Can a Bank Change Currency on a Mortgage Contract: Decoding the Possibilities

No, a bank cannot switch currency on a mortgage contract. A mortgage contract is typically agreed upon in one currency and cannot be changed later on by the bank.

Mortgages are an essential part of many individuals’ lives as they provide the means to purchase a home or property. However, when it comes to mortgage contracts, there are certain limitations and rules that must be followed. One question that often arises is whether a bank can switch the currency on a mortgage contract.

This article aims to provide a clear and concise answer to this query. Understanding the rules and regulations governing mortgage contracts is important for both prospective homeowners and those who already have existing mortgages. So, let’s delve into this topic and discover the answer to whether a bank has the power to switch currency on a mortgage contract.

Credit: m.facebook.com

Understanding Mortgage Contracts And Currencies

A bank has the ability to switch the currency on a mortgage contract, which can have important implications for borrowers. It is crucial to fully understand the terms and conditions before signing the contract to avoid potential financial challenges in the future.

What Is A Mortgage Contract?

A mortgage contract is a legally binding agreement between a borrower and a lender that outlines the terms and conditions of a mortgage loan. It typically includes important details such as the loan amount, interest rate, repayment period, and any penalties or fees associated with the loan. In simpler terms, a mortgage contract is a document that lays out the rules and responsibilities for both the borrower and the lender when it comes to a mortgage.

Different Currency Options In Mortgage Contracts

When taking out a mortgage, borrowers often have the option to choose the currency in which the loan will be denominated. This can be an important consideration for those who are purchasing property or planning to relocate to a country with a different currency than their own. However, it’s crucial to carefully weigh the pros and cons before making a decision.

Here are some common currency options you may encounter in mortgage contracts:

1. Local Currency

Opting for the local currency means taking out the mortgage in the currency of the country where the property is located. This choice can provide stability and predictability, as borrowers are not exposed to currency exchange rate fluctuations. It also eliminates the need for converting funds between currencies, which can involve additional costs and risks.

2. Foreign Currency

In certain cases, borrowers may choose to take out a mortgage in a foreign currency. This option may be attractive when the borrower’s income or assets are in the same currency, or when there is an expectation of favorable exchange rate movements. However, it’s important to note that borrowing in a foreign currency can expose the borrower to exchange rate risk. Fluctuations in exchange rates can significantly impact the monthly mortgage payments and overall loan affordability.

3. Currency Basket

In some instances, mortgage contracts may offer the option to choose a currency basket, which is a combination of currencies. This can be useful for borrowers who have income or assets in multiple currencies or who want to diversify their currency exposure. However, it’s crucial to thoroughly understand the composition and weighting of the currency basket to assess the potential risks and benefits.

It’s important to carefully consider your financial situation, long-term goals, and risk tolerance before deciding on the currency option for your mortgage contract. Consulting with a financial advisor or mortgage specialist can provide valuable insights and help you make an informed decision.

:max_bytes(150000):strip_icc()/outrightoptiontradeexampleAAPL-01e05f85d910444cb5c8119c7b830dc5.jpg)

Credit: www.investopedia.com

Factors Influencing Currency Changes In Mortgage Contracts

Currency changes in mortgage contracts are influenced by various factors like economic stability, exchange rates, and government policies. Banks may switch currency on a mortgage contract, depending on the terms agreed upon by both parties. It is essential for borrowers to understand these factors and be aware of potential risks before entering into such agreements.

A mortgage contract is a legally binding agreement between a borrower and a bank, specifying the terms and conditions of a loan. One important consideration when taking out a mortgage is the currency in which the loan will be repaid. While most mortgages are denominated in the borrower’s local currency, some borrowers may opt for mortgages in foreign currencies. However, it’s vital to understand the factors that can influence currency changes in mortgage contracts.

Exchange Rate Fluctuations

Exchange rate fluctuations play a significant role in determining the value of one currency relative to another. These fluctuations occur due to various factors such as market demand, economic indicators, and geopolitical events. For borrowers with mortgages in foreign currencies, exchange rate fluctuations can have a direct impact on the cost of repayment. If the local currency weakens against the chosen foreign currency, the cost of the mortgage will increase. On the other hand, if the local currency strengthens, the cost of the mortgage will decrease.

