Why Does Rocket Mortgage Keep Calling Me? Stop Annoying Calls Now!

Rocket Mortgage keeps calling you because they are likely trying to follow up on a previous inquiry or engage you in their services.

Credit: tcpaworld.com

Understanding Rocket Mortgage Calls

If you’ve ever received calls from Rocket Mortgage, you might be wondering why they are reaching out to you. In this post, we’ll delve into the world of Rocket Mortgage calls and help you understand how their process works and why they contact their customers.

How Rocket Mortgage Works

Rocket Mortgage is an online mortgage lender that simplifies the home loan process, making it faster and more convenient for borrowers. Unlike traditional lenders, Rocket Mortgage allows you to complete the entire mortgage application process online, from filling out the forms to submitting the necessary documents. This streamlined approach eliminates the need for multiple in-person meetings and lengthy paperwork, providing a quicker and smoother experience.

Using Rocket Mortgage, you can easily calculate your mortgage affordability, explore various loan options, and customize your loan terms to match your needs. The platform also offers real-time mortgage rates, which allows you to stay up-to-date with the current market conditions and make informed decisions.

Once you’ve completed the application process, Rocket Mortgage reviews your information and verifies your financial details. They assess your credit score, income, employment history, and other factors to determine your eligibility for a mortgage. Using their advanced algorithms and automated systems, they provide potential loan options tailored to your specific financial situation.

Why Rocket Mortgage Contacts Customers

Rocket Mortgage may reach out to customers for various reasons, all of which aim to assist in their mortgage journey and ensure a seamless experience. Here are a few common scenarios where you might receive a call from Rocket Mortgage:

- Application Updates: Rocket Mortgage may contact you to provide updates on your application status, request additional documents, or ask for clarification regarding any information you’ve provided. These calls help keep you informed throughout the process and ensure that everything is on track.

- Rate Lock: Mortgage rates can fluctuate daily. If you were previously pre-approved for a loan but haven’t locked in a rate, Rocket Mortgage might call to inform you about any favorable rate changes. This allows you to secure a more favorable interest rate for your mortgage.

- Loan Options: Rocket Mortgage has a wide range of loan options available, including conventional, jumbo, FHA, and VA loans. If they identify a loan product that better aligns with your financial goals or if you qualify for more favorable terms, they may contact you to discuss these options.

- Follow-ups: After completing your mortgage application or having a conversation with one of their loan specialists, Rocket Mortgage may reach out to ensure that you have all the information you need and to address any questions or concerns you may have.

Making and receiving calls is an integral part of the Rocket Mortgage process as it allows them to establish clear communication channels, provide personalized assistance, and ensure that you have the necessary support throughout your mortgage journey.

If you’re receiving frequent calls from Rocket Mortgage and want to reduce their frequency, you can always let them know about your preferences or update your communication settings through their online platform. Remember, Rocket Mortgage’s goal is to make your mortgage experience as smooth as possible, and their calls are aimed at ensuring your satisfaction and success in securing the right home loan for you.

Credit: topclassactions.com

Common Reasons For Rocket Mortgage Calls

If you’ve been receiving calls from Rocket Mortgage, you may be wondering why they keep reaching out to you. There are a few common reasons why you might receive these calls, each serving a specific purpose.

Loan Application Updates

Once you’ve started the loan application process with Rocket Mortgage, they may call you to provide updates on the progress of your application. These calls keep you informed about any changes, requirements, or documents needed to move the process forward smoothly. It’s important to stay updated with the status of your loan application, and these calls help you stay informed and address any queries you may have.

Verification Of Information

Verification is a crucial step in the loan approval process. Rocket Mortgage may call you to confirm certain details provided in your application or to request additional documents for verification purposes. This ensures that all the information provided is accurate, and the loan process can proceed smoothly. It’s essential to respond promptly to these calls and provide any necessary documents to avoid delays in the approval process.

Payment Reminders

Missing loan payments can have serious consequences, such as affecting your credit score or incurring additional fees. To help you stay on top of your loan repayments, Rocket Mortgage may call you as a friendly reminder of upcoming payment due dates. These calls are a helpful way to ensure that you have the necessary funds available or make alternative arrangements if needed.

