Can You Rent an Apartment While Having a Mortgage? Discover How!

Yes, it is possible to rent an apartment even if you have a mortgage.

Renting An Apartment With A Mortgage: Is It Possible?

Renting an apartment while having a mortgage is possible, allowing you to enjoy the benefits of a home investment while earning rental income. It provides a dual opportunity to build equity and make passive income. Find out more about this possibility.

Many people wonder if it’s possible to rent an apartment while having a mortgage. The answer is yes, it is possible, and it can even have some financial benefits. In this article, we will explore the dynamics of renting an apartment while owning a home, the current market conditions, and the regulations involved.

Renting Vs Owning A Home

Before delving into the specifics of renting an apartment with a mortgage, let’s first understand the key differences between renting and owning a home. Renting allows individuals the flexibility to live in a property without the associated responsibilities of homeownership. On the other hand, owning a home provides stability and equity growth over time.

Many homeowners, however, find themselves in situations where they need to move due to work opportunities, family circumstances, or personal preferences. In such scenarios, renting out their home instead of selling it can be an appealing option, as it allows them to generate income while retaining ownership.

Market Conditions And Regulations

When considering renting an apartment with a mortgage, it’s crucial to take into account the prevailing market conditions and regulations. These factors play a significant role in determining the feasibility and profitability of this arrangement.

Market conditions can influence the demand and rent prices for apartments. Conducting thorough research and understanding the local rental market trends can help homeowners assess the potential rental income they can generate. Additionally, familiarizing oneself with any rent control laws or restrictions imposed by the local government is essential to ensure compliance.

Furthermore, homeowners must also review their mortgage agreement and consult with their lender to understand any restrictions or requirements related to renting out their property. Some mortgages may have clauses that prohibit or limit renting, while others may require homeowners to notify the lender or obtain their approval before renting.

| Key Considerations: | Renting an Apartment with a Mortgage |

|---|---|

| 1. Market Conditions: | Research local rental market trends and assess potential rental income. |

| 2. Regulations: | Familiarize yourself with any rent control laws and mortgage restrictions. |

| 3. Mortgage Agreement: | Review your mortgage terms and consult with your lender for any rental restrictions. |

By considering the market conditions and regulations, homeowners can make informed decisions regarding renting out their property while holding a mortgage. If done strategically and within legal boundaries, renting an apartment with a mortgage can offer financial benefits and provide homeowners with flexibility in their housing choices.

If you find yourself in a situation where you want to explore renting an apartment while having a mortgage, it’s advisable to seek professional advice from a real estate attorney or a mortgage specialist. They can guide you through the process, ensuring compliance with all necessary legal and financial requirements to make the experience smooth and successful.

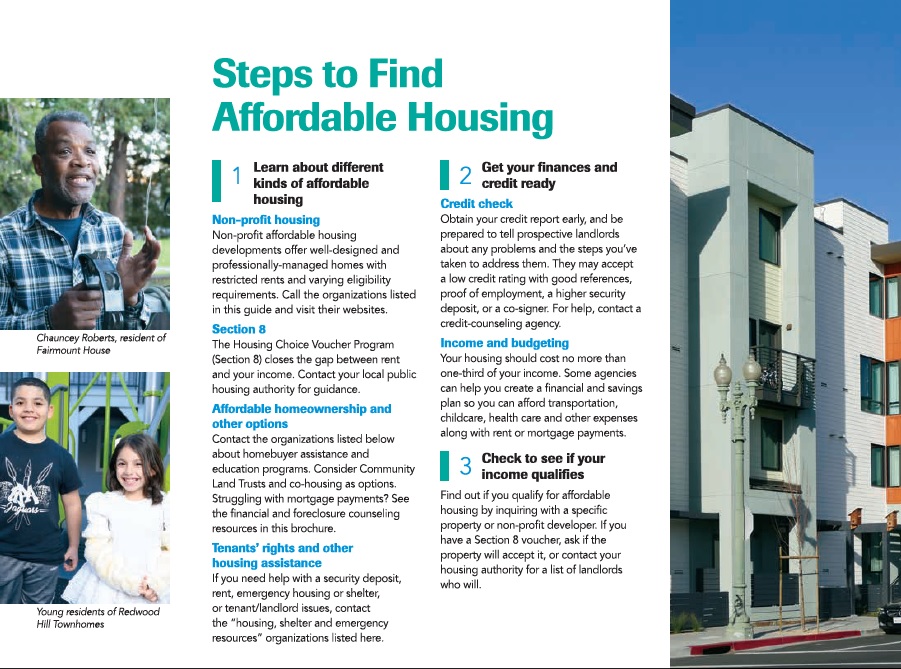

Credit: ebho.org

Factors To Consider

If you currently have a mortgage and are considering renting an apartment, there are several factors that you need to take into account. These factors include the restrictions imposed by your lender, your financial stability, and your credit score and history. Let’s explore each of these factors in more detail.