Central Bank Policies

Central banks play a crucial role in shaping the monetary policy of a country. Through their decisions on interest rates and money supply, central banks can influence the value of a nation’s currency. When a central bank increases interest rates, it can attract foreign investment and strengthen the local currency. Conversely, a decrease in interest rates may result in a weaker currency. As mortgage lenders often base their interest rates on the prevailing central bank rates, changes in these policies can impact the cost of mortgage repayments for borrowers.

Political And Economic Factors

- Political stability is a vital factor influencing currency changes in mortgage contracts. Countries with stable political systems and strong economic conditions generally have more stable currencies. On the other hand, countries experiencing political turmoil or economic upheaval may see significant fluctuations in their currency’s value. Political and economic factors, such as inflation, unemployment rates, and government policies, can all impact the stability of a currency and, consequently, the cost of mortgage repayments.

- Geopolitical events can also have a profound impact on currency values. Wars, trade disputes, and other global events can create uncertainty in the markets and lead to currency volatility. Borrowers with mortgages in foreign currencies should be aware of these geopolitical risks and their potential impact on their mortgage repayments.

It’s crucial for borrowers to consider these factors when choosing a mortgage in a different currency. While a foreign currency mortgage may offer potential advantages, such as lower interest rates or investment opportunities, it also carries inherent risks. Understanding the influence of exchange rate fluctuations, central bank policies, and political and economic factors can help borrowers make informed decisions and mitigate potential risks in their mortgage contracts.

Possibilities Of Changing Currency In A Mortgage Contract

When it comes to mortgages, currency fluctuations can have a significant impact on repayment amounts and overall financial stability. But can a bank switch currency on a mortgage contract? Let’s explore the possibilities of changing currency in a mortgage contract.

Renegotiating With The Bank

If you find yourself in a situation where you want to switch currency on your mortgage contract, one possibility is to renegotiate the terms with your bank. This involves discussing the option of changing the currency with your bank and reaching an agreement that works for both parties. Renegotiating can be a viable option if you have a good relationship with your bank and if currency exchange rates are favorable for the switch.

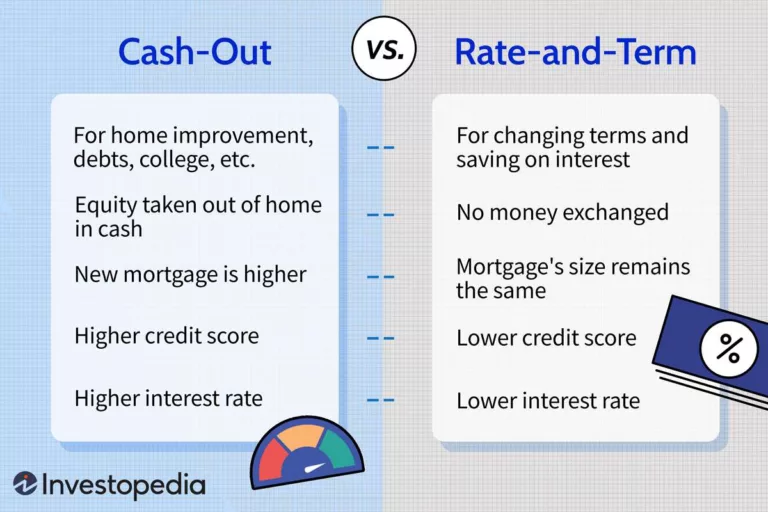

Refinancing The Mortgage

Another option to consider is refinancing your mortgage. Refinancing involves taking out a new loan to replace your existing mortgage. In this case, you may have the opportunity to switch currency when refinancing, depending on the options available from different lenders. It’s important to research and compare the terms and conditions of refinancing with various lenders to ensure you get the best rates and currency options that fit your financial goals.

When considering whether to switch currency in a mortgage contract, it’s crucial to weigh the potential advantages and disadvantages. Here are a few points to keep in mind:

- Advantages of changing currency in a mortgage contract:

- Protection against currency fluctuations: Switching to a stable currency may protect you from exchange rate risks, ensuring a more predictable repayment schedule.

