Best Banks for Mortgage Refinance: Top Rate-Slashing Options

Are you thinking about refinancing your mortgage? Great idea! Refinancing can help you get a lower interest rate or change your loan type. It might help make your monthly payments smaller. Or it can help you pay off your house sooner.

What is Mortgage Refinancing?

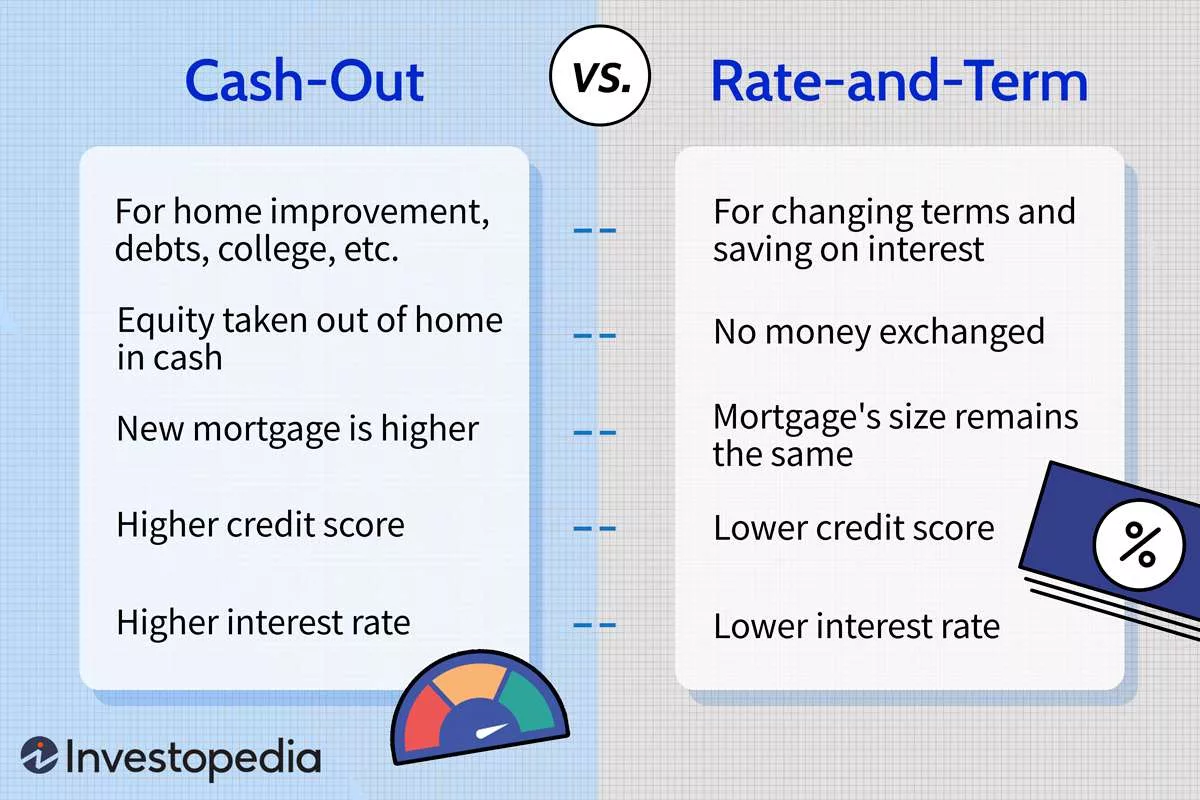

Mortgage refinancing means you get a new loan for your house. It pays off the old mortgage. Many people refinance to save money. They look for better interest rates and loan terms.

Benefits Of Refinancing Your Mortgage

- Save money with a lower interest rate.

- Change from an adjustable-rate to a fixed-rate loan.

- Change how many years it takes to pay off your house.

- Get cash from the equity in your home.

How to Choose the Best Bank for Refinancing

Not all banks are the same. You should compare them. Look at fees, rates, and customer service. Check out bank reviews too.

Important Factors To Consider

- Interest Rates: Lower rates will save you money.

- Fees: These can add up. Compare them among banks.

- Customer Service: Good service is very important.

- Talk to more than one bank: Don’t pick the first bank you find.

Credit: www.bankrate.com

Top Banks for Mortgage Refinance

Below is a list of some of the best banks for refinancing. Remember to do your own research too.

| Bank | Interest Rates | Fees | Customer Reviews |

|---|---|---|---|

| Wells Fargo | Competitive | Low to Moderate | Mostly Positive |

| Chase Bank | Competitive | Low to Moderate | Mostly Positive |

| Bank of America | Competitive | Moderate | Mixed Reviews |

| Quicken Loans | Often Lower | Varies | Very Positive |

| U.S. Bank | Competitive | Low to Moderate | Mostly Positive |

You should also think about local banks or credit unions. They may offer good deals. Online banks can be good too. They often have lower fees. But first, always read reviews and ask questions.

Credit: m.facebook.com

Getting Ready to Refinance

Getting ready is important. Check your credit score first. Gather all of your home and financial papers. This makes the process easier.

Documents You May Need

- Proof of income (like pay stubs)

- Tax returns

- Details of your current mortgage

- Information about your home (like a home appraisal)

- Credit report

A good credit score will help with your refinance. But if your credit could be better, don’t worry. You can still talk to banks. Some might still help you.

Frequently Asked Questions For Best Banks For Mortgage Refinance: Top Rate-slashing Options

What Determines Mortgage Refinance Rates?

Mortgage refinance rates are influenced by credit score, home equity, loan amount, and market conditions.

How To Choose A Refinance Lender?

Selecting a refinance lender involves comparing rates, fees, customer service, and loan options that fit your financial goals.

Can Refinancing Save Me Money?

Refinancing has the potential to save you money by securing a lower interest rate or altering the loan term.

What Are Current Refinance Trends?

Current refinance trends include fluctuating interest rates and a shift in borrower preferences for fixed-rate or adjustable-rate mortgages.

Conclusion

Refinancing can be a smart move. Picking the right bank is important. Compare rates, fees, and service. Think about your needs too. Then choose the best bank for you.

Refinancing your mortgage doesn’t have to be scary! With the right information and a good bank, you can save money and maybe even buy that toy you’ve been wanting. Happy refinancing!