Lender’s Restrictions

If you have an existing mortgage on a property, your lender may have certain restrictions or requirements regarding renting another property. It is important to review your mortgage agreement or consult with your lender to understand if renting an apartment is allowed and if there are any conditions you need to meet. Violating any lender restrictions could have serious consequences, including the potential for foreclosure.

Financial Stability

Before deciding to rent an apartment while having a mortgage, it is crucial to assess your financial stability. Renting an apartment means taking on additional monthly expenses, such as rent, utilities, and possibly security deposits. Ensure that you have a solid understanding of your current financial situation and can comfortably afford both the mortgage payment on your existing property and the expenses associated with renting a new apartment. This will help you avoid any potential financial strain or difficulties down the line.

Credit Score And History

Your credit score and history play a crucial role in most rental applications. Landlords often rely on credit reports to assess an applicant’s financial responsibility and ability to pay rent. Having a mortgage does not necessarily impact your ability to rent an apartment, but your credit score and history may be affected if you have missed mortgage payments or accrued significant debt. It is important to review your credit report before applying to rent an apartment, ensuring that it is accurate and reflects positively on your financial standing.

Additionally, having a mortgage adds to your overall debt-to-income ratio, which landlords may evaluate during the tenant screening process. Keeping your credit score in good standing by making timely mortgage payments and maintaining a low debt-to-income ratio will increase your chances of renting an apartment while having a mortgage.

Benefits And Drawbacks

Renting an apartment while having a mortgage can have its benefits and drawbacks. It provides flexibility and freedom, allowing you to have an additional income source. However, it also comes with financial responsibilities that require careful consideration.

Flexibility And Freedom

Renting out an apartment while having a mortgage offers you flexibility and freedom. It allows you to take advantage of a unique opportunity to generate income from your property. By renting out your apartment, you have the flexibility to move elsewhere while still having someone else cover the monthly mortgage payment. This gives you the freedom to explore new areas, travel, or even purchase a new property.

Income Potential

Renting out an apartment can provide you with a stable additional income source. By finding reliable tenants who pay their rent on time, you can offset your monthly mortgage payments or even generate profit. This extra income can be used to supplement your current financial situation, pay off debts, or save for other investments. By effectively managing the rental income, you can improve your financial stability and security.

Financial Responsibilities

While renting out an apartment can offer advantages, it also entails financial responsibilities. You need to ensure that you can cover all the costs associated with your property, including mortgage payments, property taxes, insurance, and maintenance expenses. Additionally, you have to be prepared for unforeseen circumstances such as vacancies, repairs, or legal issues related to tenancy. Staying on top of these financial responsibilities is crucial to maintaining the success of your rental property.

In summary, renting out an apartment while having a mortgage has its benefits and drawbacks. It provides flexibility and freedom to explore new opportunities, generates additional income, but also comes with financial responsibilities that need careful consideration. By weighing these factors, you can make an informed decision on whether renting your apartment is suitable for your situation.

