Who Misses Out on Student Loan Forgiveness? Find Out Now!

Not included in student loan forgiveness are private student loans and PLUS loans taken out by parents. Student loan forgiveness typically applies to federal direct loans acquired by the borrower.

Challenges Of Student Loan Forgiveness

If you are burdened with student loans, the prospect of student loan forgiveness might seem like a ray of hope. However, it’s important to understand that not everyone is eligible for this form of debt relief. There are certain challenges and limitations associated with student loan forgiveness programs that could exclude you from receiving this assistance. In this article, we will explore two key factors that could hinder your chances of qualifying for student loan forgiveness.

Income-driven Repayment Plans

One of the most commonly used methods to manage student loan debt is through income-driven repayment plans. These plans adjust your monthly payments based on your income, making it more affordable for borrowers who have a low income or are experiencing financial hardship. While income-driven repayment plans can be helpful, they can also pose a challenge when it comes to student loan forgiveness.

It’s important to note that simply being enrolled in an income-driven repayment plan does not automatically make you eligible for student loan forgiveness. In most cases, you must make a certain number of qualifying repayment payments before you can be considered for forgiveness. These payments are typically spread out over a period of 20 to 25 years, depending on the specific repayment plan you are enrolled in. This means that it could take several years before you are eligible for forgiveness, and even then, there are certain requirements that must be met.

Non-qualifying Student Loans

Another challenge that could prevent you from accessing student loan forgiveness is having a non-qualifying student loan. While federal student loans are generally eligible for forgiveness programs, not all types of loans fall under this category. For example, if you have private student loans from a bank or other lending institution, you may not be eligible for forgiveness through government programs.

Additionally, certain specialized loans such as Parent PLUS loans or Perkins loans may have their own forgiveness options and criteria separate from the general student loan forgiveness programs. It’s important to thoroughly research and understand the requirements for forgiveness based on the type of loan you have.

In conclusion, while student loan forgiveness can provide much-needed relief for borrowers struggling to repay their loans, it’s essential to be aware of the challenges and limitations that could prevent you from qualifying. Understanding the intricacies of income-driven repayment plans and the types of loans that are eligible for forgiveness is crucial when making decisions about your student loan repayment journey.

Credit: www.nysut.org

Urban Myths And Misconceptions

When it comes to student loan forgiveness, there are many urban myths and misconceptions floating around. It’s important to separate fact from fiction to fully understand who is not included in student loan forgiveness. Let’s debunk some common misconceptions surrounding this topic.

All Student Loans Are Eligible

Contrary to popular belief, not all student loans are eligible for forgiveness. Many borrowers mistakenly assume that any type of student loan is included, but that’s not the case. Only specific types of loans qualify for forgiveness, such as federal direct loans and federal FFEL loans, under certain conditions.

Additionally, private student loans, which are offered by banks and other financial institutions, are not eligible for forgiveness. It’s important for borrowers to understand the type of loan they have and whether it falls under the eligible categories for forgiveness.

Loan Forgiveness Is Automatic

Another common misconception is that loan forgiveness is automatic. Some borrowers believe that once they meet the criteria, their loans will be magically forgiven without any effort on their part. Unfortunately, that’s not the reality.

In order to qualify for loan forgiveness, borrowers usually need to fulfill specific requirements, such as making a certain number of qualifying payments or working in a qualifying profession for a designated period of time. There is an application process involved, and borrowers must actively pursue loan forgiveness by following the necessary steps.

It’s crucial to stay informed and not fall victim to urban myths and misconceptions when it comes to student loan forgiveness. Understanding who is not included and the requirements for eligibility can help borrowers make informed decisions and take the necessary steps to pursue loan forgiveness if they qualify.

Navigating The Complex Application Process

When it comes to student loan forgiveness, navigating the complex application process can be daunting. Understanding the eligibility criteria and documentation requirements is pivotal to ensure a smooth journey through the application process.

