How Much Mortgage Can I Afford With 80K Salary: A Comprehensive Guide

With an 80K salary, you can afford a mortgage of approximately $320,000, assuming a 20% down payment and a 30-year fixed-rate mortgage. When considering how much mortgage you can afford, it’s important to assess your monthly income, debts, and expenses, as well as consider favorable interest rates and loan terms.

As an expert writer in SEO-friendly content, I understand the importance of delivering concise and accurate information to answer your question. When determining the mortgage within an 80K salary, there are several factors to consider. This includes your down payment amount and the type of mortgage you seek.

By carefully analyzing your monthly income, debts, expenses, and market conditions, you can make an informed decision about the mortgage you can afford. Let’s dive into the details to help you make a well-informed choice.

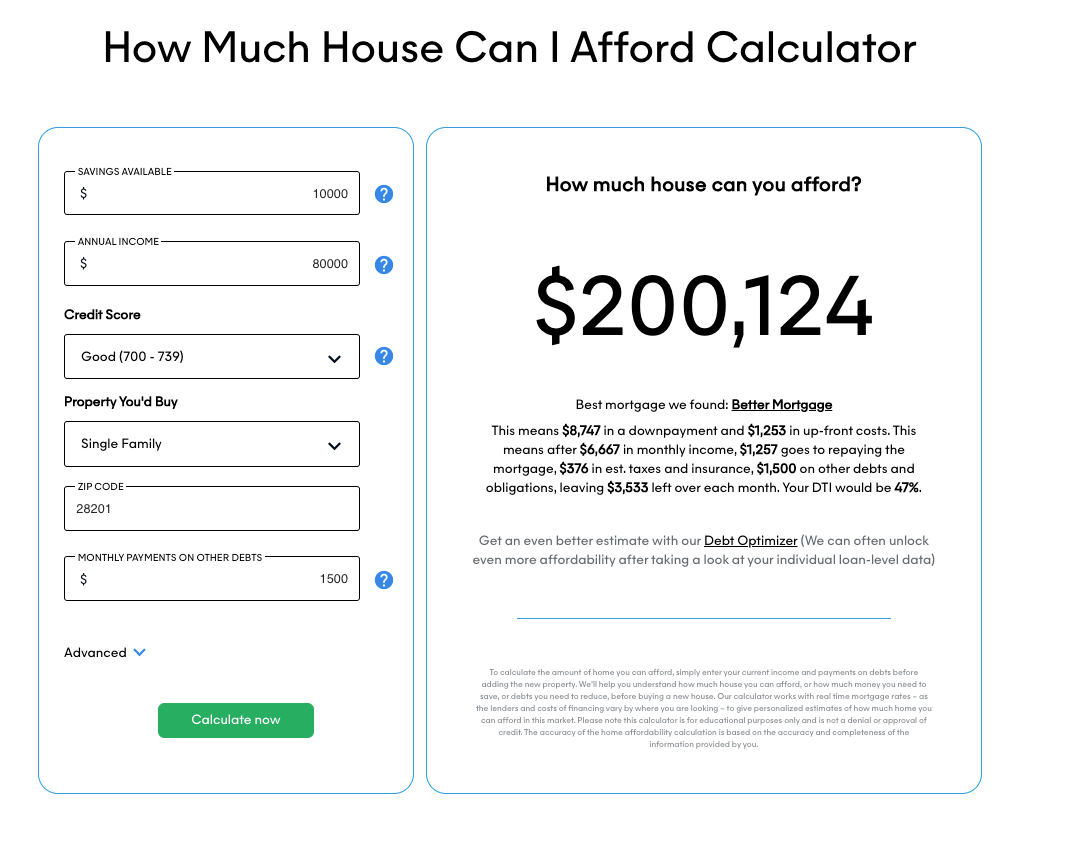

Credit: www.biggerpockets.com

Determining Your Budget

When you’re considering buying a home, one of the most important factors to consider is how much mortgage you can afford with your $80,000 salary. Determining your budget is a crucial step in the homebuying process, as it helps you understand the price range you can comfortably afford. To help you determine your budget, we’ll walk you through the key elements you need to consider. These include calculating your income, assessing your expenses, and considering your savings and debts.