- Potential cost savings: If the currency you want to switch to has lower interest rates, you may be able to save on interest payments over the life of the mortgage.

- Improved financial stability: Switching to a currency that aligns with your income or assets can enhance financial stability, especially if you earn or own assets in the desired currency.

- Disadvantages of changing currency in a mortgage contract:

- Conversion costs: Switching currency may involve fees or costs for converting your mortgage to a different currency.

- Market uncertainty: It’s important to remember that currency exchange rates can be volatile, and predicting their future performance is challenging. Switching currency carries some level of risk.

- Legal and administrative considerations: Changing currency in a mortgage contract may involve legal and administrative processes that can be time-consuming and require additional paperwork.

Before making a decision, it’s always recommended to seek advice from a financial professional who can assess your specific situation and provide guidance on whether switching currency in a mortgage contract is suitable for you.

Legal And Financial Implications

When it comes to a mortgage contract, the decision to switch currency can have significant legal and financial implications. It is crucial for both the bank and the borrower to understand and carefully consider these implications before proceeding with such a change.

Legal Considerations

Switching currency on a mortgage contract involves important legal considerations that must be taken into account. Here are a few key points to consider:

- Review the original mortgage contract: The first step is to carefully review the original mortgage contract to determine whether it allows for currency changes. Some contracts may explicitly prohibit currency switches, while others may have specific provisions detailing the process.

- Consult with legal experts: It is advisable to seek legal advice from professionals experienced in mortgage contracts and currency exchange regulations. They can guide you through the legal implications and help ensure compliance with any applicable laws or regulations.

- Notify all parties involved: If a decision is made to switch currency, it is essential to notify all parties involved, including the lender and any relevant government authorities. This ensures transparency and prevents potential legal issues in the future.

Financial Risks And Benefits

Switching currency on a mortgage contract can present both financial risks and benefits. It is important to weigh these factors to make an informed decision:

- Risk of currency fluctuations: One of the main financial risks is exposure to currency fluctuations. If the borrower’s income is in a different currency, changes in exchange rates can significantly affect their ability to meet mortgage payments.

- Interest rate differentials: Switching currency may also lead to changes in interest rates. It’s crucial to evaluate the interest rates in both currencies and analyze the potential impact on the overall mortgage payments.

- Tax implications: Currency switches may have tax implications that need to be carefully considered. Different tax rules may apply depending on the currency used, leading to potential financial consequences.

- Hedging options: It’s worth exploring hedging options to mitigate currency risk. Hedging instruments like forward contracts or currency options can help minimize the impact of exchange rate fluctuations.

- Access to better loan terms: Switching currency may open up opportunities to access loans with better terms and conditions, including lower interest rates or longer repayment periods. This can potentially result in financial benefits for the borrower.

Before making a decision regarding switching currency on a mortgage contract, it is important to carefully evaluate both the legal considerations and the financial risks and benefits. Seeking professional advice is key to ensure compliance with regulations and make an informed choice that aligns with your financial goals.

Credit: www.facebook.com

Frequently Asked Questions For Can A Bank Switch Currency On A Mortgage Contract

Can Banks Switch Currencies On Mortgages?

Yes, banks have the ability to switch currencies on mortgages. They offer this service to cater to the needs of customers who may want to change from one currency to another.

What Happens To Your Mortgage If The Currency Changes?

If the currency changes, your mortgage payments may be affected. The amount you pay could increase or decrease depending on the exchange rate. It’s important to monitor and understand the currency fluctuations to anticipate any changes in your mortgage payments.

What Voids A Mortgage Contract?

A mortgage contract can be voided if there is fraud, misrepresentation, failure to disclose important information, or violation of the terms and conditions. An illegal purpose for the loan or invalid documentation can also void the contract.

Can A Bank Transfer Your Mortgage?

Yes, a bank can transfer your mortgage to another lender.

Conclusion

To sum up, it is important to understand that banks have the ability to switch currency on a mortgage contract. However, this decision should not be taken lightly, as it involves various factors such as exchange rates, interest rates, and potential risks.

Before making a final decision, it is advisable to consult with financial experts who can provide guidance based on your specific circumstances. Remember, being well-informed is crucial when it comes to making the right choice for your mortgage contract.