Documentation Requirements

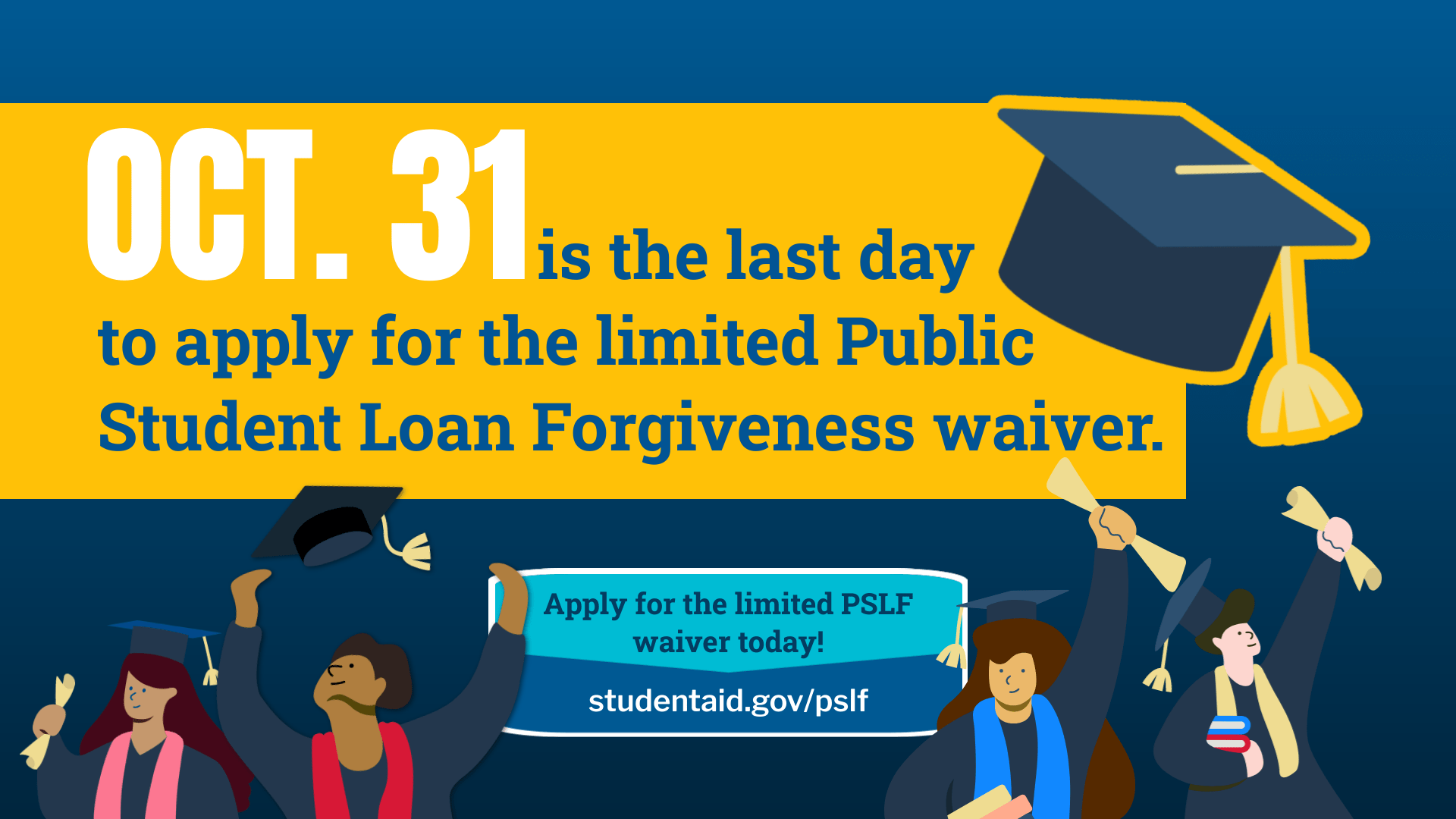

Applying for student loan forgiveness demands meticulous attention to documentation. Whether you are pursuing Public Service Loan Forgiveness (PSLF) or Teacher Loan Forgiveness, accurate proof of employment, loan records, and tax information is crucial. Additionally, ensuring all submitted documentation is complete and error-free is vital to avoid delays or rejection.