Calculating Your Income

Before jumping into any financial decision, it’s important to have a clear understanding of your income. Start by determining your annual salary and any additional sources of income you may have. This includes bonuses, commissions, and other regular income streams. Once you’ve identified your total annual income, divide it by 12 to get your monthly income. For example:

| Annual Salary: | $80,000 |

| Monthly Income: | $80,000 / 12 = $6,667 |

Calculating your income accurately allows you to have a clear picture of your financial resources and helps you determine the maximum mortgage payment you can comfortably afford.

Assessing Your Expenses

To further determine how much mortgage you can afford, it’s crucial to assess your expenses. Start by listing out all your fixed monthly expenses, such as rent, car payments, student loans, and other debts. Next, take into account your variable expenses, including groceries, utilities, entertainment, and transportation costs. Be thorough and realistic when estimating these expenses. Subtracting your total monthly expenses from your monthly income will give you a clearer idea of how much you have available for mortgage payments.

For example:

| Monthly Income: | $6,667 |

| Total Monthly Expenses: | $4,000 |

| Available for Mortgage Payments: | $6,667 – $4,000 = $2,667 |

By assessing your expenses meticulously, you can determine a more accurate estimate of the mortgage payments you can comfortably afford.

Considering Savings And Debts

Your savings and debts also play a crucial role in determining your budget. Take into account any existing debts, such as credit card balances, personal loans, or student loans, as these will affect your overall financial situation. Additionally, consider your savings, including emergency funds and retirement accounts. Taking both savings and debts into account gives you a clearer picture of your financial health and can help you determine the maximum mortgage you can afford without stretching your finances too thin.

By considering your savings and debts alongside your income and expenses, you’ll have a comprehensive understanding of your financial situation. This will empower you to make informed decisions about how much mortgage you can afford with your $80,000 salary.

Credit: www.forbes.com

Understanding Mortgage Affordability

When it comes to buying a home, understanding mortgage affordability is crucial. Your income plays a significant role in determining how much mortgage you can afford. If you have an annual salary of 80,000 dollars, there are a few key factors to consider. By taking a careful look at your debt-to-income ratio, down payment options, and other influencing factors, you can make an informed decision about the mortgage that best suits your financial situation.

Debt-to-income Ratio

The debt-to-income ratio is an essential factor when determining mortgage affordability. It measures the percentage of your gross monthly income that goes towards paying debts, including mortgages, credit cards, and car loans. Lenders typically look for a debt-to-income ratio of 43% or lower.

To calculate your debt-to-income ratio, simply divide your total monthly debt payments by your monthly gross income. For example, if your monthly debt payments amount to $2,000 and your gross monthly income is $5,000, your debt-to-income ratio would be 40% (2,000 divided by 5,000, multiplied by 100). A lower debt-to-income ratio indicates a lower risk for lenders and may result in more favorable loan terms.

Down Payment And Loan Options

Another critical aspect to consider is your down payment and loan options, as they can greatly impact mortgage affordability. Generally, a higher down payment will reduce your monthly mortgage payments and may even eliminate the need for private mortgage insurance (PMI).

Conventional mortgages typically require a down payment of at least 20% of the home’s purchase price. However, there are other loan options available that allow for smaller down payments, such as Federal Housing Administration (FHA) loans and Veterans Affairs (VA) loans.

FHA loans require a minimum down payment of 3.5% and are available to borrowers with a credit score of at least 580. VA loans are exclusively available to eligible veterans and provide the opportunity for zero down payment.

Factors Affecting Affordability

Aside from your debt-to-income ratio and down payment, there are other factors that can affect your mortgage affordability.

1. Interest Rates: Lower interest rates result in lower monthly mortgage payments, making homeownership more affordable.

2. Loan Term: The term of your loan, such as 15 or 30 years, can impact affordability. While longer terms may result in more affordable monthly payments, you’ll generally end up paying more in interest over the life of the loan.

