Does Fafsa Give Out Loans? Discover the Truth Today!

Fafsa provides loans to eligible students. The loans from Fafsa aim to assist students in financing their education.

The Free Application for Federal Student Aid (FAFSA) is a vital resource for students seeking financial assistance for higher education. While FAFSA offers various types of aid, such as grants and work-study programs, it also provides loans to eligible students.

These loans are designed to help students cover the cost of tuition, books, and other educational expenses. By completing the FAFSA application, students can determine their eligibility for federal loans, including the Direct Subsidized Loan, Direct Unsubsidized Loan, and Direct PLUS Loan. These loans offer competitive interest rates and flexible repayment options to make education more affordable. Students should thoroughly review and understand the terms and conditions of these loans before accepting them to ensure responsible borrowing.

Credit: www.chalkbeat.org

The Purpose Of Fafsa

FAFSA, the Free Application for Federal Student Aid, provides financial assistance to college students through grants, work-study funds, and loans. Yes, FAFSA offers both subsidized and unsubsidized loans based on financial need, ensuring students have access to the necessary funds for higher education.

Access To Federal Aid

FAFSA, also known as the Free Application for Federal Student Aid, is a crucial gateway for students to access various forms of financial aid to make pursuing higher education more affordable. Through FAFSA, eligible students can receive grants, work-study opportunities, and yes, loans as well.

Determining Eligibility

In order to determine a student’s eligibility for financial aid, FAFSA takes into account various factors such as family income, assets, number of family members attending college, and more. This information is used to assess the student’s financial need and determine the types and amounts of aid they qualify for.

When it comes to loans, FAFSA offers two main types: federal and private loans.

Federal loans are offered directly by the U.S. Department of Education, and they provide students with low-interest loans to help cover the costs of education. These loans come with certain benefits such as flexible repayment plans and the potential for loan forgiveness or cancellation under specific circumstances.

Private loans, on the other hand, are offered by private banks, credit unions, and other financial institutions. Unlike federal loans, private loans usually have higher interest rates and fewer borrower protections. They often serve as a supplemental option for students who still need additional funding after exhausting federal loan options.

It’s important to note that while FAFSA helps determine eligibility for loans, it does not actually distribute the loans itself. That responsibility falls on the respective lenders who follow FAFSA’s guidelines when disbursing the funds.

In conclusion, FAFSA plays a crucial role in providing students with access to federal aid, including loans. By accurately assessing a student’s financial need, FAFSA helps determine the types and amounts of loans they are eligible for. Whether it’s federal loans with their favorable terms or private loans for additional funding, FAFSA ensures that students have the opportunity to pursue their educational goals without undue financial burden.

Types Of Federal Student Loans

When it comes to financing your education, Federal Student Aid (FSA) offers different types of federal student loans to help you cover the costs. These loans are provided through the Free Application for Federal Student Aid (FAFSA). Understanding the various options available to you can make a significant difference in managing your finances during your college years. In this blog post, we will explore two types of federal student loans: Direct Subsidized Loans and Direct Unsubsidized Loans.

Direct Subsidized Loans

Direct Subsidized Loans are a type of federal student loan that is offered to undergraduate students with demonstrated financial need. They are considered a desirable option since the federal government pays the interest that accrues on the loan while you are in school, during your grace period, and during any authorized deferment periods. This means that the loan amount you borrow will not increase due to interest during these times.

Here are some key features of Direct Subsidized Loans:

- Borrowing Limit: The maximum amount you can borrow depends on your grade level and dependency status.

- Interest Rate: The interest rates for Direct Subsidized Loans are determined annually by the U.S. Department of Education. These rates are fixed and generally lower than private student loan rates.

- Repayment: Repayment for Direct Subsidized Loans typically begins six months after you graduate, leave school, or drop below half-time enrollment. You will have a grace period before you need to start making payments.