Eligibility Criteria

To successfully navigate the application process, understanding the eligibility criteria is imperative. Whether you are a public servant, teacher, or pursuing forgiveness through income-driven repayment plans, meeting the specific criteria is vital. Familiarizing yourself with the nuances of each forgiveness program is essential to avoid unnecessary hurdles during the application process.

Credit: www.tiktok.com

Impact On Credit Scores And Financial Future

When it comes to student loan forgiveness, it is important to understand that not everyone is included in these programs. While forgiveness can provide much-needed relief to struggling borrowers, it is crucial to consider the long-term financial implications, especially when it comes to credit scores and financial futures. Let’s explore the impact of student loan forgiveness on credit scores and the potential ramifications it can have.

Long-term Financial Implications

While student loan forgiveness may alleviate the burden of outstanding debt for some, it’s essential to recognize that it does not come without consequences. It’s important to consider the long-term financial implications before pursuing forgiveness options. This includes evaluating the potential impact on credit scores and future financial security.

Credit Score Ramifications

A significant concern for individuals seeking student loan forgiveness is the impact it may have on their credit scores. Your credit score is a crucial factor that lenders consider when determining your creditworthiness for future loans, credit cards, or mortgages. Defaulting on student loans or having them forgiven can lead to negative effects on your credit score.

- Forgiveness may result in the loan status being reported as “Settled” or “Charged-Off,” which can significantly harm your credit score.

- Defaulting on your student loans before forgiveness eligibility can have a severe impact on your creditworthiness, making it challenging to secure favorable interest rates or obtain credit in the future.

It’s important to note that while forgiveness itself may not directly harm your credit score, the associated actions and circumstances that lead to forgiveness can have lasting effects. Being proactive and exploring alternative options, such as loan refinancing or establishing manageable repayment plans, can help maintain a healthy credit score while managing your student loan debt.

Alternative Strategies For Managing Student Debt

While not everyone qualifies for student loan forgiveness, there are alternative strategies that can help you effectively manage your student debt. Here, we explore two key approaches: refinancing options and debt repayment strategies.

Refinancing Options

If you’re looking to lower your monthly payments or secure a better interest rate, refinancing your student loans can be a viable solution. In this process, you essentially take out a new loan to pay off your existing student loans, often with more favorable terms. Here are a few refinancing options to consider:

- Private refinancing: This involves refinancing your federal or private student loans with a private lender. It may provide the opportunity to secure a lower interest rate and decrease your monthly payments.

- Consolidation: Consolidating your federal loans allows you to combine multiple loans into a single new loan, simplifying your repayment process. Keep in mind that the interest rate on the new loan will be a weighted average of your current rates.

- Alternative repayment terms: Through refinancing, you may have the option to choose alternative repayment terms. For instance, you might opt for a longer repayment period to decrease your monthly payments or a shorter term to save on interest in the long run.

Debt Repayment Strategies

If refinancing isn’t the right fit for you, there are several debt repayment strategies worth exploring:

- Snowball method: This strategy involves paying off your smallest student loan balance first, then moving on to the next smallest. As each loan is paid off, you free up more money to put towards the remaining balances, creating momentum in your debt repayment journey.

- Avalanche method: With this approach, you prioritize paying off the student loan with the highest interest rate first. By tackling your highest-cost debt initially, you can potentially save more money on interest over time.

- Income-driven repayment plans: If you have federal student loans and your income is limited, income-driven repayment plans can make your monthly payments more manageable. These plans set your monthly payments based on your income and family size.