Promotional Offers

Rocket Mortgage occasionally reaches out to customers with promotional offers that may be relevant to their financial needs. These offers could include refinancing options, rate adjustments, or other loan-related opportunities. While not every call will be a promotional offer, these calls present an opportunity to explore potential benefits or savings related to your mortgage or other financial needs.

Customer Support

As a customer, you may have questions, concerns, or require assistance with any aspect of your loan or mortgage process. Rocket Mortgage offers dedicated customer support and may call you to assist with queries, provide guidance, or address any issues you may be facing. These calls are designed to provide you with the necessary support and ensure you have a positive experience throughout your journey.

Ways To Stop Rocket Mortgage Calls

If you’ve been receiving unwanted calls from Rocket Mortgage and you want to put an end to this annoyance, there are several ways you can stop their calls. Here are some effective methods to help you regain your peace and silence those persistent calls:

Contacting Rocket Mortgage Directly

If you want to address the issue directly, getting in touch with Rocket Mortgage might be your best bet. Reach out to their customer service department and let them know about the unwanted calls you have been receiving. Clearly express your desire to be removed from their calling list, providing them with your contact details for proper identification. Remember to stay calm and assertive when explaining your situation, ensuring they understand the importance of resolving this matter promptly.

Adding Your Number To The Do Not Call List

The National Do Not Call Registry is a valuable resource in curbing unwanted telemarketing calls. By adding your phone number to this list, you inform organizations like Rocket Mortgage that you do not wish to receive any further solicitations. To register, simply visit the National Do Not Call Registry website or call their toll-free number. Be sure to follow the instructions carefully and provide accurate information. Once your number is registered, telemarketers, including Rocket Mortgage, should cease their calls within a reasonable time.