Direct Unsubsidized Loans

Direct Unsubsidized Loans are another type of federal student loan offered to undergraduate, graduate, and professional students regardless of financial need. Unlike Direct Subsidized Loans, interest begins accruing on Direct Unsubsidized Loans as soon as the loan is disbursed, even while you are in school.

Here are some key features of Direct Unsubsidized Loans:

- Borrowing Limit: The maximum amount you can borrow depends on your grade level and dependency status, as well as any additional unsubsidized loan amounts you receive.

- Interest Rate: The interest rates for Direct Unsubsidized Loans are also determined annually by the U.S. Department of Education. These rates are fixed and generally lower than private student loan rates.

- Repayment: Repayment for Direct Unsubsidized Loans follows the same timeline as Direct Subsidized Loans, typically beginning six months after graduation, leaving school, or dropping below half-time enrollment.

It is essential to note that both Direct Subsidized Loans and Direct Unsubsidized Loans have eligibility requirements and limits for borrowing. It is crucial to consult with your financial aid office to determine which loan options are suitable for your circumstances.

Understanding Fafsa Loan Availability

Understanding FAFSA Loan Availability is crucial for students who are looking for financial assistance to pursue higher education. FAFSA, the Free Application for Federal Student Aid, offers various types of aid, including loans, to eligible students. It’s important to understand the terms and conditions associated with FAFSA loans to make informed decisions about financing your education.

Loan Limits

FAFSA provides two main types of loans: subsidized and unsubsidized. The loan amounts are determined based on the student’s year in school and their dependency status. Undergraduate students have lower aggregate loan limits compared to graduate and professional students. It’s important to consider these limits when planning your financial aid strategy.

Interest Rates And Fees

FAFSA loans offer competitive interest rates that are fixed for the life of the loan. For subsidized loans, the government pays the interest while the student is enrolled in school at least half-time and during deferment periods. Unsubsidized loans accumulate interest from the time they are disbursed. Understanding the interest rates and potential fees is essential for managing your loan repayment effectively.

Credit: news.wgcu.org

Applying For Fafsa Loans

FAFSA offers loans to students who need financial assistance for their education. These loans are available at low interest rates and can be repaid after graduation. Applying for FAFSA loans is a straightforward process that can help students achieve their educational goals.