Credit: www.chase.com

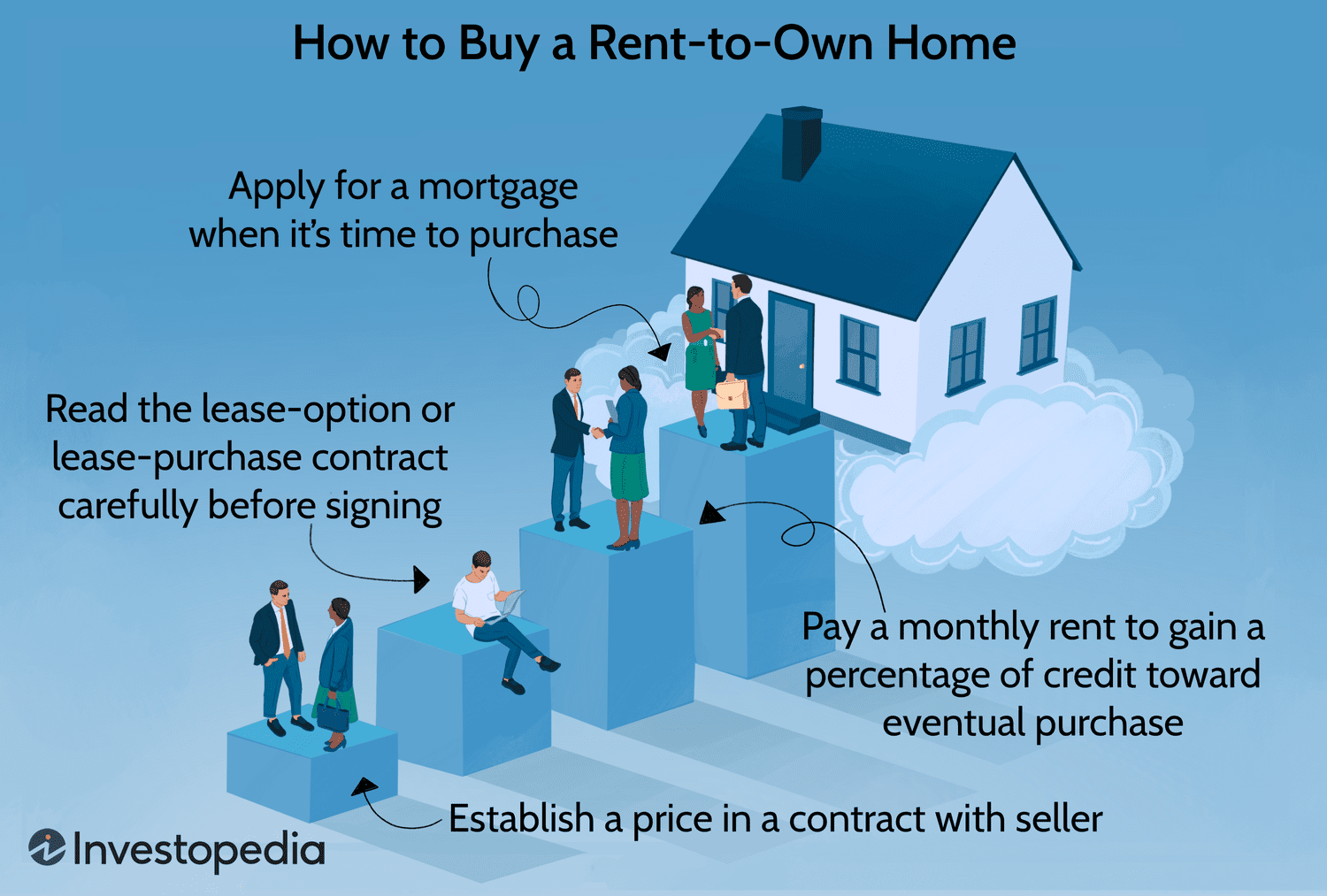

Steps To Renting An Apartment With A Mortgage

Are you considering renting an apartment while still having a mortgage? It’s not an uncommon scenario. Many people find themselves in a situation where they need to relocate temporarily or want to explore other living options while still paying off their mortgage. However, before you jump into this decision, it’s important to understand the steps you should take to ensure a smooth process. In this blog post, we will guide you through the necessary steps to renting an apartment with a mortgage, including reviewing your mortgage agreement, communicating with your lender, and considering your budget.

Review Your Mortgage Agreement

When exploring the possibility of renting while having a mortgage, the first step is to review your mortgage agreement. Take the time to carefully read through the terms and conditions outlined in your agreement to understand any restrictions or clauses that may affect your ability to rent out your current property. Look for any stipulations related to rental income or occupancy requirements that could impact your situation.

Communicate With Your Lender

Once you have reviewed your mortgage agreement, it’s crucial to communicate with your lender. Reach out to them to discuss your plans and intentions of renting out your property. Being transparent about your situation allows your lender to provide you with the necessary guidance and updates on any modifications that might need to be made to your mortgage agreement. This step will help you avoid any potential issues that may arise by renting out your property without informing your lender.