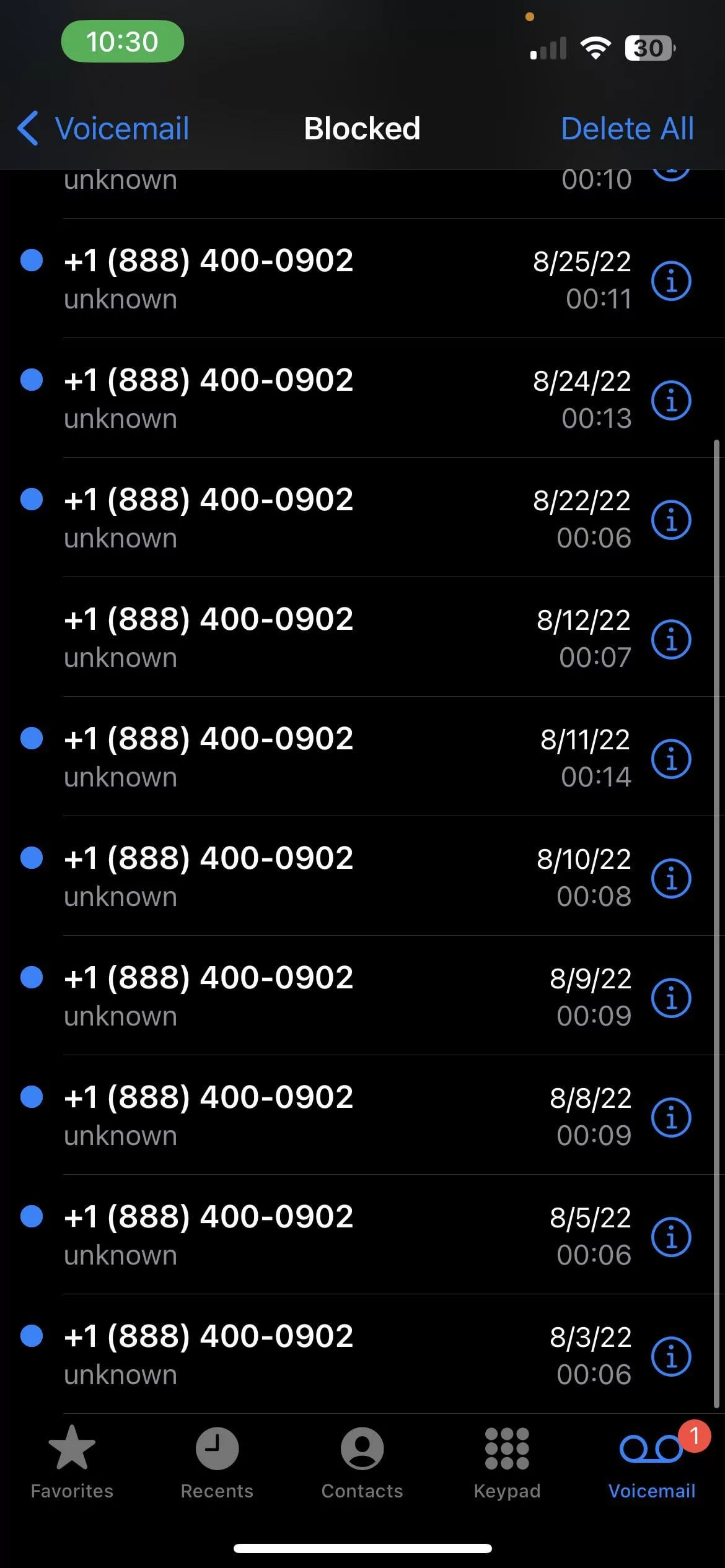

Exploring Call-blocking Options

If the calls persist even after contacting Rocket Mortgage and being on the Do Not Call list, it may be time to consider call-blocking as an effective solution. Most smartphones offer built-in call-blocking features that can be easily enabled. Check your device’s settings or contact your service provider for specific instructions on how to block unwanted calls. Additionally, there are various call-blocking apps available for download that can help you filter out and block calls from unwanted numbers, including those from Rocket Mortgage.

Seeking Legal Assistance

If Rocket Mortgage continues to disrupt your daily life with persistent and unwanted calls, seeking legal assistance might be necessary. Consult with an attorney who specializes in consumer protection or telecommunications laws to understand your rights and available legal avenues for recourse. They can guide you through the process of filing complaints and taking appropriate legal action against Rocket Mortgage, ensuring that your privacy and peace of mind are protected.

Tips For Dealing With Rocket Mortgage Calls

Being Proactive In Communication

Communicating proactively with Rocket Mortgage can help address any issues or concerns you may have regarding their calls. By taking the initiative, you can ensure that your concerns are heard and that any misunderstandings are resolved effectively. Here are some tips for proactively dealing with Rocket Mortgage calls:

- Answer their calls and be polite and courteous during the conversation.

- Clearly and calmly express any specific questions or concerns you may have.

- Ask for clarification if anything discussed during the call is unclear.

- Take notes during the call to keep track of important details.

Keeping Track Of Call Details

Keeping track of the details of each Rocket Mortgage call can be helpful in case you need to refer back to specific information or file a complaint. Here are some suggestions for effectively keeping track of call details:

- Create a spreadsheet or table to record the date, time, and duration of each call.

- Note down the name of the person who called you and their contact information.

- Summarize the main points discussed during the call and any actions agreed upon.

- If there are any discrepancies or issues, document them as well.

Assertively Requesting To Be Removed From Call Lists

If you no longer wish to receive calls from Rocket Mortgage, it is important to assertively request to be removed from their call lists. Here are some steps you can take:

- Politely ask the caller to remove your phone number from their call list.

- If the calls persist, ask to speak to a supervisor or manager to escalate your request.

- Follow up in writing, either through email or by sending a letter, reiterating your request to be removed from their call lists.

- Keep a copy of the written communication for your records.