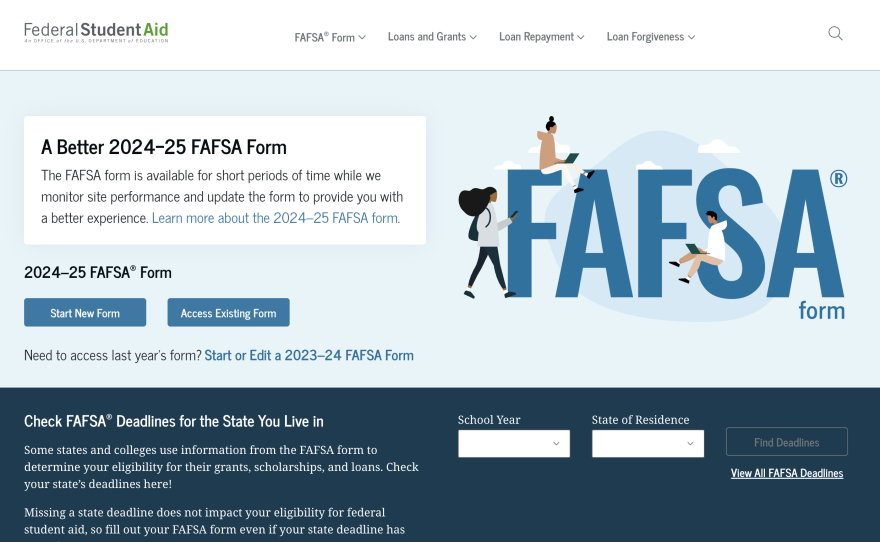

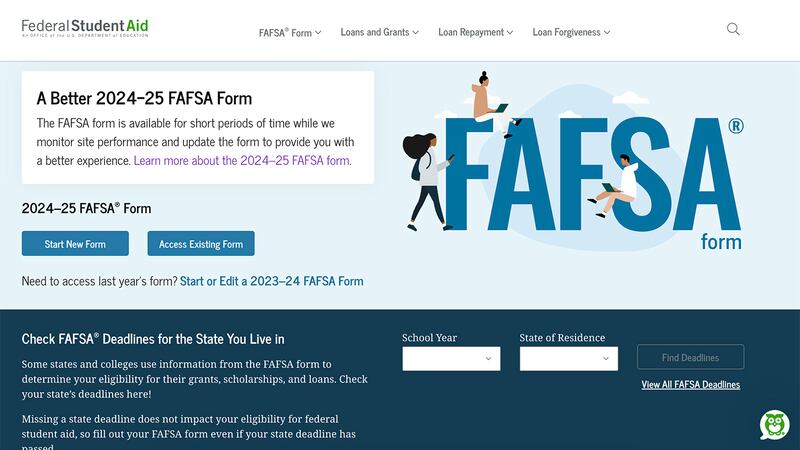

Completing The Fafsa Form

If you are considering applying for FAFSA loans, the first step is completing the FAFSA (Free Application for Federal Student Aid) form. This is a crucial part of the process as it determines your eligibility for financial aid, including loans. The FAFSA form collects information about your personal and financial situation to determine how much aid you qualify for.

To complete the FAFSA form, you will need to gather important documents such as your social security number, federal income tax returns, and bank statements. You will also need to provide information about your current employment status, the schools you are interested in attending, and any other scholarships or grants you may have received.

The form itself is available online and can be easily accessed through the official FAFSA website. It is important to double-check all the information you provide for accuracy, as any mistakes or omissions could potentially delay the processing of your application.

Receiving The Loan

Once you have successfully completed the FAFSA form and it has been processed, you will receive a Student Aid Report (SAR) that outlines your eligibility for federal student aid. This report will include details about the loans you are eligible for, including the types of loans available to you and the amounts you may borrow.

It is crucial to carefully review the information provided in your SAR to ensure you understand the loan terms and conditions. If you choose to accept the loans, you will need to sign a Master Promissory Note (MPN) which serves as your agreement to repay the funds borrowed.

Once the necessary paperwork is in order and your loans have been approved, the funds will typically be disbursed directly to your school. The school will then apply the loan amount to your tuition, fees, and other eligible educational expenses.

It is important to note that FAFSA loans must be repaid. However, they often offer more favorable interest rates and repayment terms compared to private loans. Additionally, federal loans may offer options for income-driven repayment plans and loan forgiveness programs, which can be beneficial for borrowers.

In conclusion, applying for FAFSA loans involves completing the FAFSA form accurately and thoroughly. Once approved, borrowers will receive the loan amount indicated in their Student Aid Report and can use the funds to pay for educational expenses. Remember to carefully review all loan terms and conditions before accepting the loans to ensure you understand your obligations as a borrower.

Repayment Of Fafsa Loans

Once you have successfully obtained a loan through the Free Application for Federal Student Aid (FAFSA), it’s important to be aware of the repayment process. Understanding how you will need to repay your FAFSA loan can help you plan and prepare for the future.

Grace Period

When it comes to repaying your FAFSA loan, one of the first things to note is the grace period. After you graduate, leave school, or drop below half-time enrollment, you are typically given a grace period before your loan repayment begins. This grace period ensures that you have time to transition into the workforce or continue your education.

During this grace period, which usually lasts around six months, you are not required to make any loan payments. This gives you some breathing room to find a job and establish your financial stability before starting your loan repayments.