Budgeting Considerations

Before you make the decision to rent an apartment while still having a mortgage, it’s important to consider your budget. Take into account the additional financial responsibilities that come with renting a new apartment, such as monthly rent, security deposit, and utilities. Ensure that you have a clear understanding of your current financial situation and whether you can comfortably afford both your mortgage payments and the costs associated with renting an apartment.

To help you manage your finances effectively, consider creating a comprehensive budget that includes all your expenses. Take into account your mortgage payments, rent, utilities, groceries, transportation, and any other recurring bills. By assessing your financial picture, you’ll have a better understanding of whether renting an apartment while having a mortgage is a viable option for you.

If you find that your budget is too tight to comfortably manage both your mortgage and rental expenses, you may need to evaluate your options further. This could include seeking financial advice or considering alternative solutions, such as temporary rental accommodations.

In conclusion, renting an apartment while having a mortgage can be a feasible option for many individuals. By carefully reviewing your mortgage agreement, communicating with your lender, and considering your budget, you can ensure a smooth rental experience while still fulfilling your mortgage obligations. Taking these steps will help you navigate the process with confidence and make the most informed decision about renting an apartment while you have an existing mortgage.

Additional Tips

If you’re currently paying off a mortgage but find yourself needing to rent an apartment, there are a few tips to consider that can make the process smoother. From demonstrating employment stability to navigating rental applications and considering rental insurance, these additional tips can help you secure a rental property while still having a mortgage.

Employment Stability

When applying for a rental property while having a mortgage, one of the key factors landlords look for is employment stability. It’s important to convey to potential landlords that you have a steady income and are capable of managing both your mortgage payments and rental obligations. Providing a letter of employment, recent pay stubs, and any other relevant documents can help demonstrate your financial stability and increase your chances of getting approved for an apartment.

Navigating Rental Applications

While going through the rental application process, it’s crucial to provide accurate and complete information about your financial situation, including your mortgage. Landlords want to ensure they are renting to responsible tenants who will regularly pay their rent on time. Be prepared to answer questions about your mortgage, monthly payments, and any other financial obligations. Transparency and honesty are key to building trust with landlords and increasing your chances of being approved.

Considering Rental Insurance

When renting an apartment while having a mortgage, it’s essential to consider rental insurance. While your mortgage likely includes homeowners insurance, it may not cover your personal belongings or liability for accidents that occur within your rented property. Rental insurance can provide additional coverage and protection, giving you peace of mind while balancing the responsibilities of homeownership and renting. It’s recommended to thoroughly review your existing insurance policies and consult an insurance professional to ensure you have appropriate coverage.

By demonstrating employment stability, navigating rental applications diligently, and considering rental insurance, you can increase your chances of renting an apartment successfully while still bearing a mortgage responsibility. Keep these additional tips in mind as you embark on your search for a rental property.

:max_bytes(150000):strip_icc()/when-best-time-rent-apartment.asp-FINAL-93af3a97cac34e84b334826db62e219c.png)

Credit: www.investopedia.com

Frequently Asked Questions On Can You Rent An Apartment While Having A Mortgage

Can You Pay A Mortgage And Rent At The Same Time?

Yes, it is possible to pay both a mortgage and rent simultaneously if you own a property and have chosen to rent it out. This can provide an additional income while you continue to pay off your mortgage.

Should Rent Be Equal To Mortgage?

Rent and mortgage are not necessarily equal. Rent is the monthly payment for leasing a property, while a mortgage is the loan payment for buying a home. The cost of rent may vary based on the property’s market value and location, whereas the mortgage payment depends on the loan amount, interest rate, and repayment period.

How Long After Buying A House Can You Rent It Out Uk?

In the UK, you can rent out a house immediately after buying it.

Can You Rent An Apartment While Having A Mortgage?

Yes, it is possible to rent an apartment while having a mortgage. However, you need to consider a few factors like your financial stability, credit score, and lender’s permission. Renting out your property can help cover the mortgage costs, but it’s important to ensure you can afford both the mortgage payments and the rent.

Conclusion

Renting an apartment while having a mortgage is indeed possible. By carefully considering your financial situation, communicating with your lender, and staying organized, you can navigate this situation successfully. Make sure to understand the terms of your mortgage and rental agreements, and weigh the pros and cons before making a decision.

Ultimately, it comes down to your ability to manage both financial responsibilities effectively.