Understanding Your Rights As A Consumer

As a consumer, it is crucial to understand your rights and protections when dealing with unsolicited calls from companies like Rocket Mortgage. Here are some important aspects to consider:

| Do Not Call Registry: | You have the right to add your phone number to the National Do Not Call Registry, which can help reduce unwanted calls. |

| Federal Trade Commission (FTC): | The FTC regulates telemarketing calls and can provide information on your rights and how to file a complaint. |

| Fair Debt Collection Practices Act (FDCPA): | If you are receiving collection calls from Rocket Mortgage, familiarize yourself with the FDCPA and its guidelines. |

By being proactive, keeping track of call details, assertively requesting to be removed from call lists, and understanding your rights as a consumer, you can effectively deal with Rocket Mortgage calls and protect yourself from unwanted solicitation.

Preventing Unwanted Calls From Other Lenders

If you’ve ever wondered why Rocket Mortgage keeps calling you or have experienced relentless calls from other lenders, you’re not alone. Many individuals find themselves bombarded with unwanted calls from lenders and financial institutions. Luckily, there are steps you can take to prevent these calls and regain your peace of mind. By opting out of marketing communications, staying vigilant with your personal information, and utilizing call-screening services, you can effectively reduce the number of unwanted calls you receive.

Opting Out Of Marketing Communications

One way to prevent unwanted calls from other lenders is by exercising your right to opt out of marketing communications. Most financial institutions are required by law to provide you with the option to unsubscribe from their marketing lists. By opting out, you are indicating your preference to not receive any further promotional materials or phone calls. This can be done by contacting the lender directly or through the unsubscribe link provided in their emails. Remember to save any confirmation emails or communication you receive regarding your opt-out request for future reference.

Staying Vigilant With Personal Information

Your personal information is a valuable asset, and protecting it is key to preventing unwanted calls from other lenders. Be cautious when sharing sensitive information, such as your social security number or financial details, online or over the phone. Verify the trustworthiness of any website or individual requesting such information. Additionally, always read the fine print and privacy policies to understand how your data might be used by lenders or third parties. By staying vigilant, you can ensure that your personal information remains confidential, making it less likely for you to receive unsolicited calls.

Utilizing Call-screening Services

In today’s digital age, call-screening services have become an invaluable tool for preventing unwanted calls. These services help filter out calls from unknown or suspicious numbers, allowing you to screen and block undesirable calls. Many smartphones have call-blocking features built-in, while others offer downloadable apps that provide call-screening capabilities. By utilizing these services, you can minimize interruptions from unwanted lenders and focus on the calls that matter to you.

Preventing unwanted calls from other lenders is possible with the right actions. Opting out of marketing communications, staying vigilant with your personal information, and utilizing call-screening services are effective ways to regain control over your phone and reduce the constant barrage of calls. Take the necessary steps to protect your privacy and maintain a peaceful phone experience!

Credit: www.reddit.com

Frequently Asked Questions Of Why Does Rocket Mortgage Keep Calling Me

Does Rocket Mortgage Call You?

Yes, Rocket Mortgage may call you as part of the mortgage application process.

Why Are Mortgage Companies Calling Me All Of A Sudden?

Mortgage companies may be calling you suddenly because they believe you may be interested in their services or because they have obtained your contact information from a third-party source. Be cautious and research any company before providing personal information or making any commitments.

How Do I Get Mortgage Companies To Stop Calling Me?

To stop mortgage companies from calling, try these steps: 1. Register your number on the National Do Not Call Registry. 2. Ask the mortgage companies to add you to their do not call list. 3. Use call-blocking apps or settings on your phone.

4. Consider filing a complaint with the Federal Trade Commission (FTC). 5. Seek legal advice if the calls persist.

Why Would A Mortgage Company Call Me?

Mortgage companies may call you to discuss loan options, payment reminders, or updates on your application.

Conclusion

To put it simply, the constant calls from Rocket Mortgage can be quite frustrating. However, by understanding the reasons behind these calls, you can take necessary steps to manage them. Rocket Mortgage’s persistence is often driven by their sales efforts, loan offers, or even attempts to collect a debt.

By staying informed, utilizing do-not-call lists, and proactively communicating with Rocket Mortgage, you can regain control over these incessant calls. Remember, knowledge is power!