3. Property Taxes and Insurance: Property taxes and insurance can increase your monthly housing expenses. It’s important to consider these costs when calculating your overall mortgage affordability.

4. Other Monthly Expenses: Your monthly expenses, such as utilities, groceries, and transportation, should also be considered when determining how much mortgage you can afford. Keeping your overall expenses in check will ensure you can comfortably manage your mortgage payments.

Calculating Maximum Mortgage

One of the first steps to take when considering purchasing a home is to determine how much mortgage you can afford. This involves calculating your maximum mortgage based on your income and financial situation. By understanding this figure, you can make an informed decision about what type of home you can comfortably afford without straining your budget. In this section, we will explore how to calculate your maximum mortgage using an 80K salary, taking into account your monthly payment limitations and determining the maximum loan amount.

Using A Mortgage Affordability Calculator

To simplify the process of calculating your maximum mortgage, you can use a mortgage affordability calculator. This tool takes into account your income, current debts, interest rates, and other financial factors to provide an estimate of how much you can borrow. By inputting your 80K salary into the calculator along with other necessary details, such as your down payment amount and desired loan term, you can quickly determine the maximum mortgage you can afford.

Considering Monthly Payment Limitations

While it’s important to calculate your maximum mortgage based on your salary, it’s equally crucial to consider your monthly payment limitations. Just because you may qualify for a certain mortgage amount doesn’t always mean it’s a wise financial decision. It’s essential to factor in other monthly expenses such as utility bills, insurance, property taxes, and any outstanding debts. By considering these additional costs and setting a comfortable monthly payment limit, you can ensure that your mortgage payments fit within your overall budget without causing undue financial stress.

Determining Maximum Loan Amount

After determining your monthly payment limitations, the next step is to determine the maximum loan amount you can afford. This involves considering your desired monthly payment, interest rate, and loan term. Lenders generally adhere to certain debt-to-income ratios when assessing your eligibility for a loan. These ratios typically require that no more than around 30-35% of your monthly income goes towards mortgage payments. By multiplying your annual income by the specified ratio and dividing it by 12, you can calculate the maximum loan amount that is within your budget based on your 80K annual salary.

Factors Beyond Affordability

When determining how much mortgage you can afford with an 80K salary, there are several factors that go beyond simply looking at the price of the home you want to buy. It’s important to consider your creditworthiness and pre-approval status, as well as the impact of interest rates and terms, and the additional costs of property taxes and insurance.

Creditworthiness And Pre-approval

Your creditworthiness plays a crucial role in determining the mortgage you can afford. Lenders will look at your credit score and history to assess your ability to make timely payments and manage debt responsibly. A higher credit score can potentially lead to lower interest rates and better mortgage terms.

Obtaining pre-approval from a lender gives you a clearer picture of how much mortgage you can afford based on your current financial situation. It involves the lender reviewing your income, credit, and other relevant factors to determine the maximum loan amount they are willing to offer you. Pre-approval can save you time and hassle when shopping for a home, as it demonstrates your ability to secure financing.

Interest Rates And Terms

Interest rates have a significant impact on how much mortgage you can afford. Lower interest rates result in lower monthly payments, allowing you to borrow more without exceeding your budget. Additionally, the mortgage term, or the length of time you have to repay the loan, can affect your affordability. A longer term may lead to lower monthly payments, but it also means paying more interest over the life of the loan.

Property Taxes And Insurance

Property taxes and insurance are additional costs that should be factored into your mortgage affordability calculation. Property taxes vary by location and can significantly impact your monthly expenses. Additionally, lenders often require homeowners to have property insurance to protect their investment. Both property taxes and insurance should be considered when determining how much mortgage you can afford.

By considering factors beyond affordability, such as creditworthiness and pre-approval, interest rates and terms, as well as property taxes and insurance, you can make an informed decision about how much mortgage you can afford with your 80K salary. Remember to carefully assess your financial situation and consult with a mortgage professional to find the best option for your needs.

