Can You Add Someone to Mortgage? Discover the Power of Joint Ownership!

Yes, you can add someone to a mortgage by applying for a joint mortgage or requesting a mortgage assumption. Adding someone to a mortgage can be a viable option for various reasons.

Whether you want to share the financial responsibility, improve mortgage terms, or simply enable someone to own a portion of the property, it is crucial to understand the process involved. This article aims to shed light on how you can add someone to a mortgage seamlessly.

By exploring the available options, such as joint mortgages and mortgage assumptions, you can make an informed decision. It is important to note that these methods have their own requirements and implications, which we will discuss further. So, let’s dive into the details of adding someone to a mortgage and explore the possibilities.

:max_bytes(150000):strip_icc()/JTWROS_Final_4194012-edit-602dd57251a74b8192960824c0e16ebd.jpg)

Credit: www.investopedia.com

What Is Joint Ownership?

Joint ownership, in terms of a mortgage, refers to the situation where two or more individuals own a property together and share the responsibilities and benefits associated with it. It is a legal arrangement that allows individuals to combine their financial resources and purchase a property jointly.

Benefits Of Joint Ownership

Joint ownership offers several advantages for individuals looking to buy property together:

- Increased affordability: Buying a property jointly means sharing the financial burden, including the down payment and monthly mortgage payments. This can make owning a home more affordable for both parties involved.

- Shared responsibilities: With joint ownership, the responsibilities and costs associated with maintaining the property are divided among the co-owners. This can include property taxes, insurance, and maintenance expenses.

- Greater borrowing capacity: When individuals apply for a mortgage together, their combined incomes and creditworthiness are taken into account. This can increase their borrowing capacity and make it easier to qualify for a larger loan amount.

- Tax advantages: Joint owners may be eligible for certain tax benefits, such as deductions for mortgage interest payments and property taxes. It is advisable to consult with a tax professional to understand the specific tax implications of joint ownership.

Risks Of Joint Ownership

While joint ownership can have its advantages, it’s important to consider the potential risks involved:

- Liability for each other’s debts: In joint ownership, each co-owner is responsible for the entire mortgage, including any missed payments or defaults. If one co-owner fails to meet their financial obligations, it can negatively impact the credit score and financial standing of the other co-owners.

- Disagreements and conflicts: When multiple individuals own a property, there is a higher likelihood of disagreements and conflicts arising. Disputes can arise regarding property usage, maintenance, or financial decisions. It is crucial to establish clear communication and resolve any conflicts through legal means if necessary.

- Difficulty in selling or transferring ownership: Selling a jointly owned property may require the consent and cooperation of all co-owners. If one co-owner does not wish to sell, it can create difficulties and delays in the process. Additionally, transferring ownership to someone else may also require the agreement of all parties involved.

- Unequal contributions: If the co-owners have not clearly defined their financial contributions and responsibilities, it can lead to resentment and disputes. It is important to have a written agreement detailing each co-owner’s rights, responsibilities, and share of ownership.

Credit: saclaw.org

Adding Someone To A Mortgage

Adding someone to a mortgage can be a significant decision with long-term financial implications. Whether you’re looking to add a spouse, family member, or friend to your mortgage, there are important considerations to keep in mind. In this article, we will explore how to add someone to a mortgage and the factors you should consider before making this decision.

