to determine the market value of the property. Lenders also consider factors such as location, condition, and potential for future appreciation. The property’s evaluation plays a significant role in determining the terms of the participation mortgage.

Credit: www.ft.com

Risks And Considerations

When considering a participation mortgage, it is important to be aware of the potential risks and considerations. This type of mortgage carries certain limitations on control, potential for loss, and specific agreements and terms that should be thoroughly understood.

Limited Control

One key aspect to keep in mind when opting for a participation mortgage is the limited control you have over the property. Unlike a traditional mortgage, where you have full ownership and control, a participation mortgage involves shared ownership with other participants. This means that decisions regarding the property, such as renovations, leasing, or selling, may require the agreement of all parties involved.

It is crucial to carefully review and understand the terms of the participation agreement, as they will outline the level of control you have over the property and the decision-making processes. Ensure that the agreement aligns with your investment goals and preferences to avoid any potential conflicts or disagreements down the line.

Potential Loss

Another important consideration is the potential for loss. As with any investment, there is no guarantee of a profit, and the value of the property can fluctuate. In the case of a participation mortgage, your investment is tied to the performance of the property and the real estate market.

If the property experiences a decline in value or fails to generate sufficient income, you may face a loss on your investment. It is essential to evaluate the property’s location, market conditions, and potential risks thoroughly before committing to a participation mortgage. Conducting thorough research and seeking professional advice can help mitigate the potential for loss and make an informed decision.

Agreements And Terms

Participation mortgages involve specific agreements and terms that should be thoroughly reviewed and understood. These documents outline the responsibilities and obligations of all participants, as well as the distribution of income and expenses related to the property.

Additionally, these agreements may contain provisions for dispute resolution, exit strategies, and potential scenarios of property sale. Familiarize yourself with the terms and clauses mentioned in the participation agreement to ensure you are fully aware of your rights and obligations.

Some key points to consider in the agreements include:

- Income distribution among participants

- Expense allocation and sharing

- Rules and procedures for decision-making

- Responsibilities and obligations of each participant

- Terms and conditions for the potential sale of the property

- Exit strategies and options

Understanding these agreements and terms will help you make an informed decision about participating in a mortgage and ensure that your expectations align with the terms outlined in the contract.

Real-world Examples Of Participation Mortgages

A participation mortgage provides real-world examples of how individuals can invest in property collectively and share the financial benefits. This type of mortgage allows multiple parties to contribute funds, making it a flexible and collaborative option for property ownership.

Commercial Real Estate

Participation mortgages can be found in various real-world examples, one of which is in commercial real estate. In this scenario, a participation mortgage allows multiple investors to pool their funds together to finance a commercial property. Each investor becomes a participant or a co-lender and has a proportional share in the property’s income and expenses. This type of mortgage enables smaller investors to participate in lucrative commercial real estate projects that they may not have been able to afford individually. It also spreads the risk among multiple participants, minimizing the individual’s exposure to potential losses. Commercial real estate projects funded through participation mortgages can involve office buildings, shopping centers, hotels, or industrial properties.Community Development Projects

Another area where participation mortgages are commonly used is in community development projects. These projects aim to revitalize and improve specific areas within a community, such as urban neighborhoods or rural towns. Participation mortgages provide an opportunity for individuals or organizations to invest in these projects and contribute to the community’s growth. By participating in such a mortgage, investors can help finance initiatives like affordable housing, public infrastructure, or commercial establishments that promote economic development. This type of mortgage allows investors to directly impact and shape the development of their communities while potentially earning a return on their investment. It also encourages collaboration between various stakeholders, including government agencies, businesses, and community members, to achieve common development goals.Summary

In summary, participation mortgages are a versatile financial instrument that can be applied to various real-world scenarios. Commercial real estate projects benefit from the ability to attract multiple investors, sharing both the risks and rewards of owning income-generating properties. Meanwhile, community development projects can leverage participation mortgages to engage investors in initiatives that enhance local neighborhoods and economies. By exploring and understanding these real-world examples, individuals can better appreciate the practical applications and advantages of participation mortgages. Whether it’s investing in commercial properties or contributing to community growth, participation mortgages offer opportunities for individuals to be part of something bigger while potentially realizing financial gains.

Credit: www.tremendous.com

Frequently Asked Questions For A Participation Mortgage Is An Example Of A

What Is A Participation Mortgage Quizlet?

A participation mortgage is a type of loan where two or more lenders share the risks and rewards. Each lender receives a portion of interest and principal payments based on their investment. It allows lenders to finance larger projects and diversify their investment.

What Is A Participation Mortgage?

A participation mortgage is a type of loan where a lender shares in the profits or losses of a property with the borrower. Lender and borrower both have a stake in the property’s value and can benefit from its appreciation.

Why Would A Lender Want To Make A Participation Loan?

A lender may choose to make a participation loan to spread the risk, increase lending capacity, and access diverse loan opportunities. It allows them to collaborate with other lenders, share profits, and share credit exposure.

What Is A Mortgage Quizlet?

A mortgage quizlet is an online platform that provides learning resources and quizzes on mortgages. It helps people understand concepts related to mortgages and test their knowledge.

Conclusion

To sum it up, a participation mortgage is an innovative type of loan that allows multiple investors to share in the risk and rewards of owning a property. By allowing investors to participate in the equity and debt of the property, this type of mortgage offers a unique opportunity for diversification and potential returns.

With its flexibility and collaborative nature, a participation mortgage can be a game-changer in real estate investment. So, if you’re looking to expand your investment portfolio, consider exploring the possibilities of a participation mortgage.