Managing Your Mortgage

With an annual salary of 80K, you can calculate how much mortgage you can afford based on your monthly income, expenses, and other factors. Evaluating your budget and consulting with a mortgage advisor can help you determine a suitable mortgage amount for your financial situation.

Budgeting For Housing Expenses

When it comes to managing your mortgage, budgeting for housing expenses is crucial. As a homeowner, it’s important to carefully consider and plan for the costs associated with your home. Here are some key points to keep in mind:

- Calculate your monthly income: Take into account your total monthly income from all sources, including your salary, any secondary income, and investments.

- Determine your fixed expenses: List all your fixed monthly expenses such as utilities, insurance, car payments, and other debts.

- Calculate your housing expenses: Start by estimating a realistic budget for housing expenses, including mortgage repayments, property taxes, homeowner’s insurance, and maintenance costs.

- Consider other homeownership costs: Don’t forget to account for additional costs such as HOA fees, repairs, and renovations.

- Review and adjust your budget: Regularly assess your budget and make adjustments as needed to ensure your housing expenses remain manageable.

Planning For Future Financial Goals

When determining how much mortgage you can afford on an $80K salary, it’s essential to consider your future financial goals. Planning ahead can help you make informed decisions and ensure your mortgage aligns with your long-term plans. Here’s how:

- Set clear financial objectives: Determine what you want to achieve in the next few years, whether it’s saving for retirement, starting a family, or investing in another property.

- Identify potential expenses: Factor in any upcoming financial obligations, such as paying for your child’s education, planning for a child’s wedding, or saving for a dream vacation.

- Assess your savings capacity: Evaluate your ability to save money and use this information to guide your mortgage decision. Consider whether you’ll have enough funds left after paying housing expenses to save towards your future goals.

- Speak with a financial advisor: Seek guidance from a financial professional who can provide expert advice tailored to your specific situation.

Reassessing Affordability Over Time

Affordability isn’t a static concept, and it’s important to reassess your financial situation periodically. Your ability to afford a mortgage may change due to fluctuating income, economic conditions, or shifts in financial priorities. Here are some tips for reassessing affordability:

- Review your financial situation annually: Take the time to review your overall financial health, including your income, expenses, and savings. Consider any changes that may impact your ability to afford your mortgage comfortably.

- Assess your debt-to-income ratio: Calculate your debt-to-income ratio to ensure you’re not overburdened with debt. A high ratio could indicate financial strain and the need to adjust your mortgage or reduce other debts.

- Stay informed about the housing market: Keep an eye on trends in the real estate market, as changes in interest rates or property values could affect your affordability.

- Consider refinancing options: If your financial situation improves or interest rates drop, refinancing your mortgage may be a viable option to reduce your monthly payments.