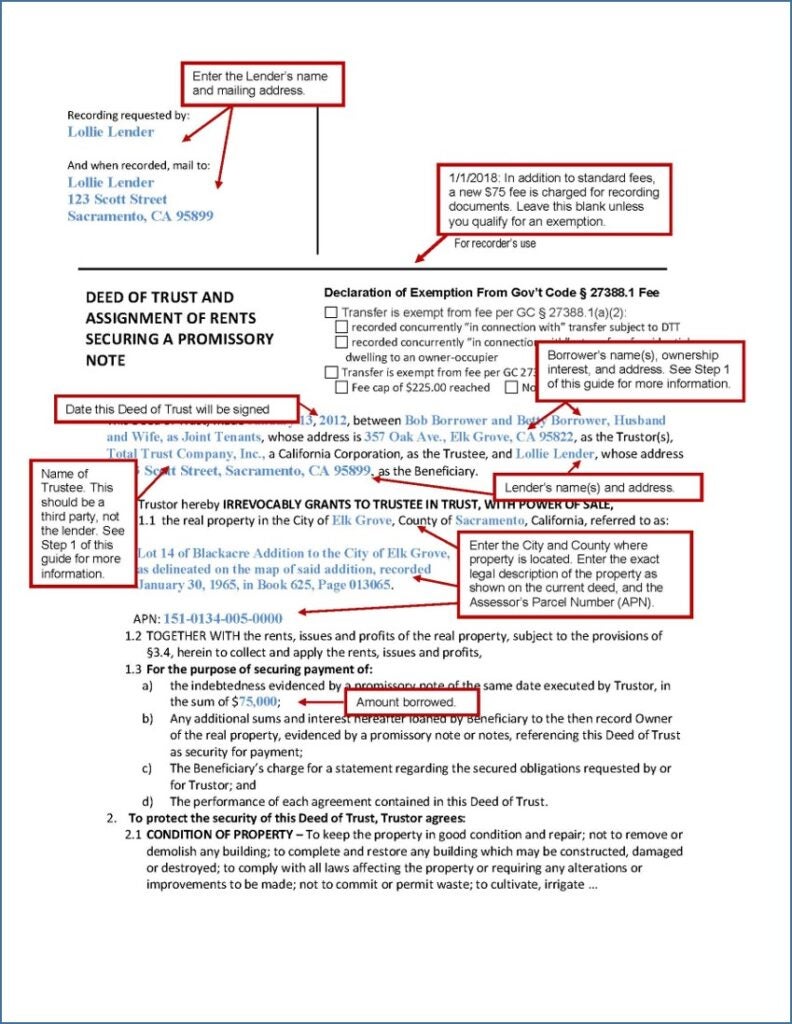

How To Add Someone To A Mortgage

Adding someone to a mortgage involves a few important steps. Here’s a straightforward guide to help you through the process:

- Speak with your lender: Before taking any action, it’s crucial to consult with your lender to understand their policies and requirements for adding someone to your mortgage.

- Submit an application: Once you have gathered the necessary information and documentation, you will typically need to submit an application to your lender to add a person to your mortgage.

- Provide financial information: Your lender may require the person you want to add to the mortgage to provide their financial information, including income, assets, and liabilities, to assess their eligibility.

- Consider the implications: Adding someone to a mortgage means they will share the responsibility of repaying the loan. It’s important to consider how this decision may impact your relationship and financial situation.

- Seek legal advice: legal advice to ensure all the necessary paperwork, such as the mortgage agreement and title deed, is updated correctly and protect everyone’s rights and interests.

Considerations Before Adding Someone To A Mortgage

Before adding someone to your mortgage, there are several crucial factors to consider:

1. Financial responsibility: Adding someone to a mortgage means they become financially responsible for the loan. You should ensure that the person you add has a good credit history and the ability to contribute to the mortgage payments.

2. Relationship dynamics: Adding a person to your mortgage can impact your relationship significantly. It’s essential to discuss and understand each party’s expectations, financial goals, and potential risks before moving forward.

3. Liability: By adding someone to a mortgage, they become equally liable for the debt. In the event of missed payments or default, both parties will be affected. You should carefully consider the potential consequences and implications of sharing this financial responsibility.

4. Legal and tax implications: Adding someone to a mortgage can have legal and tax ramifications. It’s advisable to seek legal and tax advice to understand the potential impacts, such as changes to property ownership, tax obligations, and estate planning.

5. Future plans: Before adding someone to your mortgage, discuss your future plans for the property. Considerations such as refinancing, selling, or buying additional property should be taken into account to ensure everyone’s interests align.