- Public Service Loan Forgiveness (PSLF): While not technically loan forgiveness in the traditional sense, PSLF offers loan cancellation for borrowers who work full-time for qualifying employers in the public sector or non-profit organizations.

Remember, finding the right strategy to manage your student debt depends on your personal circumstances. It’s important to explore your options, consider the benefits and drawbacks, and make an informed decision that aligns with your financial goals.

Credit: m.facebook.com

Frequently Asked Questions For Who Is Not Included In Student Loan Forgiveness?

Who Is Eligible For Student Loan Forgiveness?

Eligibility for student loan forgiveness varies depending on the program. Typically, public service employees, teachers, and those in income-driven repayment plans may be eligible for forgiveness. It’s important to review the specific requirements for each forgiveness program to determine if you qualify.

Are Private Student Loans Eligible For Forgiveness?

No, private student loans are generally not eligible for forgiveness. Forgiveness programs typically apply to federal student loans. Private loans are issued by banks or lenders and do not offer the same forgiveness options as federal loans. However, you may want to explore refinancing options for private loans to potentially lower your interest rates.

What Types Of Loans Are Eligible For Forgiveness?

Federal student loans, such as Direct loans, Stafford loans, and Perkins loans, are usually eligible for forgiveness. However, Parent PLUS loans and private loans are not eligible. Each forgiveness program has its own requirements, so it’s essential to research and understand the specific guidelines for the program you’re interested in.

Why Might Someone Not Qualify For Student Loan Forgiveness?

There are several reasons why someone might not qualify for student loan forgiveness. Some common reasons include not meeting the specific program requirements, not making the required number of qualifying payments, or not working in an eligible field. It’s crucial to thoroughly review the eligibility criteria to ensure you meet all the necessary qualifications.

Conclusion

Understanding who is not eligible for student loan forgiveness is crucial. While some borrowers may not qualify, seeking alternative options or financial guidance can provide relief. Being informed and proactive about loan repayment is essential for navigating the complexities of student loan forgiveness programs.

Stay informed to make informed decisions.

{ “@context”: “https://schema.org”, “@type”: “FAQPage”, “mainEntity”: [ { “@type”: “Question”, “name”: “Who is eligible for student loan forgiveness?”, “acceptedAnswer”: { “@type”: “Answer”, “text”: “Eligibility for student loan forgiveness varies depending on the program. Typically, public service employees, teachers, and those in income-driven repayment plans may be eligible for forgiveness. It’s important to review the specific requirements for each forgiveness program to determine if you qualify.” } } , { “@type”: “Question”, “name”: “Are private student loans eligible for forgiveness?”, “acceptedAnswer”: { “@type”: “Answer”, “text”: “No, private student loans are generally not eligible for forgiveness. Forgiveness programs typically apply to federal student loans. Private loans are issued by banks or lenders and do not offer the same forgiveness options as federal loans. However, you may want to explore refinancing options for private loans to potentially lower your interest rates.” } } , { “@type”: “Question”, “name”: “What types of loans are eligible for forgiveness?”, “acceptedAnswer”: { “@type”: “Answer”, “text”: “Federal student loans, such as Direct loans, Stafford loans, and Perkins loans, are usually eligible for forgiveness. However, Parent PLUS loans and private loans are not eligible. Each forgiveness program has its own requirements, so it’s essential to research and understand the specific guidelines for the program you’re interested in.” } } , { “@type”: “Question”, “name”: “Why might someone not qualify for student loan forgiveness?”, “acceptedAnswer”: { “@type”: “Answer”, “text”: “There are several reasons why someone might not qualify for student loan forgiveness. Some common reasons include not meeting the specific program requirements, not making the required number of qualifying payments, or not working in an eligible field. It’s crucial to thoroughly review the eligibility criteria to ensure you meet all the necessary qualifications.” } } ] }