Repayment Plans

Once your grace period ends, it’s time to start repaying your FAFSA loan. Thankfully, the federal government offers various repayment plans to suit different financial situations and needs. These plans are designed to make loan repayment manageable and affordable.

| Repayment Plan | Key Features |

|---|---|

| Standard Repayment Plan | Fixed monthly payments over a period of up to 10 years. |

| Graduated Repayment Plan | Payments start low and gradually increase every two years over a period of up to 10 years. |

| Income-driven Repayment Plans (IDR) | Monthly payments based on your income and family size. There are multiple IDR plans available, including Income-Based Repayment (IBR), Pay As You Earn (PAYE), Revised Pay As You Earn (REPAYE), and Income-Contingent Repayment (ICR). |

| Extended Repayment Plan | Fixed or graduated monthly payments over a period of up to 25 years. |

These repayment plans offer flexibility and allow you to choose the one that best aligns with your financial capabilities. It’s vital to explore each plan and consider your income, potential career growth, and future goals to make an informed decision.

Remember, the repayment plans offered through FAFSA loans provide you with options to manage your debt in a way that suits your circumstances. It is important to review the details of each plan and choose the one that aligns with your financial goals and capabilities.

Credit: www.facebook.com

Frequently Asked Questions On Does Fafsa Give Out Loans?

Does Fafsa Give Out Loans?

Yes, FAFSA (Free Application for Federal Student Aid) doesn’t directly give out loans. It determines your eligibility for federal student aid, including loans. Filling out the FAFSA form is the first step to access federal loans like Direct Subsidized Loans and Direct Unsubsidized Loans, offered by the U.

S. Department of Education.

What Loans Are Available Through Fafsa?

FAFSA provides access to various federal loans, such as Direct Subsidized Loans, Direct Unsubsidized Loans, and Direct PLUS Loans. Direct Subsidized Loans are based on financial need, while Direct Unsubsidized Loans are available regardless of financial situation. Direct PLUS Loans are typically for graduate or professional students, as well as parents of dependent undergraduate students.

How Do You Qualify For Loans Through Fafsa?

To qualify for loans through FAFSA, you need to meet certain eligibility criteria. These may include being a U. S. citizen or an eligible noncitizen, having a Social Security number, maintaining satisfactory academic progress, and not being in default on previous federal student loans.

Additionally, you must fill out the FAFSA form and demonstrate financial need.

Conclusion

Understanding FAFSA’s role in providing loans is crucial for students. The FAFSA does not directly issue loans, rather, it serves as a gateway for federal financial aid. It’s important for students to carefully navigate the FAFSA process to secure the best loans available for their education.

Understanding the intricacies of FAFSA can lead to better financial outcomes for students.

{ “@context”: “https://schema.org”, “@type”: “FAQPage”, “mainEntity”: [ { “@type”: “Question”, “name”: “Does FAFSA give out loans?”, “acceptedAnswer”: { “@type”: “Answer”, “text”: “Yes, FAFSA (Free Application for Federal Student Aid) doesn’t directly give out loans. It determines your eligibility for federal student aid, including loans. Filling out the FAFSA form is the first step to access federal loans like Direct Subsidized Loans and Direct Unsubsidized Loans, offered by the U.S. Department of Education.” } } , { “@type”: “Question”, “name”: “What loans are available through FAFSA?”, “acceptedAnswer”: { “@type”: “Answer”, “text”: “FAFSA provides access to various federal loans, such as Direct Subsidized Loans, Direct Unsubsidized Loans, and Direct PLUS Loans. Direct Subsidized Loans are based on financial need, while Direct Unsubsidized Loans are available regardless of financial situation. Direct PLUS Loans are typically for graduate or professional students, as well as parents of dependent undergraduate students.” } } , { “@type”: “Question”, “name”: “How do you qualify for loans through FAFSA?”, “acceptedAnswer”: { “@type”: “Answer”, “text”: “To qualify for loans through FAFSA, you need to meet certain eligibility criteria. These may include being a U.S. citizen or an eligible noncitizen, having a Social Security number, maintaining satisfactory academic progress, and not being in default on previous federal student loans. Additionally, you must fill out the FAFSA form and demonstrate financial need.” } } ] }