Adding someone to a mortgage is a decision that should be made after careful consideration of these factors. If you have any doubts or concerns, seeking guidance from a financial advisor or lender can provide valuable insights to help you make an informed decision.

Impact On Credit And Financial Responsibility

Adding someone to your mortgage can have significant implications on your credit and financial responsibility. Understanding these implications is crucial before making any decisions. This section will discuss the credit implications of joint ownership and the financial responsibilities that come with it.

Credit Implications Of Joint Ownership

Joint ownership of a mortgage can impact the credit of both parties involved. It is essential to comprehend how this can potentially affect your credit score and financial standing. Here are some key factors to consider:

- Payment history: Any missed payments or delinquencies by either party can negatively impact the credit scores of both individuals. It is important to ensure timely and consistent payments to avoid any negative repercussions.

- Debt-to-income ratio: The addition of another individual to the mortgage can affect your debt-to-income ratio. Lenders consider this ratio when determining loan eligibility. Make sure to reassess your financial situation and calculate the impact on your ratio.

- Credit utilization: Joint ownership can also impact your credit utilization ratio. This ratio represents the amount of credit you are using compared to your total available credit. Adding someone to the mortgage might increase your overall credit utilization, which could potentially lower your credit score.

- Creditworthiness: Lenders will assess the creditworthiness of all individuals on the mortgage. If the added party has a low credit score or a history of financial troubles, it could impact your eligibility for future loans or credit opportunities.

Financial Responsibilities Of Joint Ownership

Adding someone to your mortgage not only affects credit but also entails shared financial responsibilities. It is crucial to understand the obligations and financial implications that come with joint ownership. Here are some key considerations:

- Mortgage payments: Both parties are equally responsible for making mortgage payments. It is important to establish clear communication and a solid plan for managing expenses to avoid any disputes or financial strain.

- Property taxes and insurance: Joint owners must contribute towards property taxes and insurance. These expenses should be factored into discussions, ensuring both parties understand their share of the responsibility.

- Home maintenance and repairs: As joint owners, it is important to discuss how home maintenance and repair costs will be divided. Establishing a plan and budget for these expenses will help avoid any misunderstandings down the road.

- Selling or refinancing: If either party wishes to sell or refinance the property, both owners must agree. This means that decisions regarding the property’s future will require collaboration and consent from all parties involved.

Being aware of the credit implications and financial responsibilities that arise from adding someone to your mortgage is crucial. This understanding will help both parties navigate the joint ownership arrangement successfully and ensure a smooth and mutually beneficial financial journey.

Credit: www.bankrate.com

Legal Aspects Of Joint Ownership

When it comes to purchasing a property, joint ownership is a popular option for many individuals. Not only does it allow for shared responsibilities, but it also provides an opportunity to share the financial burden and benefits of homeownership. However, before entering into a joint ownership agreement, it is important to understand the legal aspects that come with it. This section will explore the ownership rights and responsibilities, as well as the creation of a binding agreement.

Ownership Rights And Responsibilities

Joint ownership of a property means that each party involved has a share in the ownership and is entitled to specific rights and responsibilities. These rights usually include the ability to use and enjoy the property, as well as the right to make decisions regarding its management and upkeep. Additionally, each co-owner has an obligation to contribute towards the property expenses, such as mortgage payments, property taxes, and maintenance costs. It is vital to clearly establish the distribution of these responsibilities between the co-owners to avoid potential conflicts in the future.

Creating A Binding Agreement

When entering into a joint ownership arrangement, it is crucial to create a binding agreement that outlines the terms and conditions of the partnership. This agreement should cover important aspects such as the percentage of ownership for each party, the division of expenses, and the process for resolving disputes. By having a legally sound agreement in place, co-owners can have peace of mind knowing that their rights and interests are protected. It is advisable to seek legal advice when drafting this agreement to ensure it aligns with the relevant property laws and regulations.