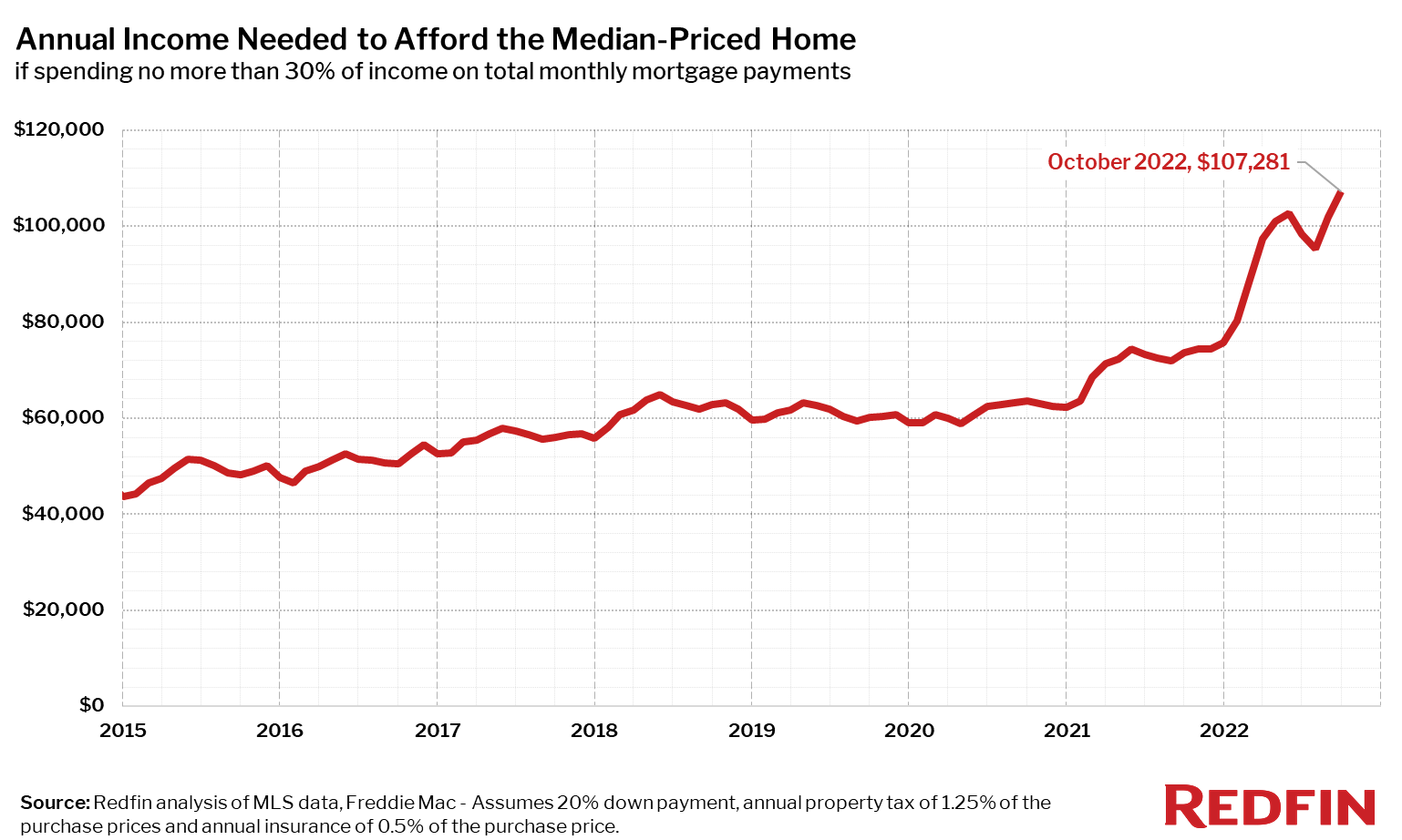

Credit: www.redfin.com

Frequently Asked Questions On How Much Mortgage Can I Afford With 80k Salary

How Much Mortgage Can I Get If I Make 80000 A Year?

If you make $80,000 a year, you can likely qualify for a mortgage of around $240,000 to $320,000. Lenders typically consider your income, expenses, credit score, and other factors when determining the mortgage amount you can afford. It’s recommended to speak with a mortgage professional to get an accurate estimate for your specific situation.

How Much House Can I Afford On A 85k Salary?

With an 85k salary, you can afford a house worth around 3-4 times your annual income. Based on this, you can look for homes in the range of 255k to 340k. Remember to consider other expenses like down payments, recurring costs, and loan interest rates when calculating your affordability.

What Income Do You Need For A 400k Mortgage?

To qualify for a $400k mortgage, you’ll typically need a stable income that can comfortably cover monthly payments. Lenders usually look for a debt-to-income ratio of 43% or less, meaning your total monthly debts should not exceed 43% of your monthly income.

Is $80000 A Good Salary For A Single Person?

Yes, $80,000 is a good salary for a single person. It provides financial stability and allows for a comfortable lifestyle.

Conclusion

Calculating the mortgage you can afford based on an 80K salary is a crucial step towards making a wise financial decision. By considering factors like your monthly income, expenses, and debt-to-income ratio, you can determine an affordable mortgage amount. Remember to analyze your present and future financial goals carefully.

Consulting a financial advisor can help you navigate the complexities and find the best mortgage option for your unique situation. Make informed choices to secure a stable and comfortable future.