Exiting Joint Ownership

Whether due to a change in circumstances or a desire to move on, exiting joint ownership of a mortgage is a significant decision. Knowing your options and understanding the process is crucial to navigating this situation smoothly. In this section, we will explore the choices available to you and discuss potential consequences that may arise.

Options And Process For Exiting Joint Ownership

If you find yourself in a situation where you need to exit joint ownership of a mortgage, there are several choices at your disposal. These options, however, may vary depending on your specific circumstances and the agreements you have in place with your co-owner.

- Buyout: One option is for either party to buy out the other’s share of the mortgage. This involves determining the fair market value of the property, as well as any outstanding debts or liabilities. A buyout agreement can be reached through negotiations or by seeking legal advice to ensure a fair and equitable division of assets.

- Sell the property: Another option is to sell the property and use the proceeds to pay off the mortgage. This requires the agreement and cooperation of both owners. It is essential to consult with a real estate agent or legal professional to navigate the intricacies of the selling process and ensure a seamless transfer of ownership.

- Refinance: If one party wishes to remain in the property and assume sole ownership of the mortgage, refinancing may be a viable solution. This involves applying for a new mortgage in one person’s name and using the funds to pay off the existing joint mortgage. However, it is crucial to consider the financial implications and eligibility requirements before pursuing this option.

Potential Consequences Of Exiting Joint Ownership

Exiting joint ownership of a mortgage can have several consequences, both financial and legal, that need careful consideration. These consequences may vary based on individual circumstances and the agreements in place. Here are some potential ramifications to be aware of:

- Financial obligations: Exiting joint ownership does not automatically release you from your financial responsibilities related to the mortgage. Debts and liabilities may still need to be settled, especially if a buyout or sale of the property is involved.

- Credit impact: If either party fails to fulfill their financial obligations, it could have a negative impact on their credit scores. Late or missed mortgage payments can affect creditworthiness and make it more challenging to secure future loans or mortgages.

- Tax implications: Depending on the specific circumstances, there may be tax implications associated with exiting joint ownership. It is essential to consult with a tax professional to understand the potential tax consequences of the chosen exit strategy.

- Legal considerations: When exiting joint ownership, it is crucial to review any legal agreements, such as a co-ownership agreement or prenuptial agreement, that may be in place. Seeking legal advice can help clarify rights, obligations, and potential legal issues that may arise.

Frequently Asked Questions For Can You Add Someone To Mortgage

Can You Add Someone To Your Mortgage Loan Without Refinancing?

No, you cannot add someone to your mortgage loan without refinancing. Refinancing is necessary to modify the terms and include another person.

How Do I Add Someone To My Existing Mortgage?

To add someone to your existing mortgage, follow these steps: 1. Contact your lender and inquire about their process for adding a joint borrower. 2. Complete the necessary paperwork, including a mortgage application and credit check for the person you want to add.

3. Provide the lender with any required documentation, such as income verification and identification. 4. Wait for the lender’s decision, which may involve a review of the joint borrower’s financial situation. 5. Once approved, the person will be added to the mortgage, sharing the responsibility and benefits of homeownership.

What Is It Called When You Add Someone To Your Mortgage?

Adding someone to your mortgage is known as “mortgage co-signing. ” It involves adding another person’s name to the mortgage agreement, making them equally responsible for the loan.

Can Anyone Be Added To A Mortgage?

Yes, anyone can be added to a mortgage as long as they meet the lender’s requirements. They must have a good credit score, income stability, and be willing to assume the financial responsibility of the mortgage. Contact the lender for more details on the process.

Conclusion

In a nutshell, adding someone to a mortgage is indeed possible, but it is not a decision to be taken lightly. It involves careful consideration of financial responsibilities and implications. Consulting with a mortgage professional, understanding the legal aspects, and assessing the risks involved are crucial steps in making an informed choice.

Ultimately, the decision should align with your long-term goals and financial stability. Remember, thorough research and expert advice are key when it comes to mortgage-related matters.